by Daniel Morillo, Ph. D, iShares

One of the most common conversations we’ve been having with clients recently relates to the tradeoff between the upside potential of an increased allocation to emerging markets equities and the additional risk that such an investment brings into an overall portfolio. Clients are becoming more interested in emerging markets, yet they remain concerned about risk and how the ongoing European financial crisis and the U.S. political situation will affect equity risk in general.

One potential way to increase your emerging markets exposure while also keeping risk in your comfort zone is by using a minimum-volatility approach to investing in emerging markets.

Minimum-volatility portfolios, as I explain in this video, are designed to provide exposure to a particular market with lower risk than a traditional capitalization-weighted portfolio. As might be expected, minimum volatility strategies may sacrifice some upside during strong market rallies. What’s surprising, though, is that over longer time periods minimum volatility portfolios have generally been shown to deliver similar return to their cap-weighted counterparts but do so with lower risk[1].

How can an investor take advantage of this feature of minimum volatility portfolios in the case of emerging markets?

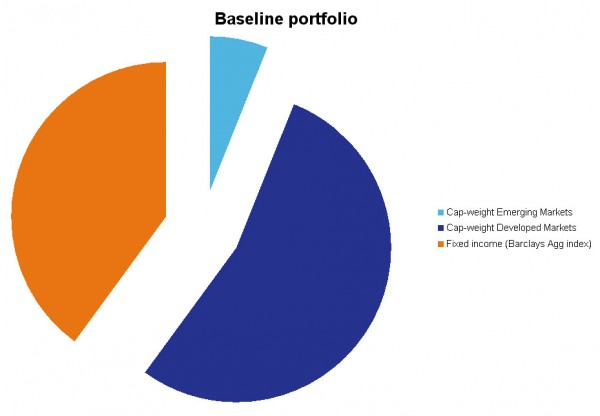

Consider, as a starting point, a portfolio constructed with a typical 60%/40% allocation split between stocks and bonds. Assume, in addition, that the allocation to emerging markets within the equity portion of the portfolio is 10%, using a broad emerging markets benchmark like the MSCI Emerging Markets Index. Over the last 10 years this 60/40 portfolio would have delivered an average annualized return of 6.3% and annualized risk of 10.6%[2].

Baseline Portfolio with 6.3% annualized return and 10.6% annualized risk

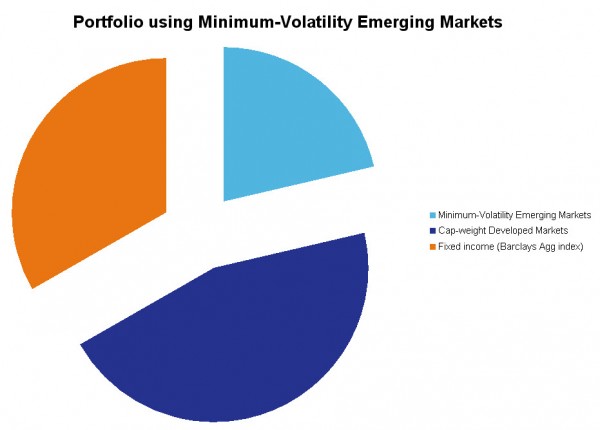

Now imagine swapping out the traditional cap-weighted emerging market exposure for a minimum-volatility emerging markets strategy, for example the MSCI Emerging Markets Minimum Volatility Index[3]. How would the swap affect your portfolio? Because the minimum-volatility exposure to emerging markets is less risky than the traditional cap-weighted exposure (19.3% vs. 24.4% over the last 10 years), this means that it is possible to increase the allocation to emerging markets while keeping the same total risk of the portfolio.

Portfolio using minimum volatility emerging markets exposure with 9% annualized return and 10.6% annualized risk

In particular, within the equity portfolio it would be possible to go from 10% cap-weighted exposure to emerging markets to about 40% minimum-volatility exposure to emerging markets while keeping to the same 10.6% total risk of the portfolio over the last 10 years.

To compare, a 40% exposure to emerging markets within equities in the form of a cap-weighted exposure such as the broad MSCI Emerging Markets Index would have resulted in annualized risk of about 12% over the same time period. That’s a significant increase over the original risk budget — 10.6% — of the baseline portfolio.

Accessing equity exposure via minimum-volatility alternatives can allow investors to take on more exposure to risky assets, including equities, while keeping to a stable risk budget. A minimum volatility strategy could be compelling in the current environment, where equity risk remains a concern for many investors.

Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume.

Asset allocation may not protect against market risk.