A Value-Driven, Buy-and-Hold Stock Market?

by James Paulsen, Chief Investment Strategist, Wells Capital Management (Wells Fargo)

April 9, 2013

Since the U.S. stock market reached a new all-time record high last week, investors are understandably wondering “What now?” Is the stock market again at its peak for this cycle like it was the last two times it reached this level in early 2000 and again in late 2007? After all, profit growth has clearly slowed and as we enter the earnings reporting season this week, most are mindful of the challenges companies face in the next few years since profit margins are already near record highs. Moreover, isn’t the Fed close to taking away the punch bowl officially ending this equity party?

Fortunately, a continuation of this bull market does not require rapid earnings growth, nor neverending Fed liquidity injections. Rather, the stock market may evolve into a buy-and-hold investment, driven in future years by a slow but steady rise in price-earnings (PE) multiples. This is possible because the current PE multiple on the U.S. stock market is lower than about 55 percent of the time compared to post-war history. Moreover, since WWII, when the rate of inflation was below 4 percent (we are currently at an inflation rate of only 2 percent), historic PE multiples have been higher than the contemporary PE multiple of about 15 times almost 70 percent of the time. Indeed, when inflation has been below 4 percent, the PE multiple has ranged between 20 and 30 times almost one-quarter of the time! Earnings cannot collapse, but as long as the recovery continues and earnings grow in line or even slightly less than nominal GDP, solid total equity returns can be achieved simply by PE multiples returning to levels seen commonly in similar environments of the post-war era.

Finally, for the stock market to evolve into a value-driven bull market, it will be paramount to keep inflation under control. For this reason, the future of the stock market is indeed in the hands of the Federal Reserve. However, while most believe the stock market will collapse once the Fed ends its accommodative stance, we believe the stock market may only be able to enter a buy-and-hold era once the Fed shows its resolve to keep inflation in check by normalizing monetary policy.

