Pre-opening Comments for Monday May 13th

(Editor’s Note: Jon Vialoux is scheduled to appear on BNN’s “Money Talks” at 8:00 PM EDT)

U.S. equity index futures were lower this morning. S&P 500 futures were down 3 points in pre-opening trade. Futures are responding to less than expected growth in China’s industrial production.

Index futures recovered after April retail sales were released. Consensus was a decline of 0.3% versus a revised decline of 0.5% in March. Actual was a gain of 0.1%. Excluding auto sales, consensus was a decline of 0.2% versus a drop of 0.4% in March. Actual was a gain of 0.1%.

Boeing eased $0.67 to $93.57 despite an increase in target price by Sterne Agee from $100 to $120.

Autozone (AZO $420.95) is expected to open lower after Deutsche Bank downgraded the stock from Buy to Hold.

Cisco (CSCO $21.10) is expected to open higher after FBR Capital upgraded the stock from Under Perform to Market Perform. Target was raised from $17 to $19.

AuRico Gold (AUQ C$4.86) is expected to open higher after Desjardins upgraded the stock from Hold to Buy.

Economic News This Week

April Retail Sales to be released at 8:30 AM EDT on Monday are expected to decline 0.3% versus a decline of 0.4% in March. Excluding autos, Sales are expected to decline 0.2% versus a decline of 0.4% in March.

March Business Inventories to be released at 10:00 AM EDT on Monday are expected to increase 0.3% versus a gain of 0.1% in February.

April Producer Prices to be released at 8:30 AM EDT on Wednesday are expected to fall 0.5% versus a decline of 0.6% in March. Excluding Food and Energy, PPI is expected to increase 0.1% versus a gain of 0.2% in March.

May Empire Manufacturing Index to be released at 8:30 AM EDT on Wednesday is expected to improve to 3.5 from 3.1 in April.

April Industrial Production to be released at 9:15 AM EDT on Wednesday is expected to slip 0.2% versus a gain of 0.4% in March. April Capacity Utilization is expected to slip to 78.3% from 78.5% in March.

Weekly Initial Jobless Claims to be released at 8:30 AM EDT on Thursday are expected to increase to 330,000 from 323,000 last week.

April Consumer Prices to be released at 8:30 AM EDT on Thursday are expected to decline 0.2% versus a decline of 0.2% in March. Excluding Food and Energy, CPI is expected to increase 0.2% versus a gain of 0.1% in March.

April Housing Starts to be released at 8:30 AM EDT on Thursday are expected to slip to 950,000 units from 1,036,000 units in March.

May Philadelphia Fed Index to be released at 10:00 AM EDT on Thursday is expected to improve to 2.5 from 1.3 in April.

May Michigan Sentiment Index to be released at 9:55 AM EDT on Friday is expected to improve to 78.5 from 76.4 in April.

April Leading Economic Indicators to be released at 10:00 AM EDT on Friday are expected to improve 0.3% versus a decline of 0.1% in March.

April Canadian Consumer Prices to be released at 8:30 AM EDT on Friday are expected to increase 0.1% versus a gain of 0.2% in March.

Earnings Reports This Week

Tuesday: Pan American Silver, Power Financial, Rona

Wednesday: Cisco, First Majestic Silver, Macy’s, Power Corp.

Thursday: CAE, Kohl’s, Nordstrom, Wal-Mart

Equity Trends

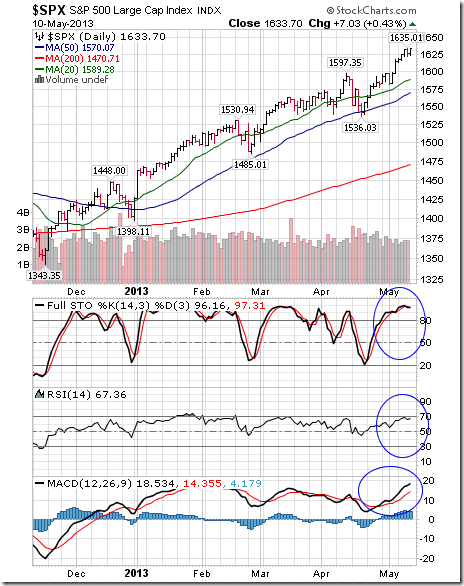

The S&P 500 Index gained 19.28 points (1.19%) last week. Trend remains up. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators remain overbought.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 89.20% from 80.80%. Percent remains intermediate overbought.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 93.98% from 90.60%. Percent remains intermediate overbought

