Upcoming US Events for Today:

- The NFIB Small Business Optimism Index for March will be released at 90.6 versus 90.8 previous.

- Wholesale Trade for February will be released at 10:00am. The market expects a month-over-month increase of 0.5% versus an increase of 1.2% previous.

Upcoming International Events for Today:

- China Trade Balance for March will be released. The market expects $15.0B versus $15.25B previous.

- German Trade Balance for February will be released at 2:00am EST. The market expects €15.0B versus €15.7B previous.

- Great Britain Industrial Production for February will be released at 4:30am EST. The market expects a year-over-year decline of 2.8% versus a decline of 2.9% previous.

- Great Britain Trade Balance for February will be released at 4:30am EST. The market expects 8.7B versus 8.2B previous.

- Canadian Housing Starts for March will be released at 8:15am EST. The market expects 175K versus 180.7K previous.

The Markets

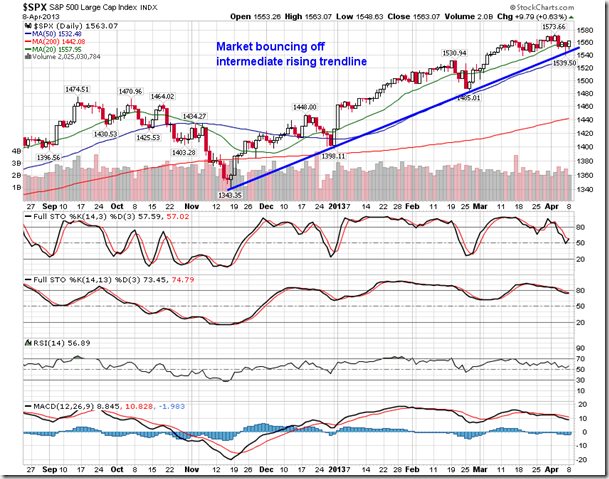

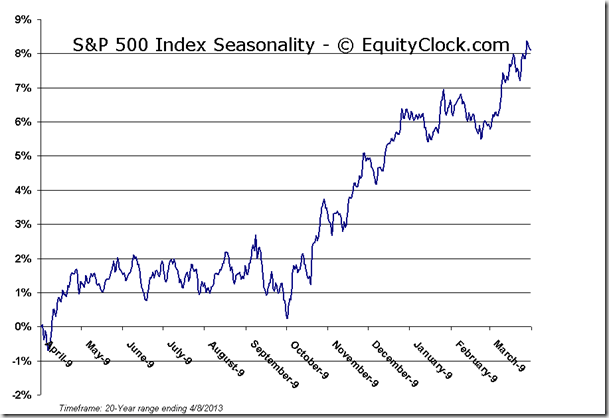

Equity markets moved higher on Monday, rebounding from early morning losses as investors prepared for earnings season to begin with Alcoa after the closing bell. The bounce occurred around a rising intermediate trendline on the S&P 500 index and Dow Jones Industrial Average as the bulls remain committed to the prevailing trend.

