by Don Vialoux, Tech Talk

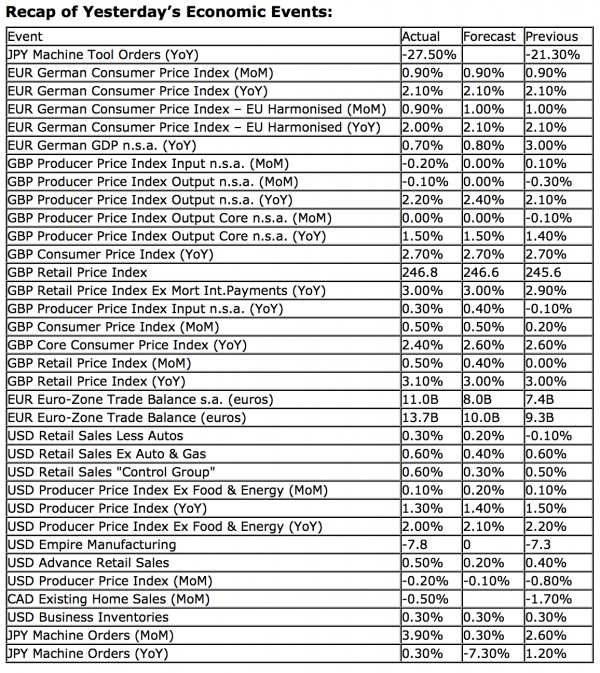

Upcoming US Events for Today:

- Consumer Price Index for December will be released at 8:30am. The market expects no change (0.0%) on a month-over-month basis compared to a decrease of 0.3% previous. Core CPI is expected to reveal an increase of 0.1%, consistent with the previous report.

- Net Long-Term TIC Flows for November will be released at 9:00am.

- Industrial Production for December will be released at 9:15am. The market expects a month-over-month increased of 0.2% versus an increase of 1.1% previous. Capacity Utilization is expected to reveal 78.5% versus 78.4% previous.

- NAHB Housing Market Index for January will be released at 10:00am. The market expects 48 versus 47 previous.

- Weekly Crude Inventories will be released at 10:30am.

- Fed’s Beige Book for January will be released at 2:00pm.

Upcoming International Events for Today:

- Euro-Zone CPI for December will be released at 5:00am EST. The market expects a year-over-year increase of 1.5% versus an increase of 2.2% previous.

- Australian Unemployment Rate for December will be released at 7:30pm EST. The market expects 5.4% versus 5.2% previous.