Bullish Percent Index for S&P 500 stocks increased last week to 86.40% from 81.40% and remained above its 15 day moving average. The Index remains intermediate overbought

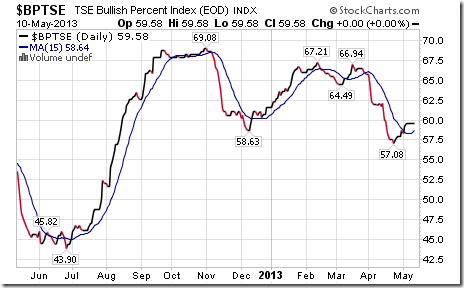

Bullish Percent Index for TSX Composite stocks was unchanged last week at 59.58% and remained above its 15 day moving average. The Index remains intermediate overbought.

The TSX Composite Index added 151.06 points (1.21%) last week. Trend remains down. The Index remains above its 20 and 200 day moving averages and moved above its 50 day moving average. Strength relative to the S&P 500 Index remains negative, but showing early signs of change. Technical score based on the above technical indicators remains at 1.0. Short term momentum indicators remain overbought.

Percent of TSX Composite stocks trading above their 50 day moving average increased last week to 50.42% from 46.25%. Percent has recovered to a slightly overbought level.

Percent of TSX Composite stocks trading above their 200 day moving average increased last week to 55.42% from 52.08%. Percent has recovered to a slightly overbought level.

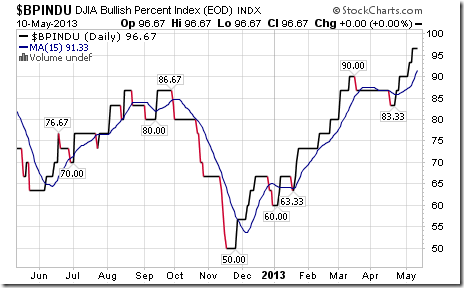

The Dow Jones Industrial Average gained 144.44 points (0.96%) last week. Intermediate trend remains up. The Average remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index remains negative. Technical score based on the above indicators remains at 2.0. Short term momentum indicators are overbought.

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 96.67% from 93.33% and remained above its 15 day moving average. The Index remains intermediate overbought.

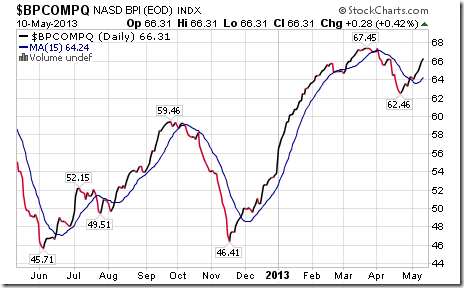

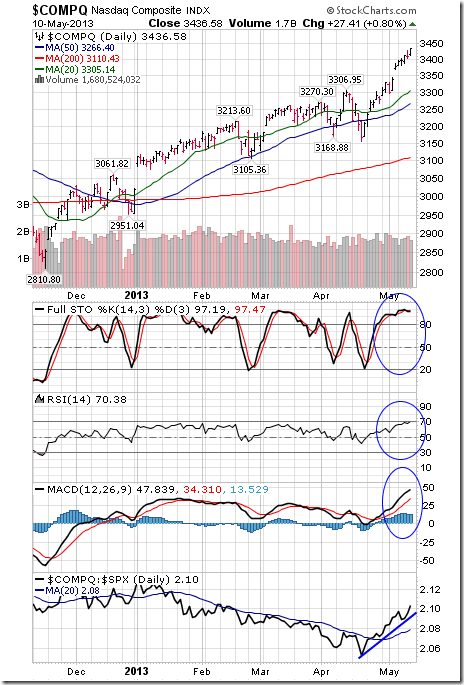

Bullish Percent Index for NASDAQ Composite stocks increased last week to 66.31% from 64.53% and remained above its 15 day moving average. The Index remains intermediate overbought.

The NASDAQ Composite Index gained 57.95 points (1.72%) last week. Trend remains up. The Index remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0. Short term momentum indicators remain overbought.

The Russell 2000 Index added 20.74 points (2.17%) last week. Trend remains up. The Index remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index improved to positive from neutral. Technical score improved from 2.5 to 3.0. Short term momentum indicators remain overbought.

