The Dividend Yield Love Affair

“Do you know the only thing that gives me pleasure?

It’s to see my dividends coming in.”

- John D. Rockefeller

by Michael Nairne, Tacita Capital

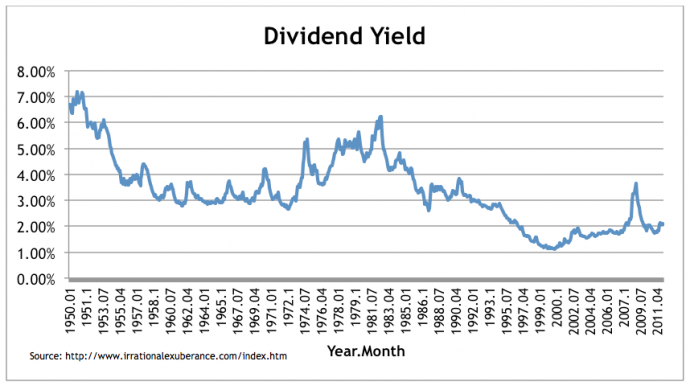

Today’s rock bottom interest rates have propelled many investors to pursue high dividend yield stocks. This quest has been made more challenging by the fall in dividend yields over the past six decades. This decline is illustrated in the following graph that depicts the annualized dividend yield on the S&P 500 since 1950. Dividend yields, which topped 7% in the early 1950’s, dropped to their nadir of nearly 1% during the tech boom of the late 1990’s. They have since recovered somewhat but are still at a paltry level of just over 2%.

The decrease in dividend yields is attributable to two factors. First, companies have dramatically reduced the proportion of earnings that they pay out in dividends. In the 1950’s, S&P 500 companies routinely paid out well over one-half of their earnings as dividends. This pay-out ratio has now dropped to about one-third of earnings. Second, stock prices relative to both earnings and dividends have increased reducing both earnings and dividend yields.

The decline in yields has sent investors flocking into sectors that offer higher dividend yields including consumer staples, utilities and telecommunications. Wall Street, always eager to capitalize on investor infatuations, has responded with a bevy of high dividend yield products. Not surprisingly, based on both forward and trailing price earnings ratios, these are among the most expensive sectors in the S&P 500.

Investors should step back from their enthrallment with high dividend yields to recognize that dividends are only one component of total return. The second is capital appreciation. Today, earnings per share growth are being accelerated as companies buy back stock in amounts even greater than their dividend payouts. These repurchases lift earnings per share which ultimately should be reflected in capital appreciation.

A common misconception of stock buybacks is that they increase the overall value of a firm. This is not the case. A firm is simply returning cash to its shareholders by reducing corporate cash in exchange for shares. Earnings per individual share are increased but in aggregate this is offset by a reduction in the number of outstanding shares. Whether a company is returning cash to its shareholders by way of dividend or stock repurchases, its aggregate value in both cases remains the same .

Dividends and stock buybacks, however, vary in one vital respect. Dividends distribute cash to all shareholders whereas buybacks distribute cash only to those shareholders who sell their shares. In the case of stock buybacks, investors can choose – they can sell and receive cash or retain their shares which, all other things being equal, will reflect an enhanced value due to the higher earnings per share or some combination thereof. Fundamentally, however, dividends and share repurchases are both mechanisms by which a firm returns cash to its shareholders in lieu of its other options – retention, debt repayment or capital investment.

Some analysts are reluctant to view share repurchases as a means of returning cash to shareholders since the popularity of employee stock options as a form of compensation has led to offsetting share issuance and dilution. However, with the release of Financial Accounting Standards No. 123 (revised 2004) and the subsequent FASB ASC 718, public companies since 2005 have been recording the cost of share-based compensation on their income statements. Employee-share based compensation which has averaged over 4% of annual selling, general and administrative expense since 2007 is now appropriately recognized as an expense. Hence, stock buybacks should be viewed for what they are – a mechanism to return cash to shareholders.

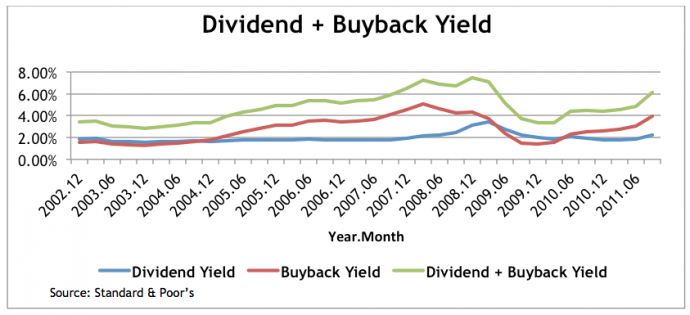

The combination of dividend and share buybacks provides a better picture of cash returns to shareholders than dividends alone. As illustrated in the following graph, since 2005 the share buyback yield (i.e. share buybacks as a percent of stock market value as shown in red) has exceeded the dividend yield (in blue) with the sole exception of the credit crisis. In total, the dividend and buyback yield is now in excess of 6%, a similar level to the payouts of six decades ago.

There are issues with buybacks. Management may benefit inappropriately from what is really financially engineered earnings growth. Many buybacks are poorly timed when the stock is expensive. Buybacks are also more volatile than dividends.

However, from an affluent investor’s perspective, buybacks have many advantages. Investors can control the timing of their sales and critically, are not forced to realize taxable income as in the case of dividends. Long-term investors can defer taxes by relying on faster earnings per share growth to drive unrealized capital appreciation. At any time, they can create a synthetic dividend by simply selling stock. In tax jurisdictions such as Canada where capital gain tax rates are lower than dividend tax rates, the synthetic dividend will have much lower tax drag.

Market history demonstrates that investor love affairs usually end badly. Investors should quit looking solely at dividend yields and move to a total, after-tax return perspective that encompasses stock buybacks.

1 Oded, J., and A. Michel, 2008, “Stock repurchases and the EPS enhancement fallacy,” Financial Analysts Journal, 64, 62-75.

2 Thompson, C., J, Muraco, and A. Robinson, 2011, “Has share-based compensation entered the “new normal” too?” Stout Risius Ross Journal.

www.tacitacapital.com

Tacita Capital Inc. (“Tacita”) is a private, independent family office and investment counselling firm that specializes in providing integrated wealth advisory and portfolio management services to families of affluence. We understand the challenges of affluence and apply the leading research and best practices of top financial academics and industry practitioners in assisting our clients reach their goals.

Tacita research has been prepared without regard to the individual financial circumstances and objectives of persons who receive it and is not intended to replace individually tailored investment advice. The asset classes/securities/instruments/strategies discussed may not be suitable for all investors and certain investors may not be eligible to purchase or participate in some or all of them. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Tacita recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor.

Tacita research is prepared for informational purposes. Neither the information nor any opinion expressed constitutes a solicitation by Tacita for the purchase or sale of any securities or financial products. This research is not intended to provide tax, legal, or accounting advice and readers are advised to seek out qualified professionals that provide advice on these issues for their individual circumstances.

Tacita research is based on public information. Tacita makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to inform any parties when opinions, estimates or information in Tacita research changes.

All investments involve risk including loss of principal. The value of and income from investments may vary because of changes in interest rates or foreign exchange rates, securities prices or market indexes, operational or financial conditions of companies or other factors. There may be time limitations on the exercise of options or other rights in securities transactions. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized. Management fees and expenses are associated with investing.