by Matt Lloyd, Advisors Asset Management

European fears have subsided a bit as the European Central Bank’s (ECB) president continued to offer words of support for a more comprehensive solution…though he appeared to dampen the statements with concessions about the ECB’s ultimate subservient role to the governments. As we noted a couple of weeks ago, the German government’s resounding approval of $120 billion of support for Spain’s banks was significant. The more important number wasn’t the $120 billion, but the 5 to 1 in favor of it in light of the public’s concerns about troubling countries and their potential drain on German prosperity. We noted that the solution ultimately lies in Germany, and with their ultimate benefit from adopting the Euro, the only solution for the future prosperity of German exports is to maintain the Euro largely as is.

The other two options leave Germany extremely vulnerable to a significant drop off in the exports competitiveness.

This has had a large impact on equity markets and certain debt markets in Europe:

- The German DAX market is up 16.40% year to date with a nearly 4.00% gain in today’s trading alone. The EURO Stoxx is only up 2.42% for the year, but had a 4.83% move in today’s trading alone.

- Italy’s two-year sovereign debt issue has dropped to a 3.13% yield after hitting an intraday high of 5.26% just last week. A stronger indicator that fear has subsided is measured in Spain’s two-year debt. The yield hit an intraday high of 7.15% last week and now sits at 3.96%.

China looks to have bottomed to most analysts, but expectations remain very tepid for their recovery. We actually see a starker rebound in growth by the fourth quarter and through 2013. Consider the last two times China’s Central Bank embarked on substantive rate cuts to their Required Reserve Ratio (RRR) and you will notice some significant expansion in equities and housing. In June, after lowering the RRR, home sales jumped 41% in one month and home prices increased in 25 of the 70 largest cities. May only saw an increase in five of the 70 cities. Consider that the Shanghai Composite Stock index rose nearly 80% over the four years after their initial cut in 1997, and again when they cut rates in 2008 they saw an immediate bounce back of 73% in their equity markets. They have also begun to prime the pump for a varied form of stimulus as they have utilized state-owned companies to raise investment and accelerated the approval process for certain projects. We would expect a more consumption-focused stimulus, though as we have seen recently a stimulus package of nearly any kind appears to be the high tide that lifts all boats.

Another aspect to raising our bullishness on the China story is the fairly undervalued current state of the equities in China. The average PE (price/earnings) multiple in the Shanghai Composite index over the last 15 years has a median of 31.95; currently it stands at 11.50 times. This represents the dire expectations of profits going forward. When one looks at the previous two periods that the RRR was cut PE multiples expanded 30% and 39% respectively. The current multiple is near the 15-year low. We always note that when expectations are so heavily skewed in one direction, the antithesis usually transpires.

Last but not least, the jobs report in the United States was better than expected and caught the bearish predisposition off guard. The U.S. Treasuries have been getting whipsawed over the last week; however, the bias has been to selling. I guess an intraday 10-year yield of 1.38% isn’t attractive enough to hold until maturity. It may be hard to remember since it was so long ago, but the 10-year was yielding a 2.40% and the 30-year yielding a 3.49% back in late March.

Because we wrote about the trending jobs environment last week (read here), we won’t rehash the trend line and base line aspects we see in the marketplace. However, in looking at the earning reports, consider that expectations for the second quarter were greatly reduced throughout the last three months. And while we are seeing some of the concerns come across in the revenue numbers as 43% of the companies reporting earnings have beaten revenue estimates, 70% have come in above earnings estimates. We continue to see this as a confirmation that lack of hiring by American businesses of all sizes has actually assisted them in maintaining certain levels of profitability and cash flow margins. Though we can understand some of the hesitations about future expectations since a large amount of companies are offering lower guidance for the third quarter, it appears there are more dire expectations built in.

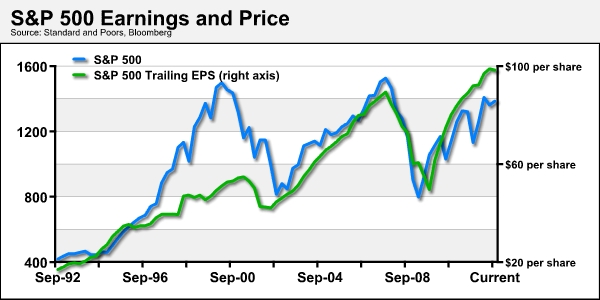

What we take note of is the relative outperformance of earnings over the last couple of years relative to the performance of the S&P 500.

Though it is always a bit presumptuous to take solitary trading days and extrapolating them into a future expectation, it may not be as fool hardy if these singular events are affirming trends. Markets and emotions are not linear, but over time they tend to become more efficient. As events continue to tell us that the economy is growing, if only slightly, it could also bode well for China. We continue to see opportunities abound in the domestic and global equity markets and would consider adding exposure to China as well as select European markets where appropriate.

This commentary is for informational purposes only. All investments are subject to risk and past performance is no guarantee of future results. Please see the Disclosures webpage for additional risk information at www.aamlive.com/blog/about/disclosures. For additional commentary or financial resources, please visit www.aamlive.com

Copyright © Advisors Asset Management