Historic distribution of PE multiples

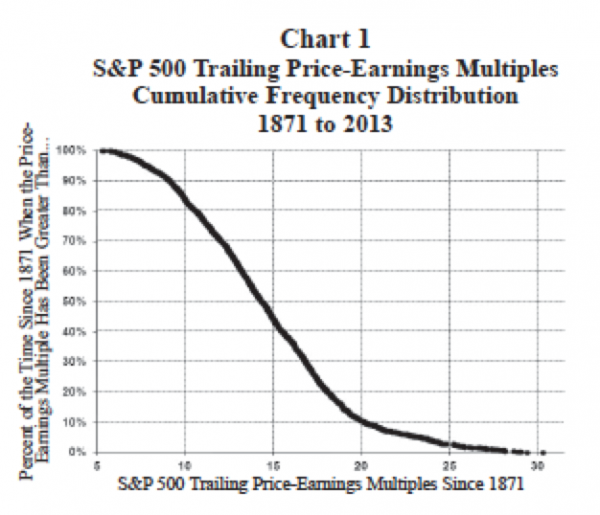

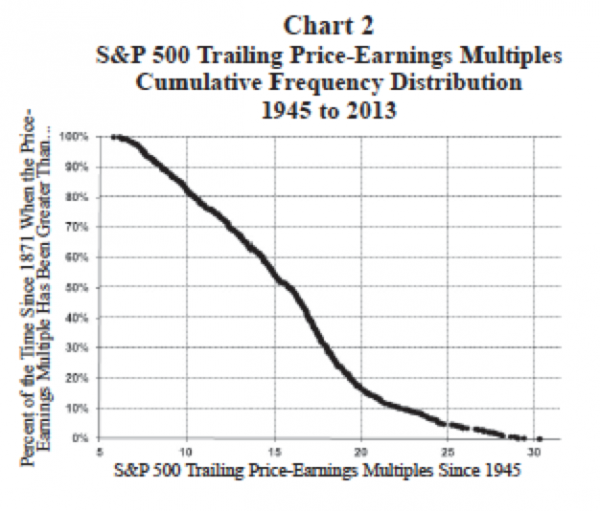

Charts 1 and 2 illustrate the cumulative frequency distribution for U.S. stock market PE multiples since 1871 and for just the post-war era since 1945. The current PE multiple is about 15 times trailing 12- month earnings per share. The dotted line rising upward from a 15 PE multiple in Chart 1 (and touching the frequency distribution at about 45 percent) shows historically PE multiples since 1871 have been higher than the current PE multiple about 45 percent of the time. Similarly, Chart 2 shows for the postwar era, PE multiples have been higher than it is today about 55 percent of the time.

Essentially, the current valuation of the stock market is historically “about average.” Based on past frequencies, PE multiples have about the same chance of rising as they do falling in the next few years. Indeed, from Chart 2, since WWII, the PE has been at 10 or less about 20 percent of the time which is almost exactly how often it has been at 20 or more. Overall, these two charts do not suggest the stock market PE is more likely to rise or fall in future years. However, when the contemporary inflation environment is taken into account, the probability of expanding PE multiples appears more likely.

PE multiple distribution and inflation

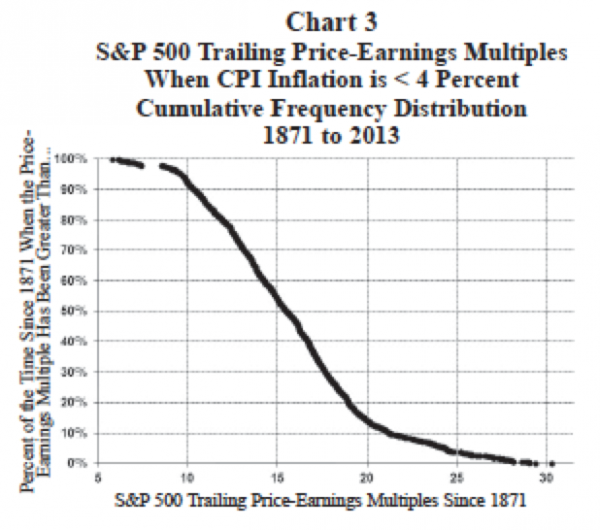

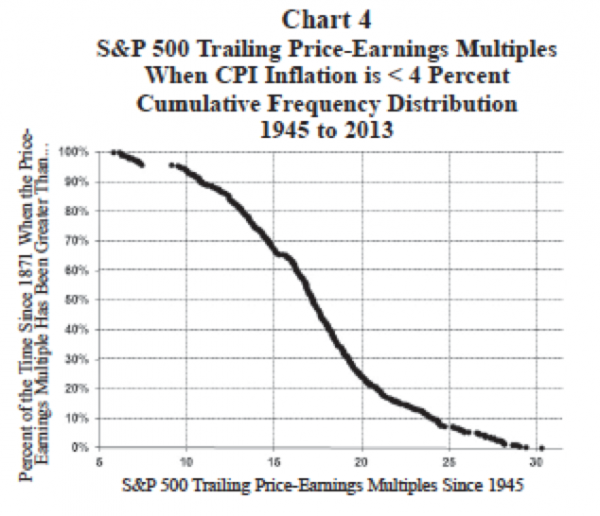

Charts 3 and 4 adjust the historic distribution of PE multiples for a low inflation environment. These charts show the distribution for all months when the annual rate of consumer price inflation was less than 4 percent. Since 1871, the current PE multiple of 15 has been surpassed almost 55 percent of the time when the inflation rate was below 4 percent as it is today. In the post-war era, the upward impact of low inflation is even more noticeable. From Chart 4, since 1945 when inflation was low, the current PE of 15 was surpassed nearly two-thirds of the time and a PE multiple of 14 or higher occurred more than 70 percent of the time. Indeed, Chart 4 also shows when inflation has been below 4 percent, the PE multiple has been 18 or higher nearly 40 percent of the time and 20 times or higher almost onequarter of the time.

