Bond Market Outlook and Review - Loomis Sayles

by James Balfour, CFA, Senior Macro Strategies Analyst

The liquidity-driven rush into riskier assets that dominated the first quarter faded during the second quarter. The European sovereign debt and banking crisis was once again the primary catalyst, but softer economic data in the US and China also fed negative investor sentiment. Global liquidity suffered following the end of the European Central Bank’s (ECB’s) long-term refinancing operation (LTRO). Shortly after LTRO concluded, peripheral euro zone countries—particularly Spain and Italy—saw their borrowing costs rise, bank stocks came under pressure and global asset markets became more volatile as investors shied away from risk.

During the quarter, investors flocked to higher-quality assets in response to the mounting stress, and this has driven sovereign bond yields lower in perceived safe-haven countries such as the US, UK, Germany, Switzerland and Japan. Meanwhile, decelerating global growth and inflation have prompted policy makers in more cyclical, emerging countries like Australia and Brazil to lower both short- and long-term interest rates. Despite cuts, short-term rates have remained well above zero in many emerging countries, leaving central banks room to trim rates further.

Though economic growth has slowed around the world, policy makers in developed countries have generally been reluctant to enact additional aggressive measures to support growth. The Bank of England recently decided against another round of quantitative easing. The Federal Reserve Board announced that it would extend Operation Twist through the end of 2012 but has held off a third round of quantitative easing. During the last week of June, delegates at the European Union summit made significant headway on policies to address the ongoing crisis, agreeing to recapitalize Spanish banks directly via the European Stability Mechanism and laying the groundwork for an ECB-supervised euro zone banking union. The initial market response was favorable; however, these plans will not take effect until 2013, and concrete details and implementation remain to be seen. The past four years have shown that during a debt deleveraging cycle, hopes for a normal recovery and a convincing policy response to end the turmoil can often be disappointed. We anticipate that investors will demand additional near-term policy measures to support the European banking system.

A number of variables could shake growth expectations and rattle market confidence in the months ahead. Europe continues to grapple with recessionary conditions, solvency concerns and policy challenges. The US faces expiring tax cuts, sequester spending reductions related to last year’s debt ceiling agreement, a potential fiscal cliff, and another impending debt limit. A lame-duck session of Congress and the upcoming presidential election could contribute to uncertainty. If global deflationary pressures worsen, we would expect renewed balance sheet expansions from the major central banks. We believe the global search for yield will remain a key theme for the rest of 2012, and if central banks provide sufficient liquidity to the markets, we would consider taking more aggressive positions in high yield bonds, bank loans and investment grade credits.

Ailing Spanish banks, possible Greek exit from the euro, and signs of slowing growth around the globe gave investors cause for concern this quarter. Many sought the comfort of relatively safe harbors, driving Treasury returns higher and riskier-asset returns lower.

Treasurys performed well in the quarter. Slowing job growth in the US and continued turmoil in Europe prompted an investor flight to quality. The euphoria over the LTRO programs in the first quarter faded rapidly in the second quarter as concerns piled up over the potential for a Greek exit from the euro, a bailout for Spanish banks, and sharply rising yields for Spanish and Italian government bonds. Long Treasurys did particularly well, helped by the Fed’s extension of Operation Twist, in which the Fed supports the economy by purchasing long Treasury bonds to keep long yields low.

As a high-quality, relatively stable market, municipals also benefited from turmoil in Europe, with fairly steady inflows during the quarter. Returns moved up with Treasurys, though by a smaller amount.

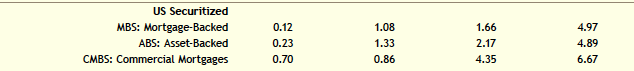

Agency MBS performance for the quarter was positive, though prices fluctuated as investors debated whether economic growth was sufficiently weak to cause the Fed to rollout QE3. CMBS was hurt by (and ABS helped by) the general “risk off” sentiment in the markets.

