The following paper by Andrei A. Kirilenko (CFTC) and Andrew W. Lo (MIT Sloan) "reviews key innovations" around trading beginning with the optimization techniques used on portfolios in the 1950's to today's current and starkly different (becausae moral corruption leads to the damage of uninformed orders through the use of unknown and unpublished order-types were to scalp the American investing public) HFT.

At today's rate of change from technological limit (x) to new limit (x1), we have an amazing ability to see technology's alteration take effect on our societies and cultures. Because of Moore's Law, we are able to see more clearly now than before the intricate effects imposed by technology on Wall Street. Surely telephones and electronic communication catapulted the Street to new levels, but those advances were not monopolized by the exchanges. Today, the very orders that make HFT a beneficial trading strategy and one worth the massive CapEx, are controlled by the exchanges. That's the difference between this form of "technological advancement" and those of the past, the direct ownership of the critical intersection between information processing and order execution.

As for addressing this issue the author's say:

...what has not changed nearly as much over this period is the regulatory framework according to which these technological and financial innovations are supposed to be overseen.

These innovations (or developments) are as follows, I'm paraphrasing here:

1. As a consequence of economic growth and globalization, financial markets have become more complex as the number of market participants increased, the variety of financial transactions evolved in complexity, and the levels & distribution of risks swelled.

2. Much of algorithmic trading involves a bunch of new people memorizing and coding a bunch of other people's intelligent discoveries about numerical relationships of which most of modern finance is based upon.

3. The last innovation is technological, Moore's Law.

The problem with much of modern finance's modeling efforts rests in using "Laws" created by humans for a system created by humans. These are not laws in the same way gravity is a law. As economic and financial "Laws" become extinct change, the introduction of new discoveries about numerical relationships alters the previous ecosystem, introducing chaos momemtarily which is a fertile playground for self-recognizing algorithms to go about encouraging their evolution to the next phase of robust coded maturity.

Oddly, the paper notes Renaissance Technologies troubles as noted in the WSJ on August 10, 2007, claiming RT told investors their key fund lost 8.7% in the first week of August and is down 7.4% in 2007. At the sametime Highbridge Statistical Opportunities Fund was down 18% as of the August 8, 2007 and down 16% in 2007. Reg-NMS was slated to come into effect in 2007 and on July 9th, 2007 the SEC's REG NMS Pilot became effective in 250 stocks, which is nearly 1 month to the day prior to the WSJ discussing the destruction to Renaissance, one of Scions of Wall Street hedge-funds, and the publically traded Highbridge Statistical.

Now note please, at this point the creation of Reg-NMS and the ability of certain lobbying firms to insert loopholes disguised to aid markets (locked-market rule) caused a dislocation instantly at two of the top Wall Street quant funds. This is the essence of the special order-type debate and the damage to market integrity caused by the for-profit exchanges catering to high volume HFT's in a form of "Guaranteed Economics" designed specifically to be beneficial only if you use the technology necessary to participate.

As highlighted in The Problem of HFT:

...the structure of the US equities market stacked the odds against the electronic exchanges. Exchanges struggled to create compelling market models that could sustain large scale algorithmic trading businesses in the absence of captive retail order-flow sources.

It is only now, years after the exodus of the retail prey, are the predator exchanges and HFT community offering up transparency but they are doing just enough to appease the naysayers, what is going on behind the curtain this time is anyone's guess (more here).

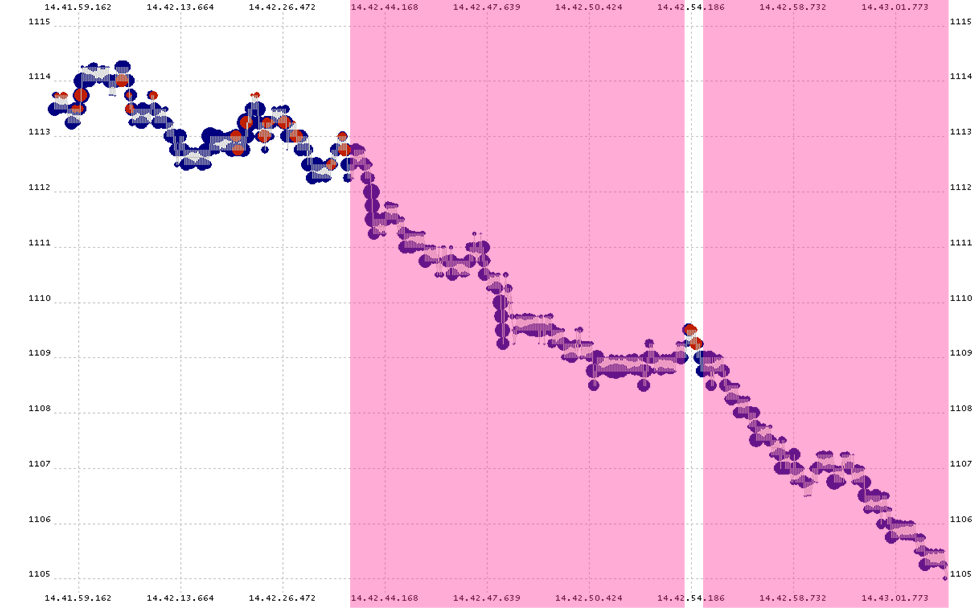

A final comment on the paper's discussion of the flash crash. The authors highlight the SEC's 75,000 contract sale which has been attributed to Waddell & Reed as the root cause on May 6, 2010. Nanex was sent the trades by Waddell & Reed and analyzed. Nanex states the flash crash began at exactly 14:42:44 and when you look at the charts of Waddell trades, you can see they did not trade at that time interval for the the following 10 seconds, at which point they only execute two trades (#000000;">red dots are Waddell Trades):

At this point it has become painfully clear that in the midst of the cries about a new level of transparency, there is a dark collusion hiding the reality facing our financial markets and our regulators are hurting us with their reliance upon the industry to guide them. As Murphy's Law plays out with our regulators, we'll sum up that action in one word: MIDAS.

Moore's Law Vs Murphy's Law: Algo Trading And Its Discontents