This article originally appeared in the Daily Capitalist.

Economists cling to statistical data like barnacles in order to have some kind of anchor to explain what is going on in the world. They will try to cram the square data peg into the round holes of economic "laws" rather than abandon them when they are obviously wrong. Which is not a very satisfactory way to explain things. You might begin to think the data you measure is just coincidentally correlative for the period measured if it falls apart at some point. Instead of trying to stretch the data into what you think it should be, then maybe you might think that you've got it all wrong.

Chairman Ben Bernanke is not letting a data inconsistency get in the way of his prior conclusions about unemployment. In his speech today, he says that he's not sure why we have such high rates of unemployment, some may be just cyclical, some may be structural, but whatever it is the Fed will be available to print money to "support demand and for the recovery." Somehow QE1 and QE2 were not enough.

In his speech Bernanke tries to explain why Okun's law (a correlation between GDP and employment/unemployment) is still valid yet doesn't explain the current situation. Perhaps GDP "growth" Bernanke sees is really a figment of money steroids, something the Fed has unleashed, and that unemployment is still high because of long-term capital/savings destruction caused by QE and ZIRP.

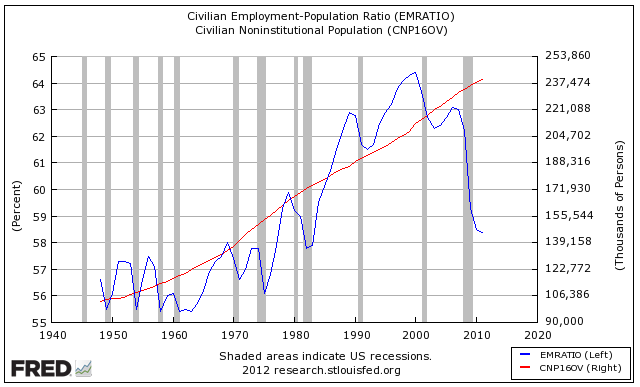

If you look at the rate of employment to the working population, you might wonder why it crashed so disproportionately to past cycles:

The blue line is the ratio of employment to population; the red line shows population growth. The population is still growing but the ratio fell off a cliff. The ratio of employed to population is back to 1977 levels. This is not something Chairman Bernanke wishes to hear or believe. He would rather adhere to the outdated ideas of the mainstream rather than question the dogma.

This is apropos of a conference sponsored by the Fed last Friday on, among other topics, the efficacy of quantitative easing. The conclusion coming from a Fed conference should be pretty obvious: QE is successful. The paper presented by economist Mark Gertler of NYU, a close collaborator with the former Professor Bernanke, concludes that QE works and he has an econometric model to prove it. What he does is look at what he considers to be the proper data and concludes that there is cause and effect and then he builds a mathematical model around this and believes it works. If his interpretation of the data is incorrect then the model is incorrect.

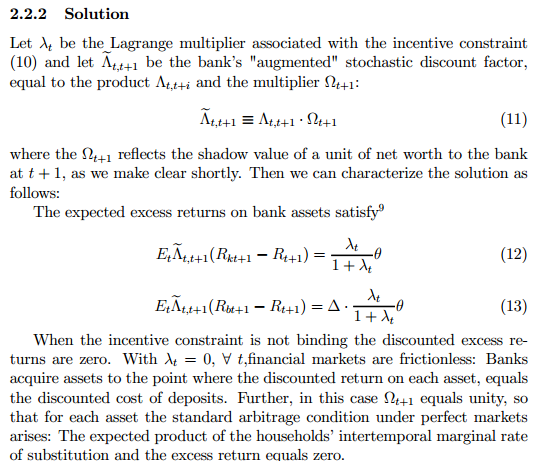

Here is a portion, out of context, of Gertler's model:

Etcetera. You would have to be an econometrician to understand this. But it is just a way to disguise false ideology by cloaking it in mathematical formula. See Hayek and Mises on this topic. Because the formula "works" doesn't mean it is right. Believe what you want to believe.

I think this is mostly an ad hoc ergo propter hoc (A happened and then B happened, thus A caused B) kind of analysis and that his conclusions are based on incorrect theory and fail to explain anything. But it doesn't matter if he's right or wrong for our purposes because Bernanke and most of the people at the Fed believe it. We can thus be assured that the Fed will unleash another round of QE when the economy stagnates (as I have forecast that it will).

It matters if he's right or wrong for our purposes as investors though, because QE distorts the entire economy, gives an illusion of growth, destroys capital, causes more unemployment, and leaves the economy structurally impaired for a considerable time. One of the nasty little side-effects of QE that is most recognizable to investors and consumers is price inflation. It is probably higher than it is reported but it would grow much higher with more money printing. It destroys your wealth. It is possible, as we found out in the 1970s that you can have economic stagnation and high inflation at the same time.

What we are seeing now in the data is an effect from QE1 and QE2 and Operation Twist. It cannot last and it won't because you can't create wealth out of thin air as they are attempting to do.

Bernanke's speech is another example of Mr. Bernanke's admission that he does not understand the fundamentals underlying our economic problems. Otherwise Fed policies he unleashed would have cured the problem long ago.

Just last Thursday in an econ class at George Washington University he said the Fed's low-interest-rate policies in the early 2000s didn't cause the housing boom and bust:

"There's no consensus on this," Mr. Bernanke told a class of college students at George Washington University. "But the evidence I've seen suggests that monetary policy did not play an important role in raising house prices during the upswing."

The housing boom-bust must have been caused by "irrational exuberance" which was Alan Greenspan's "animal spirits" Keynesian explanation for the Dotcom bubble. Greenspan has also denied that he caused the housing bubble.

What can one say about this? There is actually very good evidence that the Fed's easy money policy was the fountainhead of the bubble. But readers of the Daily Capitalist are well aware of that.

These speeches are further confirmations of disastrous Fed monetary policies that won't end until the Fed raises interest rates and stops printing money. I'm betting on stagnation, more QE, and higher price inflation.