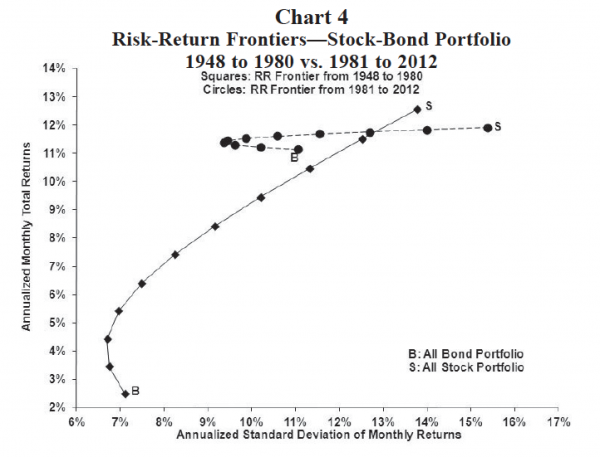

The risk-return frontier changed significantly since 1981 when bond yields began a chronic decline. In the last 30 years, stock and bond returns have been nearly identical “regardless” of the allocation between stocks and bonds. An all bond portfolio generated about 11.1 annualized percent returns compared to only 11.9 percent annualized returns from an all stock portfolio. Since 1981 (and in sharp contrast to the previous investment era before 1981), boosting stock exposure in the portfolio mostly increased risk and only marginally improved returns.

The crucial difference between the pre- and post- 1980 investment eras was the “slope” of the risk-return frontier. The investment culture of the secular rising bond yield era came to accept that adding stocks to the portfolio would raise both risk and return. By contrast, the contemporary culture of the last 30 years, essentially believes augmenting stocks within the portfolio only boost returns mildly while significantly increasing risk.

In the next several years, the slope of the risk-return frontier will likely steepen some compared to what it has been since 1981. For an investment culture educated over the last three decades however, a bit of “steepening” in the risk-return frontier could uncover many portfolios which are woefully underweighted toward equities.

Summary The post-war investment climate has been heavily dependent on the “faces of the bond market.” And, the bond market is about to change face again. The secular declining bond yield era is over. At best, bond yields will trend sideways in the years ahead. More likely, bond yields will again rise some in the next few years. Overall, investors should prepare for an investment environment whose character lies somewhere between the last two bond eras.

Compared to the last 30 years, the next investment era may produce similar equity returns but far lower bond returns. Expect the added diversification provided by bonds to diminish substantially relative to the smoothing impact bonds have provided in the last 15 years. Finally, investors should prepare for a much steeper tradeoff between risk and reward. In the years ahead, additional risk will likely be more handsomely rewarded than has been the case in the last 30 years. Perhaps, most importantly, if the risk-return frontier is about to take on more of its pre-1981 character, investors need to question whether current conventional asset allocation parameters, born out of the culture of the last 30 years, are still appropriate?

Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions.

The views expressed are those of the author at the time of writing and are subject to change. This material has been distributed for educational/informational purposes only, and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product. The material is based upon information we consider reliable, but its accuracy and completeness cannot be guaranteed. Past performance is not a guarantee of future returns. As with any investment vehicle, there is a potential for profit as well as the possibility of loss. For additional information on Wells Capital Management and its advisory services, please view our web site at www.wellscap.com, or refer to our Form ADV Part II, which is available upon request by calling 415.396.8000. WELLS CAPITAL MANAGEMENT® is a registered service mark of Wells Capital Management, Inc.

Copyright © Wells Capital Management Inc.