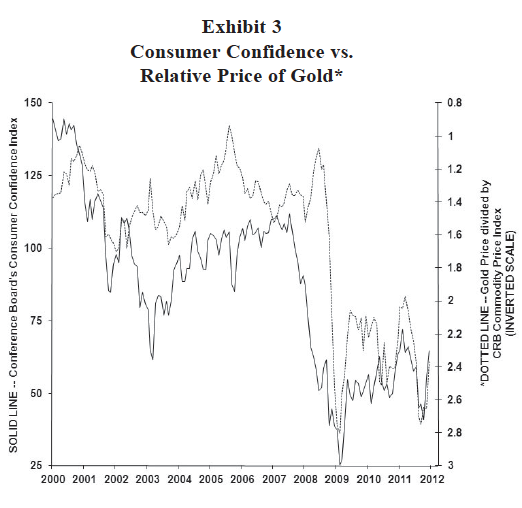

Since 2000, economic confidence and the “relative” price of gold have been closely related. Since 2007, fear has been “the” force behind the remarkable run in gold prices. Has this come to an end? As illustrated in Exhibit 3, movements in consumer confidence have typically “led” changes in the relative price of gold. For example, confidence began eroding in 2000 before the relative price of gold began rising. Likewise, confidence bottomed in early 2003 “before” the relative price of gold began declining in late-2003. Finally, confidence collapsed in 2007 “before” the relative price of gold began surging in 2008. Since 2009, the relationship between confidence and gold appears to be more coincident. However, should confidence continue to slowly improve this year, the “gold run” may be over for this recovery cycle. Although overall commodity prices, including the price of gold, may continue to rise during the balance of this recovery, if economic confidence has indeed begun a steady improvement, the price of gold going forward will probably consistently lag other commodity prices.

Confidence and Stock Market Sectors?

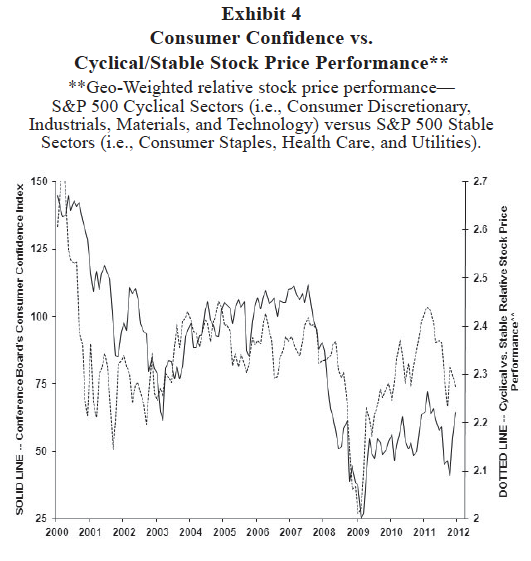

Exhibit 4 overlays the Consumer Confidence Index with the relative price performance of the stock market’s most “cyclical” versus most “stable” economic sectors. Clearly, whether investors should overweight cyclicals or stables depends crucially on what happens with economic confidence in 2012. As shown in Exhibit 4, 2011 proved a great year for “defensive/stable” equity investments. As Eurocalamity fears intensified and as U.S. recession fears escalated, investors dumped economic sensitivity in favor of steady-eddy stocks. However, as suggested by this exhibit, should the recent improvement in economic confidence persist, investors which are currently comfortable in “defensive stocks” may suffer considerable underperformance while leadership shifts toward the recently revalued cyclical sectors.

Summary

As we begin 2012, fears linger surrounding the European sovereign debt crisis and the potential for a U.S. or global recession. However, U.S. economic momentum has surprisingly “accelerated” in recent months and stands in direct contrast to the intensifying fears so prevalent since last fall.

During the first quarter of this year, it will likely become obvious whether fallout from Europe will end the U.S. and global economic recoveries or whether recent evidence of U.S. economic acceleration is for real. And, if the U.S. economy continues to persevere, rising confidence in the economy and in the financial markets should increasingly prove a dominant theme for the year.

The potential for steadily rising confidence this year suggest considerable risk for high-quality bond investors (will yields finally rise this year?), implies the “great bull run in gold” may be over, and advocates to equity investors that “cyclicality” should be preferred over the emotional comfort provided by defensive stocks.

If economic confidence continues to broaden this year, it will indeed prove a “Happy New Year”!

Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions. The views expressed are those of the author at the time of writing and are subject to change. This material has been distributed for educational/informational purposes only, and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product. The material is based upon information we consider reliable, but its accuracy and completeness cannot be guaranteed. Past performance is not a guarantee of future returns. As with any investment vehicle, there is a potential for profit as well as the possibility of loss.