The Economy and Bond Market Radar (April 23, 2012)

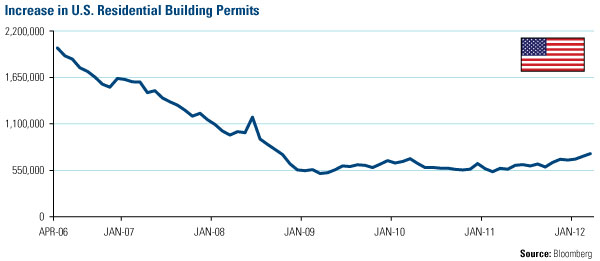

Treasuries were more or less unchanged this week. U.S. economic data was broadly in line with estimates and Treasuries didn’t move around much this week. One interesting data point that was released this week was housing permits, which rose faster than expected to 747,000 (seasonally adjusted annualized rate). This can be easily seen in the chart below and has finally broken out of the range that it occupied for the past three years. This appears to be a very favorable development, as new housing activity looks as if it is finally picking up.

Strengths

- As mentioned above, housing is showing some signs of life and appears to be picking up.

- India’s central bank cut interest rates this week and China has indicated a willingness to ease monetary policy in the near future. The global easing cycle continues.

- Retail sales rose a very strong 0.8 percent in March, well ahead of expectations and with broad-based strength.

Weaknesses

- Spanish 10-year bond yields rose above 6 percent this week as the market rotates through southern Europe, with the current focus on Spain.

- Weekly initial jobless claims rose to 386,000 this week, continuing the recent trend of higher readings.

- The Bank of Canada has become more hawkish and indicated that rates may be headed higher on better-than-expected economic growth and higher inflation.

Opportunity

- After a disappointing first-quarter GDP result, the Chinese are likely to ease monetary policy as early as this quarter.

Threat

- Rising oil and gasoline prices combined with liquidity implications of global easing, led by Europe, may raise the prospect of a reappearance of higher inflation going forward.