Weak consumer confidence good for stocks … huh?

I want to transition back to the macro landscape now. Let's take a look at what has been one of the stickiest of weak indicators—consumer confidence.

As you can see in the chart below, the Conference Board's measure of Consumer Confidence hit an all-time low in March of 2009. It has since risen, but the latest dip puts it back in extreme pessimism territory—a territory in which it's resided less than 15% of the time.

Weak Consumer Confidence Good for Stocks

Source: FactSet and The Conference Board, as of June 30, 2011.

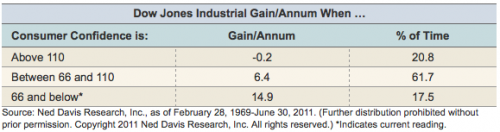

One might believe this would be by extension negative for the stock market. But much like investor sentiment, which works its contrarian magic on stocks, the same can be said for weak consumer confidence.

As you can see in the table above, the best performance for the stock market has historically come when consumer confidence was its weakest. Remember, consumers are generally reactive, while the stock market looks ahead.

Back to macro

Even some of the beleaguered macro story is getting sunnier.

Last week brought some much-needed good news:

- The Greek government passed its austerity package as a condition for further International Monetary Fund assistance, pushing potential default down the road.

- China's Premier, Wen Jiabao, was quoted in the Financial Times as saying the tightening phase was coming to an end after a dozen hikes to its required reserve ratio, noting "growth in money and credit supply has returned to normal." (China's input prices in June were at the lowest level in 11 months.)

- Japan's industrial production growth hit a 50-year high as production is coming back online more quickly than many expected after its disasters. (US auto production schedules are confirming strong growth for the third quarter.)

- The Chicago Purchasing Managers' Index (PMI) and Institute for Supply Management Manufacturing Survey were both better than expected and the latter actually saved the global PMI from plunging.

- Core capital goods orders were strong again in May, highlighting the tax benefit of accelerated depreciation available until year end, when it's set to expire.

- Although questionable as to rationale, the International Energy Agency decided to release oil from the Strategic Petroleum Reserve in order to boost supply and depress prices. It is also having the side-effect of pushing speculators out of long oil futures positions, which has been a reason for recently high prices of both crude oil and gasoline.

- Bank loans increased, bringing the positive trend to 13 weeks and counting.

- House prices appear to be starting a bottoming pattern.

- The Federal Reserve's second round of quantitative easing (QE2), or buying back Treasuries, ended without the "bang" many had expected. And, although Treasury yields are up, stock prices and yields remain positively correlated.

- The latest Fed forecast, citing the record wide-output gap (spread between actual and potential gross domestic product), suggests the fed funds rate will stay near zero through next year.

- Cyclical stocks have been outperforming during the rally, signaling a better growth outlook.

Again, it's intriguing to think about the story no one is telling. It might have a happy ending.

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative (or "informational") purposes only and not intended to be reflective of results you can expect to achieve.

Copyright © Charles Schwab & Co. Ltd.