by Andrew Pyne, PIMCO

- Equity valuations appear reasonable, but volatility is likely to remain elevated amid slowing global economic growth and macroeconomic risks.

- As macro events drive markets, the probability of fundamental mispricing increases, providing opportunity for active managers to add value.

- Investors should consider increasing exposure to emerging markets, deploying downside-risk and volatility-mitigation, emphasizing dividends and focusing on active share.

PIMCO’s secular outlook calls for slowing global economic growth, a world that is still multi-speed, and unresolved macroeconomic risks that are likely to result in continued heightened volatility. While our view on the economy is a cautious one, overall equity valuations appear reasonable, and corporate fundamentals, as measured by earnings, margins and balance sheets, are relatively attractive. The outlook for equities, then, can be expressed as a tug of war between these macro headwinds and micro fundamentals.

What does this mean for equities, which are still the dominant risk in investor portfolios? Overall, we believe that continued policy confusion and economic fundamentals that are trending in a negative direction will create headwinds. As the developed world continues to delever, we expect global equities to experience a modest-return environment.

Challenges and solutions

The clear implication is that this creates a challenge for investors. Most investors historically have relied on equities to help achieve their target portfolio returns. In this environment, though, beta is unlikely to deliver the returns required. We believe that investors should consider the following:

- Increase exposure to faster-growing economies. Many portfolios should be more global with higher allocations to emerging markets.

- Incorporate downside-risk and volatility-mitigation to address the higher probabilities of negative macro events.

- Emphasize dividends, which will likely be a more important component of equity total returns.

- Take greater active risk and focus on active share. In a modest-return world, if beta doesn’t get the job done, then alpha may be a significant percentage of an investor’s equity returns.

Multi-speed world

The key risk to the global economy is Europe, which given significant structural challenges and policy uncertainty is facing prolonged subdued growth and the risk of recession. Why then do we suggest equity portfolios be more global? The answer lies partly in the way equities have traditionally been categorized. Companies are often classified by their country of domicile, but we think they are better defined by their end-markets. Despite significant risks at home, many European multinationals have meaningful exposure to emerging markets. If we find businesses with stable cash flows, high dividend yields, strong end-market growth – and with valuations that discount home-market risks – these can be attractive investment opportunities.

In addition, we believe most investors, particularly those with a home-market bias, would benefit from increased direct exposure to emerging markets. While emerging markets are certainly not immune to the struggles of the developed world, emerging markets and developed markets face very different economic scenarios. We expect emerging markets to continue to gain share of global GDP, but most investors are still underweight the asset class. We expect emerging markets to account for more than 50% of global GDP in purchasing power parity terms over the next three to five years. They already are about a third of global equity market caps. Yet emerging market equities represent only about 7% of the average investor’s portfolio.

Managing macro risks

Our second suggestion is to prioritize downside- and volatility-mitigation in equity portfolios. Correlations among stocks have increased meaningfully over the past few years; they’ve tended to spike around negative macro events and decrease as uncertainty subsides (see Figure 1). This suggests that the “risk-on/risk-off” sentiment that drives stock prices is often governed by macro news flows, not company fundamentals.

There are two takeaways for investors. The first is that macro does impact stock prices, and so while equity investing has traditionally been thought of as a bottom-up endeavor, we believe managers need to consider both bottom-up and top-down views as part of their research process.

The second takeaway is that because there are unresolved macro risks, investors must recognize that, given the way returns compound over time, protecting on the downside could be a critical contributor to long-term returns. Part of the solution may be increasing allocations to active mandates from passive. Although investors could lose more with an active approach, by definition traditional indexes will capture 100% of down-market performance.

We believe protecting on the downside requires a very active approach. Strategies including low-volatility and dividend-focused investing, tail-risk hedging, and flexibility to short stocks or raise cash, may result in improved risk mitigation compared with a passive strategy.

