by Vadim Zlotnikov, Chief Market Strategist, AllianceBernstein

Nobody likes to be stuck for too long on a crowded bus or train—especially when it’s time to get off. But when it comes to stocks, we often take for granted the risks of getting trapped with too many people in an untenable position.

Perhaps that’s because nobody has ever really defined what a crowded trade means, even though investors talk about it all the time. And without clear criteria to identify a crowd, it’s impossible to know how to avoid one. This is a dangerous omission from the standard investment playbook; our research shows that poor performance of crowded large-cap stocks in the US is clearly coincident with periods of outflows from active management.

The concept of crowding can be easily misunderstood. You might mistake it for momentum because crowded stocks tend to have outperformed. Some may confuse it with growth, as crowded stocks often have higher valuations and expectations. To set the record straight, we designed a quantitative crowding indicator to help avoid the risk of the so-called winner’s curse, when wildly shared optimism about an investment’s desirability can create an illiquid situation just when you want out. It’s based on four factors that capture key aspects of crowding and differ from traditional growth-stock definitions:

Breadth of Ownership: Since widespread institutional adoption can leave few marginal buyers, too many buy-side overweights are a telltale sign of crowding. We’ve refined this measure by adjusting for large-cap bias.

Consecutive Net Institutional Purchases: When significant purchases are observed over consecutive quarters, a crowd may be forming.

Volumes and Valuation: Watch for irrational exuberance. Heightened trading volume coupled with valuations above historical norms probably signals an overly excited market.

Sell-Side Popularity: Beware of too many sell-side cheerleaders. Our research shows that stocks with the most analyst buy ratings underperform dramatically in the next 12 months. This serves to further highlight the value of a well-researched contrarian view in an industry susceptible to groupthink.

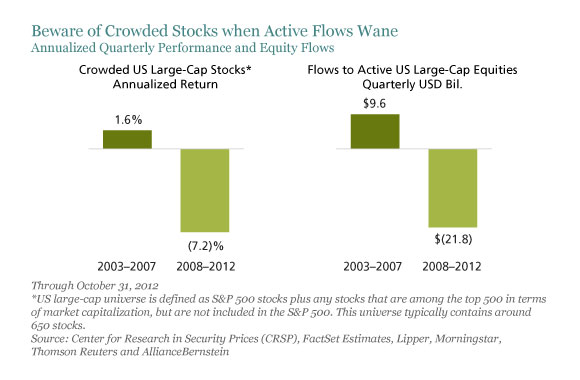

Using our indicator, we found that crowded US large-cap stocks performed especially poorly over the past four years, when there were significant outflows from active management and growing emphasis on risk management (Display).

This is no coincidence. Each of the four measures that we tested showed substantial underperformance by crowded stocks during the past four years, and more broadly, during months of outflows from active management. During the same periods, uncrowded stocks tended to outperform—especially in the last four years, as passive funds and exchange-traded funds (ETFs) became more popular. These trends are probably the result of the extreme risk-on, risk-off environment of recent years, as de-risking pressures, episodic illiquidity during big market moves and increased tail-hedging all promoted crowd formation.

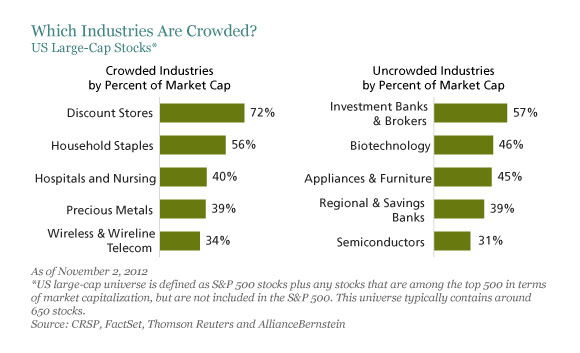

Today, the crowd is somewhat bigger than usual, with about 10.5% of US large-cap stocks ranking as crowded on our indicator, compared with 8.5% since 2003. Some industries are more crowded than others, such as discount stores, household staples and technology services (Display).

It’s time for investors to pay more attention to crowded trades and to think more about how to avoid them in certain market conditions. Until flows into active management improve, we favor highly rated uncrowded stocks and would exercise caution in adding too much exposure to crowded stocks—especially those with poor fundamentals.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Vadim Zlotnikov is Chief Market Strategist for AllianceBernstein.

Copyright © AllianceBernstein