As suggested by these charts, the stock market currently possesses considerable under-appreciated upside potential in the next few years (via higher valuations) should inflation remain under control. From Chart 4, when inflation has been below 4 percent, the PE multiple has been 17 or higher more than one-half the time. Since the contemporary inflation rate is only 2 percent, the current PE multiple should probably be between 18 to 20 times rather than 15. What this example highlights is the stock market really doesn’t need rapid economic or profit growth to provide investors with healthy future returns. Lingering 2008 crisis fears have kept confidence depressed leading to stock market valuations which are significantly below historical norms in a similar low inflation environment. Should the contemporary character of slow economic growth simply persist, confidence should slowly improve (if only because we get farther from the last crisis), eventually pushing PE multiples closer to historic norms and providing investors with solid returns even with slow growing earnings.

The Fed controls the future for stocks.... but not like you think?

Most expect when the Fed stops its quantitative easing program, the stock market will struggle. However, we believe ending the Fed’s massive crisis-like easing campaign may be required for the stock market to “sustain” its current bull run. Indeed, unless the Fed can unwind its accommodative policies without touching off a problematic inflationary episode, the stock market will not be able to enter a buyand- hold era. Therefore, rather than fear the end of Fed easing, investors should be embracing an early normalization of monetary policy.

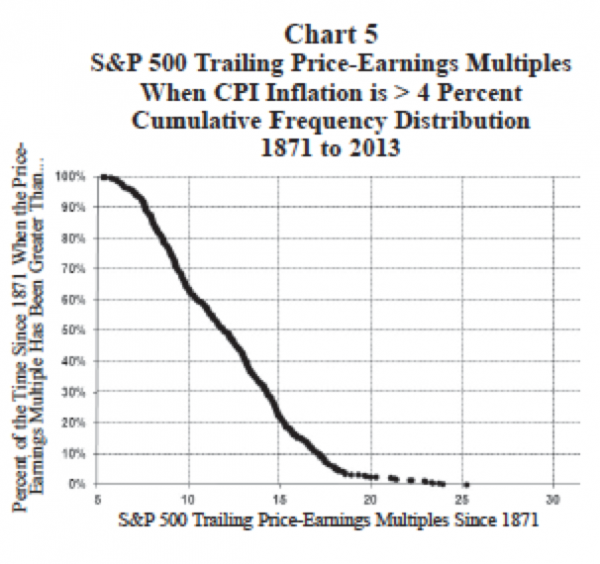

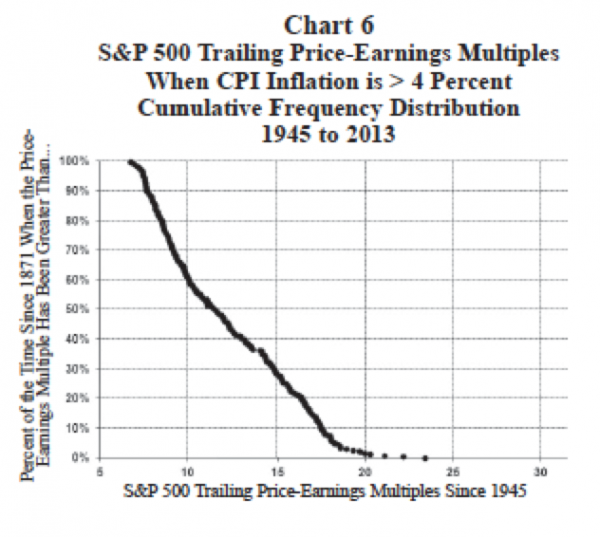

Charts 5 and 6 illustrate the damage which could befall stock market valuations should the Fed overstay its accommodative approach and produce an inflationary outcome significantly above 4 percent. Chart 6 shows for inflation rates above 4 percent, the contemporary PE multiple of 15 would have considerable downside risk. Since 1945, when the inflation rate was above 4 percent, the median PE multiple was about 12. However, the PE was below 10 times nearly 40 percent of the time. And, the PE multiple was higher than today (at 15 times) only about 28 percent of the time! The future of the stock market is indeed in the hands of the Fed. If they soon normalize policy and keep inflation moderate, they could set the stock market on a multi-year, buy-and-hold track producing solid investment returns via higher valuations. Alternatively, overstaying its massive monetary easing campaign and ultimately sparking a period of aggressive inflation is, in our view, the biggest risk now facing the economic recovery and the stock market.

Stock market possibilities???

A couple of mathematical examples provide a sense of the possibilities in the next several years depending on whether the Fed is successful at keeping inflation contained. What follows is not a forecast, but rather simply an illustration of the risk-return frontier stock investors may face in the next few years. First, assume a relatively quick exit by the Fed from its quantitative easing program which maintains relative price stability (i.e., low inflation persists say between 2 and 4 percent) and allows the recovery to continue for the next five years. Also assume S&P 500 earnings per share