The Dow Jones Transportation Average gained 156.62 points (2.52%) last week. Trend changed from neutral to up on a move above 6,291.65. The Average remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index changed from negative to positive. Technical score improved from 1.5 to 3.0. Short term momentum indicators remain overbought.

The Australia All Ordinaries Composite Index added 85.70 points (1.68%) last week. Trend remains up. The Index remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index changed from positive to neutral. Technical score eased from 3.0 to 2.5. Short term momentum indicators remain overbought.

The Nikkei Average jumped 913.50 points (6.67%) last week. Trend remains up. The Average remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0. Short term momentum indicators remain overbought.

Europe 350 iShares added $0.35 (0.83%) last week. Trend remains up. Units remain above their 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0. Short term momentum indicators remain overbought.

The Shanghai Composite Index added 41.33 points (1.87%) last week. Trend changed from down to neutral on a move above 2,250.11. The Index moved above its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score improved from 0.0 to 1.5. Short term momentum indicators are trending up.

The Athens Index gained 70.75 points (7.19%) last week. An uptrend was confirmed on a move above 1,052.83. The Index remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0. Short term momentum indicators remain overbought.

Currencies

The U.S. Dollar Index gained 1.03 (1.25%) last week. The dollar moved above its 20 and 50 day moving averages. Short term momentum indicators are trending up.

The Euro fell 1.33 (1.01%) last week. The Euro broke support at 129.74 on Friday and dropped below its 20 and 50 day moving averages. Short term momentum indicators have declined to neutral levels.

The Canadian Dollar eased US0.30 cents (0.30%) last week. Trend remains up. The Canuck Buck remains above its 20 and 50 day moving averages. Short term momentum indicators are overbought and showing early signs of rolling over.

The Japanese Yen fell 2.57 (2.55%) last week. Intermediate downtrend was confirmed on a move below 100.07. The Yen remains below its 20, 50 and 200 day moving averages. Short term momentum indicators are oversold.

Commodities

The CRB Index slipped 1.49 points (0.51%) last week. Trend remains down. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0.

Gasoline added $0.03 per gallon (1.06%) last week. Trend changed from down to neutral on a move above $2.83. Gas remains above its 20 day moving average. Strength relative to the S&P 500 Index changed from negative to neutral. Technical score improved from 1.0 to 2.0.

Crude Oil added $0.43 per barrel (0.45%) last week. Trend remains neutral. Crude remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index remains positive. Technical score remains at 2.5. Short term momentum indicators are overbought.

Natural Gas slipped $0.13 (3.22%) last week. Trend remains neutral. Gas remains below its 20 day moving average and fell below its 50 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.5. Short term momentum indicators are trending down.

The S&P Energy Index gained 4.13 points (0.70%) last week. Trend changed from neutral to up on a move above 587.92. The Index remains above its 20, 50 and 200 day moving average. Strength relative to the S&P 500 Index remains positive. Short term momentum indicators are overbought.

The Philadelphia Oil Services Index gained 3.82 points (1.49%) last week. Trend remains up. The Index remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0. Short term momentum indicators are overbought.

Gold fell $27.60 U.S. per ounce (1.88%) last week. Trend remains down. Gold remains above its 20 day moving average. Strength relative to the S&P 500 Index remains negative, but showing early signs of change. Technical score remains at 1.0. Short term momentum indicators are mixed.

The AMEX Gold Bug Index added 2.82 points (1.02%) last week. Trend remains down. The Index moved above its 20 day moving average. Strength relative to Gold and the S&P 500 Index improved from negative to neutral. Technical score improved from 0.0 to 1.5. Short term momentum indicators are trending up.

Silver dropped $0.35 per ounce (1.46%) last week. Trend remains down. Silver moved above its 20 day moving average. Strength relative to Gold and the S&P 500 Index remains negative. Technical score improved from 0.0 to 1.0. Short term momentum indicators have recovered to neutral levels.

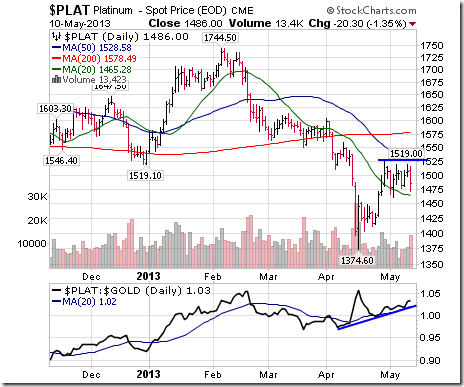

Platinum fell $15.20 per ounce (1.01%) last week. Trend remains up. Platinum remains above its 20 day moving average. Strength relative to the Gold and the S&P 500 Index remains neutral. Technical score remains at 2.5.

