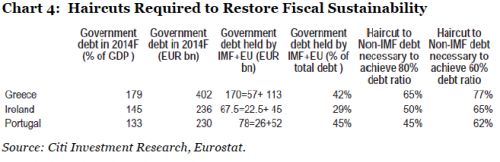

In order to bring the debt-to-GDP ratio down to a more manageable 80%, Citi’s research team reckons that haircuts of 65% (Greece), 50% (Ireland) and 45% (Portugal) respectively shall be required (see chart 4). Neither Citi nor I necessarily expect such drastic measures to be implemented this year, possibly not next year either, but the message is clear. Unless something gives, within a couple of years, the eurozone countries will have run out of options, and the hitherto unthinkable will suddenly become the only way out.

Demographics are a challenge

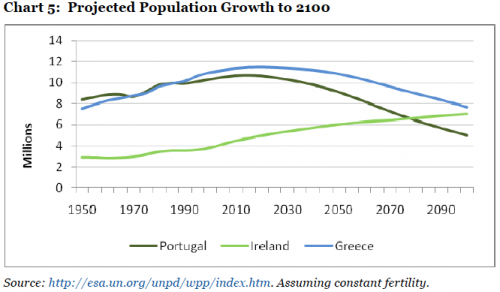

Longer term, there is not much room for optimism either. Consider what drives GDP growth in the long run – population and productivity growth4. I have been visiting the United Nations database for long-term demographic projections, and the result is rather depressing as far as Greece and Portugal are concerned, whereas Ireland is in a much better situation (see chart 5). The populations of Greece and Portugal are peaking now with no improvement expected for the rest of this century. Ireland, on the other hand, can look forward to a respectable rate of population growth, as long as it can stem the current trend where many younger - and better educated - people leave the country to land jobs which are currently not available in their home country.

Is Spain imploding?

So far I have avoided any mention of Spain. In some ways Spain is better off than the other three, but it is by no means out of trouble. Spain has indeed taken quite forceful action in terms of implementing its own version of fiscal austerity, and the overall level of sovereign debt is still very manageable; however, Spain’s problems are mostly in its private sector, and Spain is still to wake up to the fact that it is total debt that matters at the end of the day.

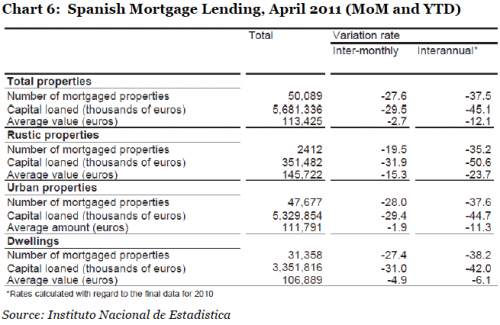

More specifically, Spain’s problems are concentrated in its banking and construction sectors after years of grotesque overbuilding to the point where well over one million homes stand idle. Even more worryingly, most of those empty homes are now owned by the banks and savings banks with the valuations in most cases not even remotely reflecting reality. Meanwhile the domestic economy is producing one shock after the other. Retail sales have been particularly badly hit with a string of awful numbers this year, and the property sector is showing no signs of life whatsoever. Chart 6 below has been produced by the Spanish national statistics office and shows that the residential property market is literally in the deep freezer with total mortgage lending down 45% year-to-date.

I am reluctant at this stage to predict a Spanish default, but the local economy is showing all the signs of implosion which will not exactly make it any easier to steer clear of default, whether sovereign or in the banking sector. And in this context it is important to remember that the Spanish economy is twice as large as Greece, Portugal and Ireland combined. The Spanish government has hopefully learned from the Irish mistake and should think twice before they embark on a wholesale bailout of the Spanish banking industry.