Investor Alert - Beware of Rising Confidence!

For the first time in this recovery, general economic confidence seems poised to improve significantly— a trend which will likely dominate major investment themes throughout 2012. Investors should therefore consider the potential rewards and risks associated with a meaningful improvement in confidence.

Rising Confidence… Why Now?

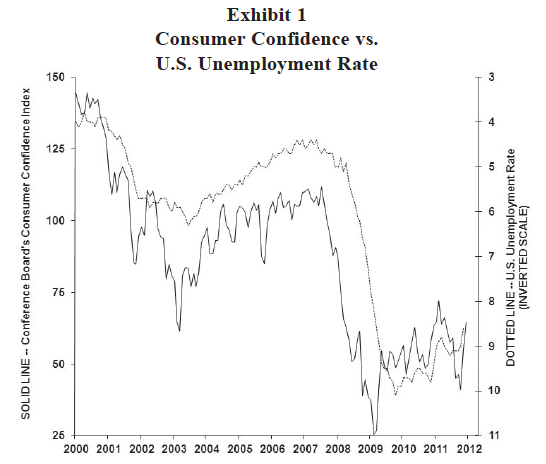

While not a perfect relationship, Exhibit 1 shows change in the unemployment rate is a very important determinant of confidence. It overlays the Consumer Confidence Index (solid line) with the U.S. unemployment rate (dotted line, shown on an inverted scale). Confidence has not yet improved much in this recovery mostly because the unemployment rate remains stubbornly high.

This may finally be changing. Although still disappointingly slow, the pace of job creation is now sufficient to slowly but steadily lessen the unemployment rate. In 2010, private monthly job gains averaged slightly less than 100 thousand whereas in 2011 (through November) monthly job gains improved to 155 thousand. Following this slow progression, private monthly job gains during 2012 seem poised to average more than 200 thousand.

For the unemployment rate, something magical happens once job gains persist in the 150 to 200 thousand range—labor demand exceeds labor force growth producing a slow but steady fall in the unemployment rate. This may already be underway. In recent months, the unemployment rate has declined to its lowest level of the recovery at 8.6 percent. We expect the unemployment rate to decline further to between 7.5 and 8.0 percent by the end of this year. Using Exhibit 1 as a reference, such improvement in the labor market would be consistent with a Consumer Confidence Index (currently at about 65) of about 85!

If economic confidence in the U.S. recovery does finally embark on a slow but steady rise, what are the implications for investors in 2012? Specifically, what would a revival in confidence imply for bond, commodity, and equity investors?

Confidence and Treasury Yields?

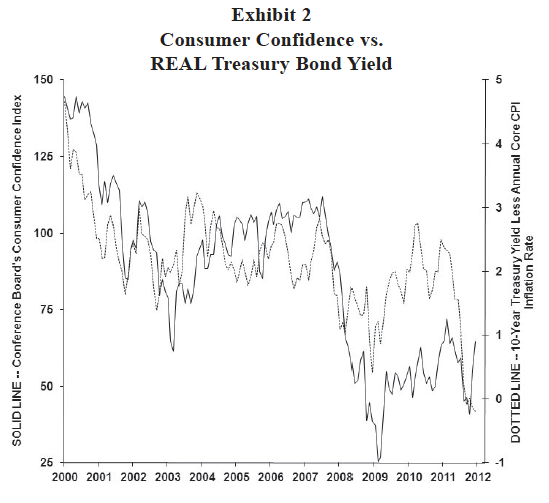

Exhibit 2 overlays the Consumer Confidence Index with the “real” 10-year Treasury bond yield (10-year yield less the annual core consumer price inflation rate). Similar to the aftermath of the dot-com crisis, “fear” has proved the bond market’s best friend since 2007. In the last recovery between 2003 and 2007, the real Treasury bond yield oscillated between 2 and 3 percent. However, as confidence collapsed to record lows in early 2009, the real bond yield declined briefly below 0.5 percent. Real bond yields were quick to recover, however, once confidence bounced from its record low reached during the darkest days of the crisis in March 2009. Indeed, even though confidence improved only marginally, by early 2010, the 10-year real bond yield surged higher by almost 2.5 percent! In 2011, the U.S. economic slowdown and escalating European contagion concerns produced another “fear-based” collapse in the real 10- year Treasury bond yield. As we begin 2012, the dominance of fear is currently illustrated by Treasury investors willingly accepting a “negative” real 10-year Treasury yield.

Exhibit 2 highlights a growing potential risk for Treasury investors. Even though the real bond yield remains at its lowest level since the crisis began, confidence has bounced again in recent months. Something seems likely to give in the next few months. Either renewed confidence in the economic recovery is about to fade or Treasury yields are likely to suffer a significant rise.

Should economic confidence improve this year, the bond market is at risk for two reasons—decaying calamity fears and rising inflation fears. If a consensus agrees the U.S. economic recovery is sustainable and risk of an imminent calamity has diminished, Treasury investors would likely reestablish a normal 2 percent real bond yield (and with a current core inflation rate of about 2 percent, a 2 percent real bond yield implies a 4 percent 10-year Treasury yield—ouch!). However, if the economic recovery is perceived as sustainable, because both monetary and fiscal policies have been too accommodative in recent years, calamity fears would likely be quickly replaced by intensifying “inflation fears.” For these reasons, high-quality bond investors should be particularly concerned with the likelihood of a steady rise in economic confidence this year.

Confidence and Gold Investors?

Rising economic confidence would certainly be good for commodity investors. A sustainable economic recovery would raise commodity price prospects and also heighten inflation expectations. However, as suggested by Exhibit 3, gold may lag other commodity investments (note, the relative price of gold is shown on an inverted scale).