The Markets

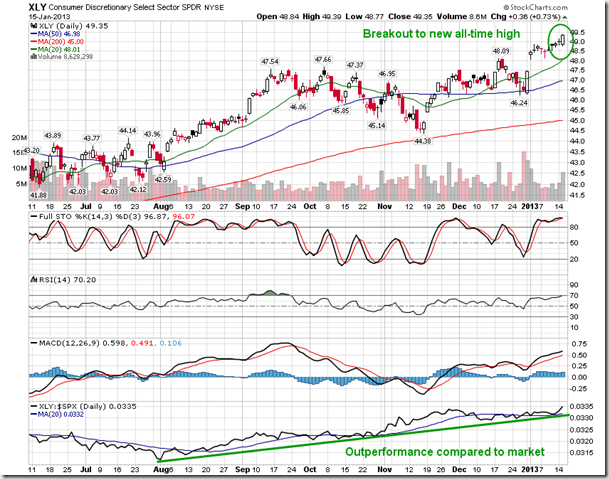

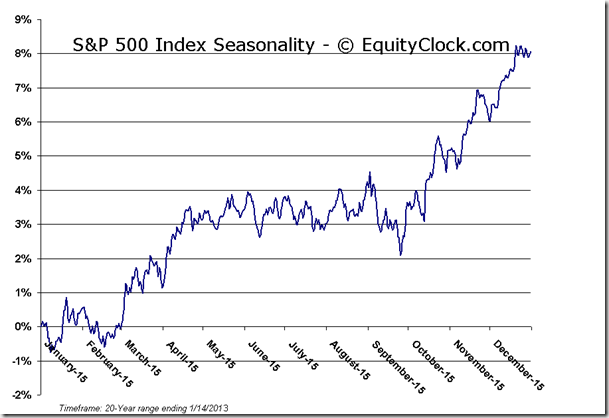

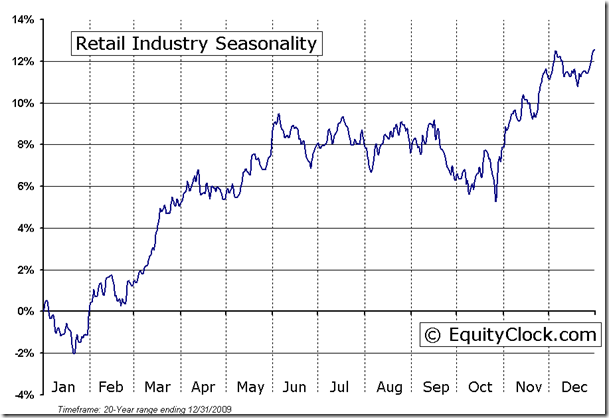

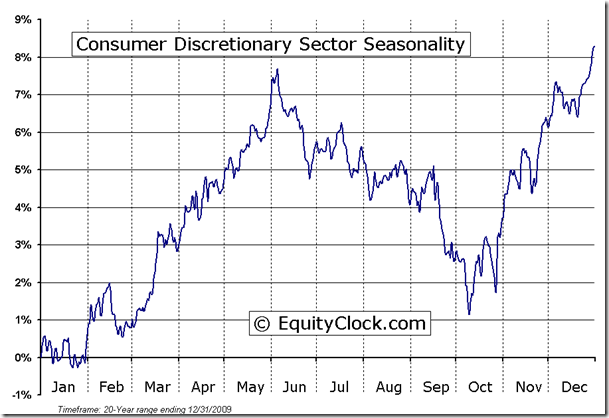

Equity markets remained resilient amidst another session of extreme selling pressures for shares of Apple. The S&P 500 and Dow Jones Industrial Average ended with marginal gains, while the technology heavy NASDAQ finished with a slight loss. A better than expected retail sales report for the month of December helped push equities higher, particularly those that benefit from strong consumer spending. Retail stocks, as gauged by the S&P Retail Index ETF (XRT), instantly broke higher on significant volume, testing a point of resistance at $64.67. The Consumer Discretionary Sector ETF (XLY) again charted new all-time highs. Retail enters a period of seasonal strength in January, running through the month of April.

Consumer Discretionary wasn’t the only sector breaking out to new levels. The Dow Jones Transportation Average also charted new all-time highs, providing Dow theorists reason to be optimistic that the Dow Jones Industrial Average will soon follow suit. The Industrial Average remains 4.9% below the all-time highs charted in 2007 of 14198.10. The Transportation Average has been outperforming the Industrial Average since the start of October, indicating that investors remain firmly in “risk-on” mode.

Other indicators that are signaling a risk-on market environment include the relative performance of Small-Caps versus Large-Caps, the relative performance of the Consumer Discretionary sector versus the Consumer Staples sector, and the relative performance of Junk Bonds versus Investment Grade Corporate Bonds. High beta investments are outperforming low beta, defensive assets, typically a characteristic of a bullish equity market trend. As long as investors continue to favour the “risk-on” trade, equity markets are poised to move higher.