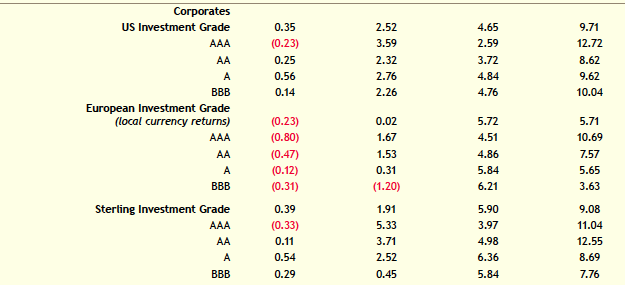

US investment grade corporate yields fell in the quarter, though the move did not keep pace with Treasurys, and spreads widened by 20 to 30 basis points or more. Investors searching for a relatively less risky asset class may have been drawn to investment grade credit, while at the same time deterred by the low yields. Returns were similar across quality buckets but much more disparate across geographies (the US outperformed euro and sterling) and industries. Railroads and electric utilities gained 4% or more while airlines, autos and much of the finance sector earned less than 2%.

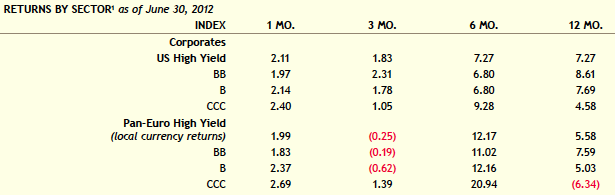

It was little surprise that traditionally riskier assets like high yield underperformed in a quarter plagued by worries over the future of the euro, a fiscal cliff in the US and slowing growth in China. US yields were flat to higher, with the spread on the high yield index widening from 576 to 631 basis points. Lower-quality meant lower returns, with CCCs gaining just 1.05%. Returns by industry ranged from strong gains in autos, entertainment and homebuilders to outright losses for life insurers, metals & mining, and energy. Euro high yield also lost ground in the quarter, with a return of (0.25%).

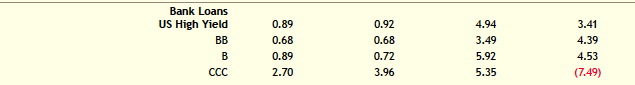

After gaining nearly 4% in the first quarter, loans rose less than 1% in the second quarter. In contrast to high yield bonds, however, lower-quality loans outperformed the higher-rated buckets. According to Moody’s, loan (and bond) default rates remain low, at just 1.9% versus 2.2% a year ago.

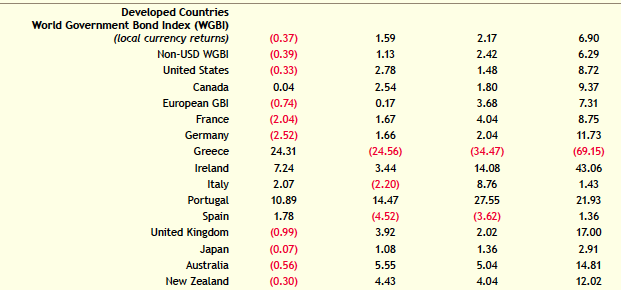

Yield moves for developed-country bond markets largely fell into two groups. Those nations regarded as “safer” or a “haven” from European turmoil performed well and saw their 10-year bond yields decline by ¼ to ½ a percentage point in the quarter. This group included the US, UK, Canada, France, Germany and Switzerland. Japan’s yields also fell, though by a smaller amount given the lower starting point. Short rates also declined, with Swiss 2-year yields moving into negative territory. Struggling nations—notably Greece, Spain and Italy—saw poor performance and higher yields. Yields were particularly volatile in Spain and Italy, as investors debated whether policymakers would provide sufficient and timely aid. Spanish yields spiked from 5.32% to a peak of 7.29% before recovering to 6.25% on the last day of the quarter due to progress made at the European Union summit.