Dividend income

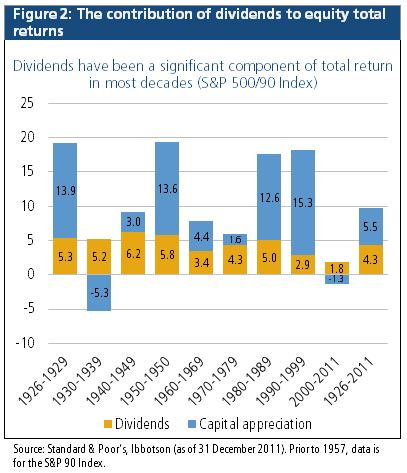

Dividend income, a significant portion of historical equity returns, is likely to be even more important in an environment of slower growth. Of course, if we were expecting broad multiple expansion and strong global growth – as we saw in the ‘80s and ‘90s – then the message simply would be “buy equities and enjoy the ride.” As Figure 2 shows, however, dividends often have been a substantial portion of total equity performance during periods of modest returns. While many investors’ assumptions and expectations for equities were formed by the 20-year bull market of the ‘80s and ‘90s, the ‘40s, ‘60s and ‘70s may be more instructive for the period ahead.

We also believe the opportunity for dividend-paying stocks is more of a global story than a U.S. one. Given demand from U.S. investors for income, traditional dividend-paying sectors in the U.S. – telecom, utilities, Real Estate Investment Trusts (REITs), and Master Limited Partnerships (MLPs) – are generally quite expensive, whereas select non-U.S. equities, including emerging markets, remain attractive sources of yield.

Essential alpha

Two points outlined above – the notion that macroeconomic news flow influences stock prices and the expectation for modest returns – each reinforce the importance of alpha in helping investors achieve their goals. As macro events drive markets, the probability of fundamental mispricing increases, providing opportunity for active managers to add value. The key is to be highly selective, identifying the long-term winners even as the markets are indiscriminate in the short term.

For many investors, the importance of alpha should prompt a reconsideration of the mix of passive and active equity allocations. At the very least, we believe investors should ensure that their active managers are truly active, with high active share a prerequisite for inclusion in their portfolio (please see Equity Investing: From Style Box to Global Unconstrained, May 2012).

Revisiting equity portfolios

In an environment of fatter tails, there is always the possibility of a right-tail event. Enactment of comprehensive and bipartisan policies to address structural problems in developed markets, for example, would be welcome news and would likely lead to broad multiple expansion and higher returns in the equity markets. However, absent such developments, economic fundamentals suggest more modest returns.

Many investor portfolios may not be positioned for a lower-return world, particularly those that were structured during a higher-return equity environment. We believe investors would be well served to take a fresh look at their equity allocations. If beta will not suffice, then investors should work to ensure their portfolios have the characteristics needed to succeed.

Past performance is not a guarantee or a reliable indicator of future results. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Dividends are not guaranteed and are subject to change and/or elimination. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. REITs are subject to risk, such as poor performance by the manager, adverse changes to tax laws or failure to qualify for tax-free pass-through of income. Entering into short sales includes the potential for loss of more money than the actual cost of the investment, and the risk that the third party to the short sale may fail to honor its contract terms, causing a loss to the portfolio. Tail risk hedging may involve entering into financial derivatives that are expected to increase in value during the occurrence of tail events. Investing in a tail event instrument could lose all or a portion of its value even in a period of severe market stress. A tail event is unpredictable; therefore, investments in instruments tied to the occurrence of a tail event are speculative. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested.

The correlation of various indices or securities against one another or against inflation is based upon data over a certain time period. These correlations may vary substantially in the future or over different time periods that can result in greater volatility.

Statements concerning financial market trends are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

The S&P 500 Index is an unmanaged market index generally considered representative of the stock market as a whole. The index focuses on the Large-Cap segment of the U.S. equities market. The S&P 90 (prior to 1957) was a value-weighted index based on 90 stocks. It is not possible to invest directly in an unmanaged index.

This material contains the opinions of the author but not necessarily those of PIMCO and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

©2012, PIMCO.