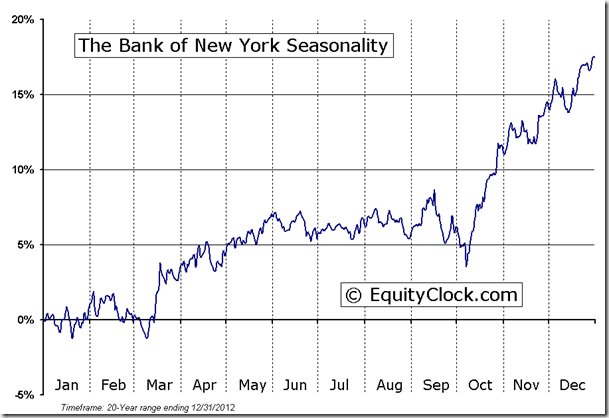

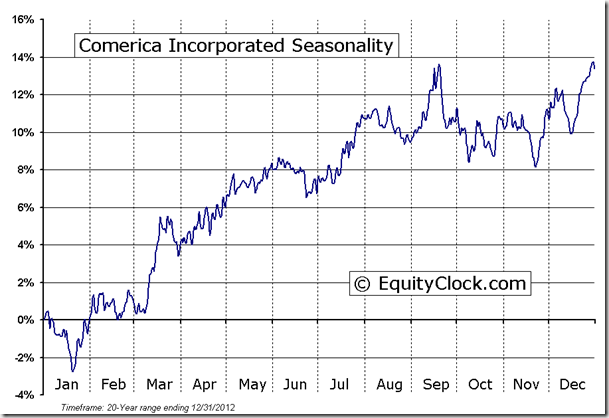

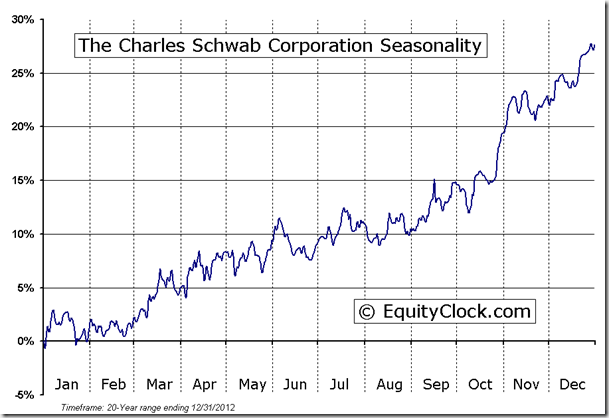

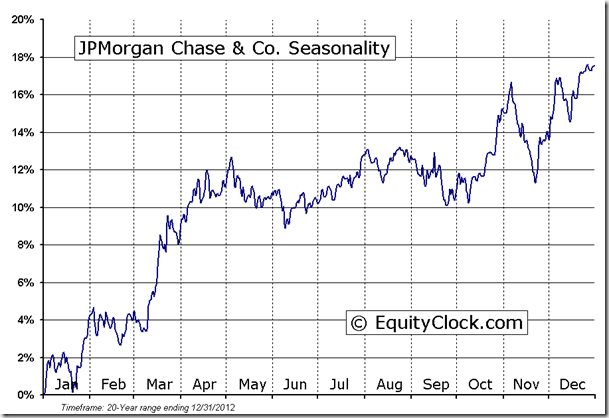

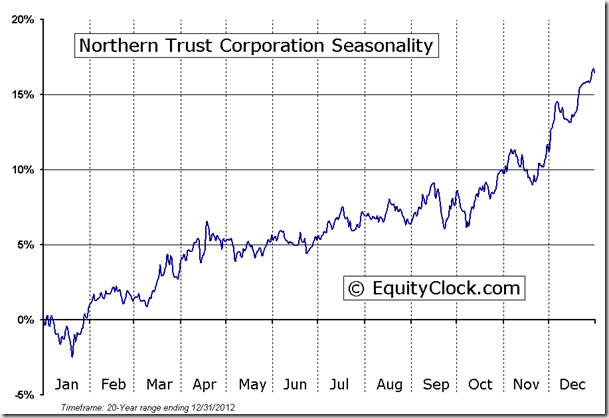

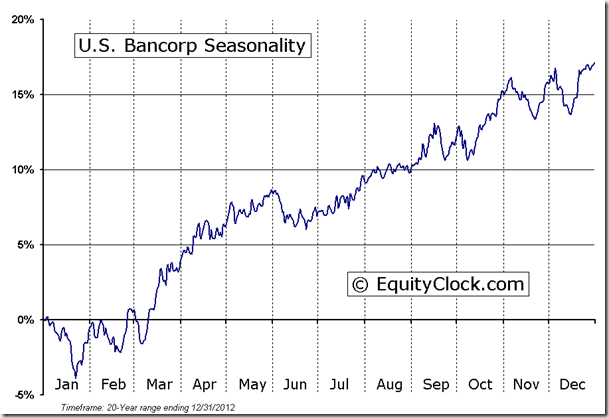

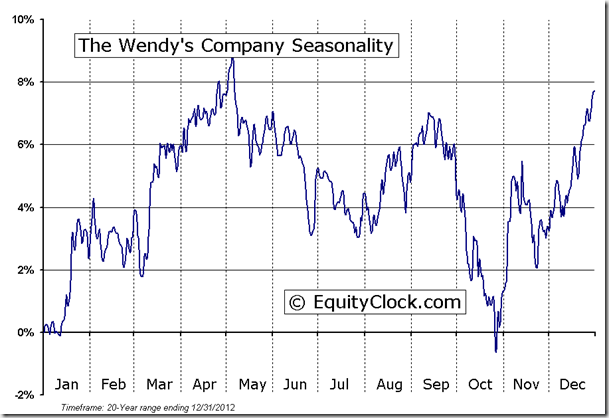

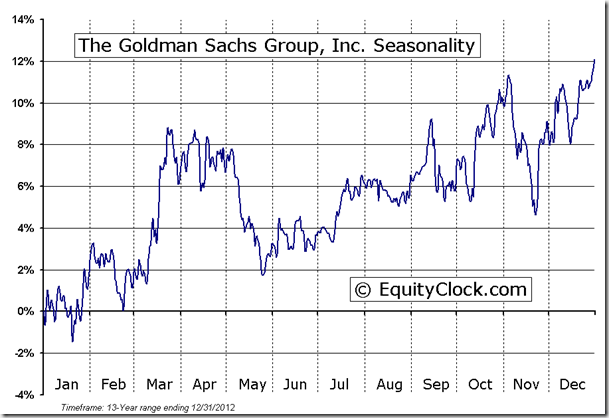

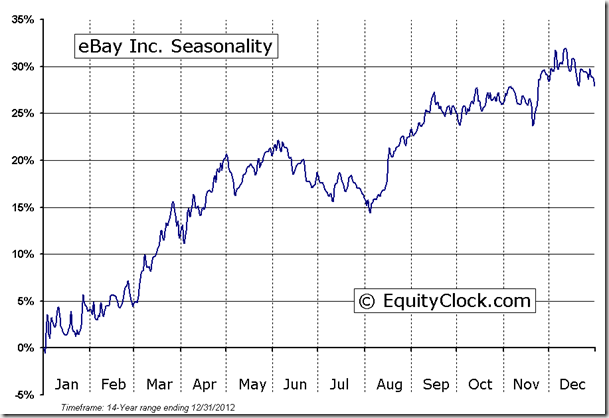

Financials are in focus as earnings season continues on Wednesday with reports from Bank of New York, Charles Schwab, Comerica, Goldman Sachs, JP Morgan, Northern Trust, U.S. Bancorp, Wendy’s International, and eBay.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bearish at 1.03. With the onslaught of financial earnings to be reported on Wednesday, investors raced to the options market to hedge portfolios in the event of a negative reaction. Signs of complacency have abated, for now.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

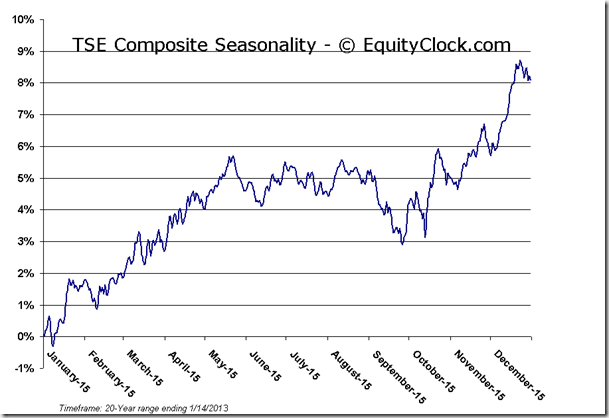

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.10 (up 0.15%)

- Closing NAV/Unit: $13.11 (up 0.28%)

Performance*

| 2013 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 3.07% | 31.1% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.

Copyright © Tech Talk