by Guy Lerner, The Technical Take

There is no question that the Federal Reserve’s market interventions have distorted market signals. What used to be no longer applies. The elephant in the room with the deep pockets has pushed bond yields down to historic lows, yet the desired effect – a growing economy — has been anything but that. Despite the massive stimulus, the recovery is the weakest on record. And now as the latest Fed incarnation of stimulus (i.e., Operation Twist) is about to end, the markets and economy are sputtering. What will the Fed do next? And this is the only thing that matters to a market hooked on the monetary morphine.

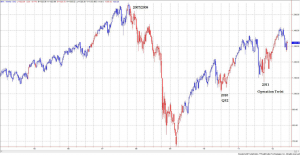

Figure 1 is a weekly chart of the SP500. The red labeled bars are those times when the Economic Cycle Research Institute’s Leading Economic Indicator (ECRI) suggests that U.S. economy is in a recession. The record of the indicator is not perfect in that it doesn’t always correlate with the National Bureau of Economic Research official recession calls, but the presence of a red labeled bar should alert one to look for other supporting factors that the economy may be sputtering. (As an aside, the ECRI’s LEI is but one factor considered in my own Real Time Recession Indicator.)

Figure 1 SP500/ weekly

Now look at figure 1 and note the 2010 and 2011 time periods. The ECRI’s LEI was suggesting that the economy was dipping into recession. But rather than head lower in anticipation of a recession, the stock market bottomed and headed significantly higher. So what gives? Of course, thanks to QE2 (2010)and Operation Twist (2011), the Fed was able to avert the natural course of events and avoid the dreaded recession. In other words, the ECRI’s LEI didn’t signal an oncoming recession; it signaled increasing liquidity and market intervention by the Federal Reserve. What used to be no longer applies! Fed intervention has distorted market signals.

Now comes 2012, which appears to be playing out like 2010 and 2011. The market is selling off as another Fed program to stimulate the economy (and stock market) is ending. The equity market is weak as the monetary morphine dissipates, and bond yields have hit new lows in anticipation of the economic weakness and a new round of bond purchases. According to the ECRI’s LEI, the economy is weakening, and we should remember, this is just one tool to assess the health of the economy. But if the Fed were going to intervene in the markets, now appears to be the time as economic growth is on the wane.

Of course the key questions remain: 1) Will doing more of the same avert the natural course of events — that is prevent another recessions? and 2) How sustainable will the economic bounce be? As I will show next time, the Fed appears to be losing the battle.

Copyright © The Technical Take