Eric Sprott: The Golden Answer To Chinese Import Data

Submitted by Eric Sprott, Etienne Bordeleau, and David Franklin of Sprott Group,

Manufacturing data in the last several months has suggested that economic growth around the world is slowing. However, China’s export growth surprised the market this week and unexpectedly accelerated in April, even as shipments to the U.S. and Europe fell. This has created a conundrum for analysts and market watchers. How can China be growing while the countries that purchase its exports are slowing? The numbers don’t add up.

Digging deeper into these figures, several analysts have come to the conclusion that the numbers are faulty. Bank of America Corp. and Mizuho Securities Co. analysts have gone so far to say the figures have been inflated by fake reports. An “astounding” 92.9 percent jump in exports to Hong Kong, the most in 18 years, raises questions on data quality, researcher IHS Inc. said. They even call some of the data ‘absurd’, suggesting that exporters are ‘faking orders’ to obtain export-tax rebates. These observations challenge the credibility of Chinese economic data once again.

It is has been suggested that China’s robust appetite for commodities from iron ore to crude oil show that Chinese domestic demand is healthy, alleviating concerns about a renewed slowdown. China’s recent surge in gold imports puts this ‘increase in domestic demand’ observation into question. Our analysis shows that trade statistics are biased by the large gold inflows the country has experienced over the past few years. Because gold imports are accounted for in the “import” numbers of the current account (instead of the capital account like other investments), they artificially inflate the total import numbers published in the Financial Press. We say “inflate” because gold, unlike other materials, is mostly used for investment purposes and as such should not qualify as an import of “goods and services”, which is used to measure real economic activity. Now that China is importing significant quantities of gold, trade flow numbers are becoming more distorted.

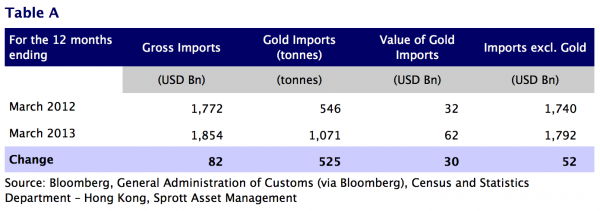

When we strip out the ‘gold effect’, we find that 37% of the increase in imports over the last 12 months into China is due to the massive amount of gold that’s being imported. In Table A, gross imports increased by $82 billion, but $30 billion of this increase was from gold alone. Put another way, more than one third of China’s import growth has been solely from its citizens’ desire to own gold and not from a growing domestic economy.

Many analysts have attributed China’s increasing imports as signs of a healthy manufacturing sector, or increasing investments in infrastructure and property. Our simple analysis shows that more than one third of the increase in imports is due to China’s increasing gold consumption. We expect this will only increase in the near future when the explosion of gold buying in April is accounted for. New reports have suggested that Chinese housewives (affectionately known as ‘aunties’ according to the Beijing Daily newspaper) have purchased as much as 300 tons of gold in the past three weeks alone, worth almost $16 billion USD. This new gold buying could have a significant impact on Chinese import statistics and force analysts to reconsider the strength of the Chinese domestic economy.