by Sober Look

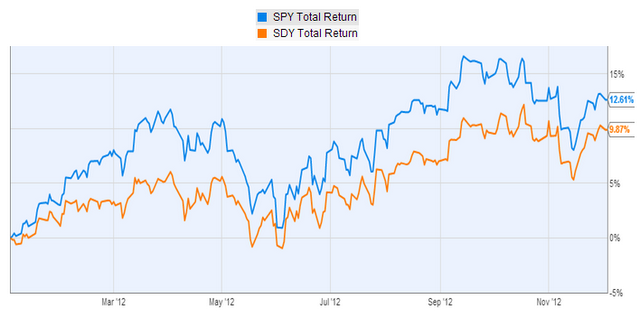

The impending increase in US dividend tax has caused a number of high dividend shares to underperform the broader market this year. The S&P500 did roughly 3% better than the dividend share index on a total return basis.

SPY (S&P500 ETF) vs. SDY (high dividend index ETF) (source: Ycharts)

Increasing dividend tax will clearly hurt conservative investors, many of whom are older and trying to save for retirement. It will also discourage some firms from paying the same amount of dividend investors have become accustomed to. Nevertheless many argue that high dividend equities remain a good investment, particularly in an environment in which dividend yields are higher than long-term treasury yields. IMCA (see attached presentation) makes the following three points:

1. Taxes alone may not determine valuations. The US in the 21st century has had the lowest taxes in recent history, yet stocks had the worst performance during that period.

2. What makes people uneasy about high dividend stocks is that in a "fiscal cliff" scenario "families with adjusted gross income above $250,000 will face a top rate of 40.5% on wages, 43.4% on interest/dividend income and 23.8% on capital gains." Add to that high state taxes and the US top tax rate on dividends becomes the highest in the developed world (higher than France - see discussion). However in an environment like that, high-dividend shares may in fact do OK because the US will likely face a recession. In a period of economic contraction or slow growth, dividend is at a premium. Even if taxed at a much higher rate, dividends provide some downside protection.

3. One clearly needs to be careful with sector selection, but dividend shares look attractive on a relative basis. IMCA's point is that dividend stocks certainly do not currently exhibit signs of a "crowded trade".

Enjoy.