‘Facing’ the Portfolio Allocation Decision?

by James Paulsen, Chief Investment Officer, Wells Capital Management

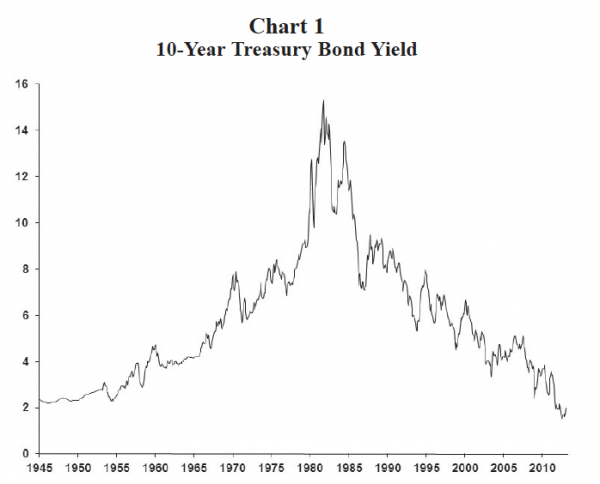

Perhaps no other event has shaped the post-war investment environment more than the two faces of the bond market. Shortly after WWII, U.S. bond yields began a slow but steady advance spanning more than 30 years and climaxing with a surge in bond yields in the late 1970s never before seen in U.S. history. This was followed by an equally dogmatic secular decline in bond yields, also lasting more than three decades, which last year saw the 10-year Treasury bond yield decline to a post-war record below 1.5 percent! Investors are already pondering the future face the bond market. With a current 10-year Treasury yield of only about 2 percent, they can no longer depend, as they have for decades, on a persistent decline in bond yields. Who knows what the new face of the bond market will be? Yields could remain rangebound at very low levels. Perhaps they will bounce higher and then trend sideways. Or, maybe bond yields will begin another secular climb.

What is clear, however, is the long-standing character of the bond market is about to undergo change and its relationship to stock investments will also likely be altered. For this reason, it is worthwhile examining the interrelationship between stocks and bonds and just how much this relationship has depended on the two post-war faces of the bond market.

A two-faced bond market!

Chart 1 illustrates each face of the post-war bond market. Essentially, the post-war history of bond yields is 35 years of a chronic rise followed by about 35 years of persistent declines. Indeed, its two faces are nearly a mirror image. In 1971, about 10 years before the Treasury bond yield would reach its post-war peak of about 16 percent, the bond yield first rose to about 8 percent. Similarly, about 10 years after the post-war peak in yields in 1991, bond yields would rally above an 8 percent yield for the last time. Likewise, 20 years before its post-war peak in 1961 the bond yield broke through 4 percent whereas 20 years after its post-war peak, bond yields were also again hovering about 4 percent. Finally, today, about 30 years beyond the post-war peak in yields, the Treasury yield is about 2 percent as it was in 1950 about 30 years before its post-war peak.

With amazing symmetry, bond yields “doubled” about every 10 years between 1950 and 1980 (i.e., about 2 percent in 1950, about 4 percent in 1960, about 8 percent in 1970 and about 16 percent at the peak in 1981) and then “declined by half” every 10 years since (i.e., from 16 percent in 1981 to about 8 percent in 1991, about 4 percent in the early 2000s and about 2 percent today). The dramatic shift in the personality of the bond market during the post-war era produced two entirely different investment environments. The question is which bond market are investors likely to face in the next several years? Since bond yields are currently so low, continuing the secular decline of the last 30 years is impossible. Either bond yields will soon begin another secular rise or the bond market will exhibit a character somewhere in between its two personalities of the post-war era. Understanding how much the investment environment could change depending on the personality of the bond market is useful when considering future portfolio allocations.

Historically, the two personalities of the post-war bond market altered the investment environment in three major ways. First, average annualized bond returns differed significantly across the two investment eras. Second, the diversification impact of bond ownership was much stronger during the era of falling bond yields than when they were in a secular rise. Finally, the risk-reward frontier has been nearly flat since 1980 whereas it was quite steep in the earlier post-war era. Each of these differences is worth examining.

Bond returns to diminish significantly?

Chart 2 divides the 68 years of post-war history into the 36 years when the 10-year bond yield rose and the 32 years when it declined. Obviously bond returns were much better since 1980 when bond yields chronically declined compared to when yields persistently rose. However, surprisingly and perhaps less appreciated, the average return from the stock market was about 12.5 percent regardless of whether bond yields rose or declined.