For this week's edition of the SIA Equity Leaders Weekly we are going to revisit a common topic of discussion here at SIACharts, which is managing a position once it drops out of the Favored zone and why it is so important to not continue to hold on to these relatively weak positions. We are going to look at 2 specific examples: EMC and INTC.

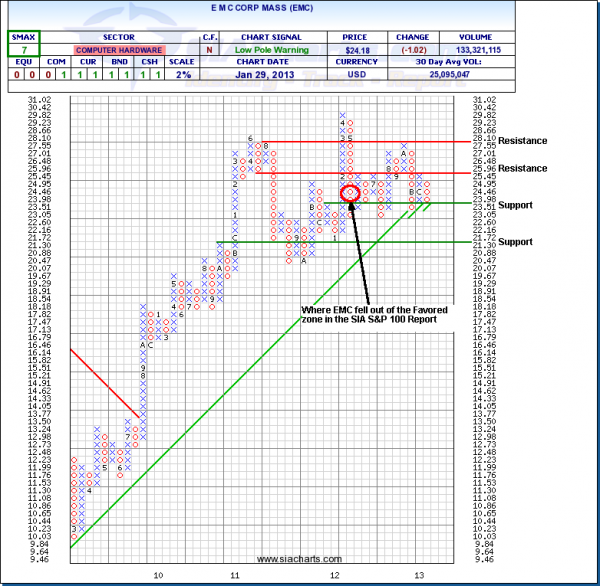

EMC Corp (EMC)

EMC fell out of the Favored zone in the SIA S&P 100 Report back on May 24, 2012 at a price of $24.23. 8 months later, as of the close of January 29, 2013 EMC was at $24.18. Over this time frame the S&P 500 was up 14.2% and EMC was basically flat. In this case the stock did not fall in value, but the dollars that were invested could have been much better served being in a different position, instead of languishing away doing nothing. In fact, just as a comparison HD was up 35.2%, CMCSA was up 31.1% and V was up 30.8%. All of these positions were in the Favored zone when EMC fell out and were all valid replacement positions.

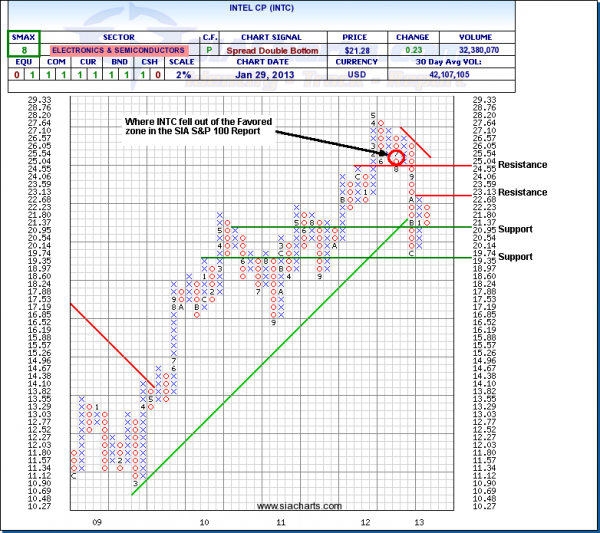

Intel (INTC)

Our second example today is INTC. Back on July 6, 2012 INTC fell out of the Favored zone in the SIA S&P 100 Report at a price of $26.16. As of the close of January 29, 2013 it was at $21.28. Unlike EMC above which just went sideways, INTC dropped 18.7% over a period of time that the S&P 500 was up 11.3%. As a comparison, HD was up 28.9%, V was up 25%, and CMCSA was up 24.7% and were all valid replacement positions.

These are just a couple of examples of why we want to be managing positions once they start showing weakness against their peer group. Time and again we see that the failure to be mercenary and eliminate positions when necessary can do damage to a portfolio, or just reduce the portfolios ability to perform at its optimal level. We always want those client dollars at work whenever possible.

Click on Image to Enlarge

Copyright © SIACharts.com