grow only modestly in the next five years at a pace in line with modest nominal annualized GDP growth of only 5 percent (i.e., 2.5 percent real growth and 2.5 percent inflation on average). Current trailing earnings per share are about $102. If they grow at 5 percent per annum for the next 5 years, they will be about $130. Finally, assume because inflation remains tame and the recovery continues, investor confidence improves and the PE multiple rises from its current level of 15 to about 18. Even these modest assumptions produce a five-year target price for the S&P 500 of 2340 (i.e., 18 PE times $130 earnings per share). From its current level of about 1550, this would represent an annualized S&P 500 price return of 8.6 percent—with dividends the expected annualized return would be more than 10 percent!

Conversely, what if the Fed overstays and inflation surges (e.g., assume the pace of consumer inflation rises to 8 percent or more)? S&P 500 earnings would likely grow faster as inflation would increase nominal GPD growth (even though most of the growth would likely be price hikes). Assume earnings under this inflation scenario rise at an 8 percent annualized pace which would produce earnings five years hence at about $160. Finally, from Chart 6, assume the resulting inflation surge causes the PE multiple to collapse to about nine times share earnings. Together, a nine PE with $160 earnings would produce a price target for the S&P 500 of about 1440. With dividends, the suggested total annualized return would be about zero (but of course, a loss in real terms).

Overall, the upside in this stock market remains considerable should the Fed keep inflation under control in the next few years and allow this economic recovery to mature. By contrast, should the Fed’s unconventional and massive monetary policies of the last several years spark an inflationary spiral, the stock market will not do very well, but it may largely end up not that far from where it is today. Consequently, the risk-reward character of the stock market over the next few years is probably more favorable than most appreciate.

Summary

In the post-war era, when the inflation rate has been as low as it is today, the U.S. stock market PE multiple has been higher than it is currently almost 70 percent of the time. Although earnings will need to rise, investors should not fret too much about the speed of earnings growth because the primary driver behind continued gains in the equity market will likely be rising PE multiples rather than rapid earnings growth. Latent 2008 crisis fears currently keep valuations on equities below historic norms. Consequently, should inflation remain moderate allowing this economic recovery to persist (and confidence and PEs to improve), stocks may provide investors with double-digit, buy-and-hold returns in the next several years. The greatest risk to this rosy scenario is current Fed policy. Should its unconventional and massive monetary easing policies of the last several years ultimately produce problematic inflation, PE multiples will contract and stock market investment outcomes, while not disastrous, will prove disappointing. The fate of the stock market is certainly in the hands of the Fed. However, rather than fear the end of monetary ease, stock market investors should be watching and rooting for an early and significant normalization of monetary policy.

Copyright © Wells Capital Management