by Jared Woodward, Condor Options

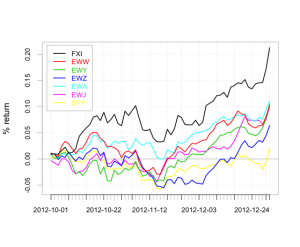

One of the interesting things about Q4 equity returns was how little most of the world seemed to care about the U.S. fiscal cliff.

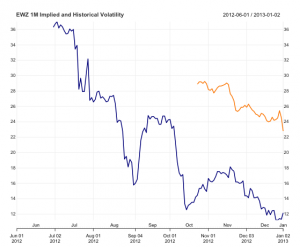

Except for SPY (yellow), equities around the world put together a pretty solid quarter. What’s interesting, though, is how high option premiums still are in some of these markets. For example, Brazil:

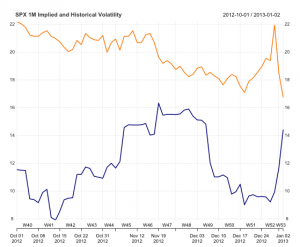

The blue line is the one month historical volatility of EWZ; the orange line shows the price of February EWZ volatility futures. That ten point difference is pretty noticeable, and it’s not just the nature of the type of product, either. The same sort of relationship exists in EEM and its volatility futures, but not in SPX. Compare the February VIX futures and SPX historical volatility:

February VX sold off after the cliff deal was announced, and we can expect short term realized volatility to decline as markets return to normal. I would expect the premium in this chart a week from now to be about 5-6 points.

Given the relative outperformance of international stocks, high bids for emerging market volatility are kind of curious.

Disclosure: short VX and VXEW.

About the author

Jared Woodard is the principal of Condor Options. With over a decade of experience trading options, equities, and futures, he publishes the Condor Options newsletter (iron condors) and associated blog. Jared has been quoted in various media outlets including The Wall Street Journal, Reuters, Bloomberg, Yahoo! Finance, Financial Times Alphaville, and The Chicago Sun-Times. He is the author of Options and the Volatility Risk Premium and Iron Condor Spread Strategies: Timing, Structuring, and Managing Profitable Options Trades, both published by FT Press. In 2008 he was profiled as a top options mentor in Stocks, Futures, and Options magazine, and in 2010 was interviewed for Technical Analysis of Stocks & Commodities magazine. He is a founder and contributing editor of Expiring Monthly: The Option Trader’s Journal, and is a daily contributor to TheStreet’s Options Profits premium service. He is also an associate member of the National Futures Association and registered principal of Clinamen Financial Group LLC, a commodity trading advisor.