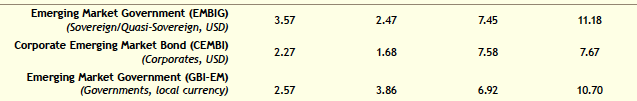

Emerging markets offered mixed returns in the quarter, with the EMBIG up 2.5% (outperforming US high yield) and local currency bonds (GBI-EM) gaining 3.9%. Investment grade emerging market corporates rallied with their US counterparts in the quarter, though they fell behind in high yield. For investment grade corporates, the US index gained 2.5%, EM was up 2.4% and Europe was down 0.2%. For high yield, the US index gained 1.8% while EM lost 0.4% and Europe was down 0.5%.

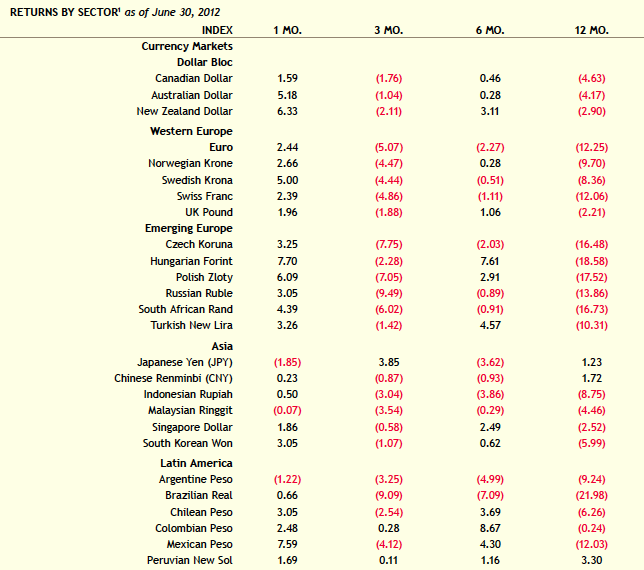

A bumpy landing in China and a rolling crisis in Europe have been pressuring global growth lower and making the US a more attractive destination for capital. The US dollar rose sharply in May when investor anxiety was at its most acute regarding “Grexit” and rising yields in Spain and Italy. The yen also rose, but most other currencies lost ground. Falling commodity prices weighed on the dollar bloc and Brazil. The Brazilian real also weakened on aggressive rate cuts and intervention efforts by the government. The Mexican peso was swept up in the “risk off” sentiment. It has been one of the most liquid currencies and has generally been readily available to trade, making it a favored instrument to express views and hedge EM.

Footnote:

1. All returns sourced from Barclays Indices except: World Government Bond (Citigroup), Emerging Market Bond (JPMorganChase), and S&P 500 (FactSet and Ned Davis Research).

Barclays US Aggregate Bond Index is an index of investment grade bonds with one- to ten-year maturities issued by the US government, its agencies and US corporations. Barclays US Government/Credit Bond Index includes Treasurys (public obligations of the US Treasury that have remaining maturities of more than one year) and agencies (publicly issued debt of US government agencies, quasi-federal corporations, and corporate or foreign debt guaranteed by the US government) as well as other publicly issued investment grade corporate and non-corporate debentures that meet specified maturity, liquidity, and quality requirements. S&P 500 Index is a capitalization-weighted Index of 500 common stocks chosen for market size, liquidity, and industry group representation to measure broad US equity performance. Citigroup World Government Bond Index represents the broad global fixed income markets and includes debt issues of US and most developed international governments, government entities and supranationals. JP Morgan Emerging

Markets Bond Index Global (EMBIG) tracks total returns for traded external debt instruments in the emerging markets including US dollar-denominated Brady bonds, loans and Eurobonds. JP Morgan Corporate Emerging Markets Bond Index (CEMBI) tracks US-dollar denominated debt issued by emerging market corporations. JP Morgan Government Bond Index-Emerging Markets (GBI-EM) tracks local currency bonds issued by emerging market governments. All indexes are unmanaged, do not incur fees and it is not possible to invest directly in an index.

This commentary is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P., or any portfolio manager. Investment recommendations may be inconsistent with these opinions. There can be no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual or expected future performance of any investment product. We believe the information, including that obtained from outside sources, to be correct, but we cannot guarantee its accuracy. The information is subject to change at any time without notice. Indexes are unmanaged and do not incur fees, and you may not invest directly in an index. Past performance is no guarantee of future results.