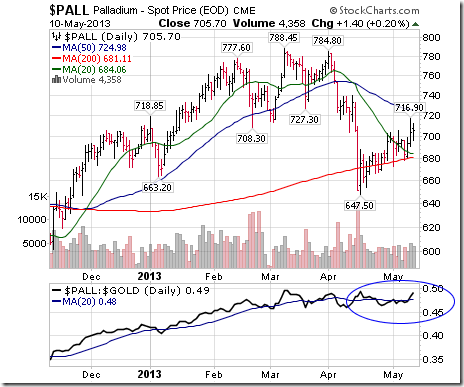

Palladium improved $12.40 per ounce (1.79%) last week. Trend remains up. Palladium remains above its 20 day moving average. Strength relative to Gold has turned positive.

Copper added $0.04 per lb. (1.21%) last week. Trend remains neutral. Copper remains above its 20 day moving average. Strength relative to the S&P 500 Index changed from negative to neutral. Technical score improved from 1.5 to 2.0. Short term momentum indicators are trending up.

The TSX Metals and Minerals Index added 51.57 points (6.28%) last week. Trend remains up. The Index remains above its 20 day moving average and moved above its 50 day moving average. Strength relative to the S&P 500 Index changed from neutral to positive. Short term momentum indicators continue to trend up.

Lumber fell another $4.62 (1.36%) last week. Trend remains down. Lumber remains below its 20 and 50 day moving averages and fell below its 200 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0.

The Grain ETN slipped $1.00 (1.99%) last week. Trend remains up. Units remained above their 20 day moving average. Strength relative to the S&P 500 Index remains neutral.

The Agriculture ETF added $0.92 (1.70%) last week. Trend remains neutral. Units remain above their 20 and 50 moving averages. Strength relative to the S&P 500 Index remains neutral. Technical score remains at 2.0. Short term momentum indicators are overbought.

Interest Rates

Yield on 10 year Treasuries jumped 14.8 basis points (8.45%) last week. Yield remains above its 20 day moving average and moved above its 50 and 200 day moving averages. Short term momentum indicators are trending up.

Conversely, price of the long term Treasury ETF fell $2.18 (1.80%) last week. Units fell below their 50 and 200 day moving averages.

Other Issues

The VIX Index slipped 0.26 (2.02%) last week. The Index remains below its 20, 50 and 200 day moving averages.

First quarter earnings reports will focus on the retail merchandisers this week (e.g. Macy’s, Kohl’s, Nordstrom, Wal-Mart).

Economic data released this week will be mixed at best. Data released in April generally showed a slowdown in growth. Consensus for reports released this week is for no change from April to slightly greater deterioration.

Currency wars are a focus. Weakness in the Yen below “par” triggered major changes in currencies late last week. This weekend, G7 ministers met in the United Kingdom to discuss.

Short term and medium term technical indicators for broadly based equity indices and most sector indices are overbought, but have yet to show significant signs of peaking.

Favourable seasonal influences normally peak after the release of most first quarter earnings reports. Between now and last October, the frequency of recurring annual events that influence equity markets is lacking (with a possible exception of second quarter reports). Net result is a period of greater volatility and random investment returns.

Large cash positions held by Canadian and U.S. corporations increasingly are being employed in dividend hikes and share buy backs instead of building additional productive capacity, a scenario that is favourable for short term gains, but unfavourable to additional earnings growth.

The Bottom Line

Strength in equity markets continues to surprise on the upside. However, a lack of favourable seasonal influences, mixed responses to quarterly reports, a slowdown in U.S. economic growth, concerns about a slowdown in monetary stimulus and virtually no progress on U.S. fiscal policy suggest that upside potential is limited and downside risk is significant. Appropriate action is recommended.

The latest weekly update on ETFs in Canada is available at

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. Notice that most of the seasonality charts have been updated recently.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

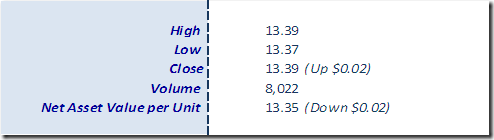

Horizons Seasonal Rotation ETF HAC May 10th 2013