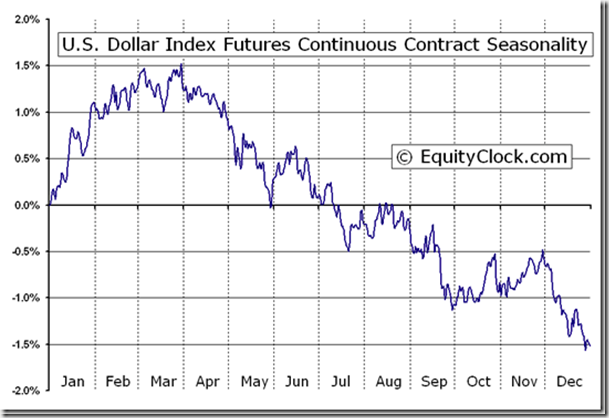

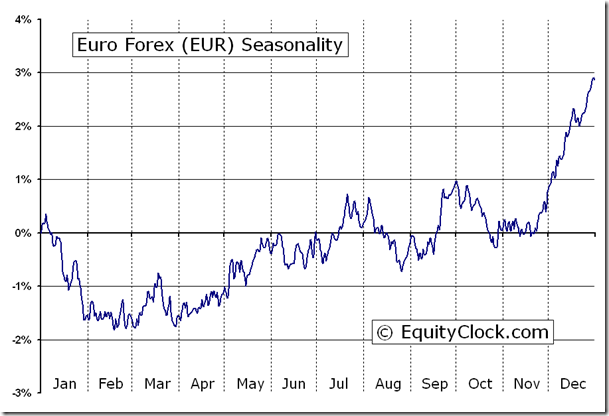

Perhaps acting as a catalyst for yesterday’s market gains was the recent rebound in the Euro. The currency has realized rather pronounced declines since the start of February, but recently momentum indicators have diverged from the short-term price action, indicating that selling pressures were abating. The intermediate trend is noted to have changed, but a continuation of this short-term rebound is reasonable as the currency corrects an oversold condition. A retest of the 50-day moving average around 1.32 is increasingly probable as the currency exits a period of seasonal weakness that concluded at the end of March. Euro strength has generally coincided with US Dollar index weakness, often seen as a positive catalyst for equity and commodity prices. The US Dollar index is showing signs of rolling over from its recent positive trend, also pushing towards its 50-day average as seasonal weakness in the month of April pressures the currency lower.

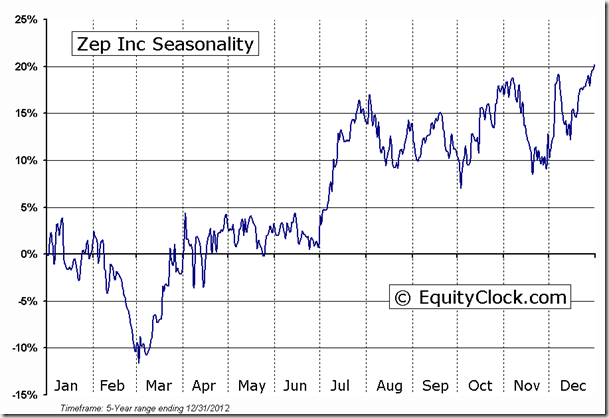

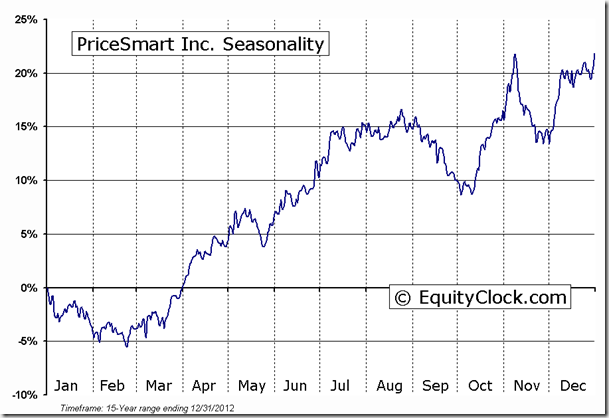

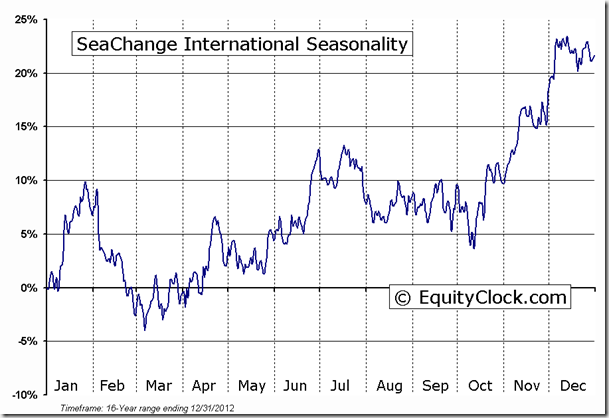

Seasonal charts of companies reporting earnings today:

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.90. The positive, bearish trend in the ratio that has become evident over the past few weeks remains intact.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.30 (up 0.38%)

- Closing NAV/Unit: $13.36 (up 0.77%)

Performance*

| 2013 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 5.03% | 33.6% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.