Sparks: Are Stocks Telling a Better Story For the Second Half?

Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.

July 5, 2011

Key points

- Investors continue to focus on the macro … but the micro is telling a much better story.

- There was lots of good micro and macro news last week.

- Is the market's rally sending a signal that the second half of the year is looking up?

Lately, one of the most frequently asked questions I hear at client events is, "What keeps you up at night?" It reflects an at-times grave set of macro obstacles that the market has had to climb.

In fact, the vast majority of questions I've been getting at events are of the macro variety. Rarely am I asked about what companies are doing or saying, about corporate earnings, about the stock market's short- or even longer-term fundamentals.

The macro remains top-of-mind, including:

- US debt ceiling deadline.

- Euro-zone debt crisis/Greek austerity.

- Impact of Japan's disasters on global growth.

- Global soft patch/risk of a double-dip recession.

- China's potential hard economic landing.

- Inflation risks.

One of the things I like to talk about at events is what could actually go right (and maybe already is). I am always most intrigued by the story no one is telling.

Today, that story would be a very positive one. I don't write this with blinders on, but I want to lay out a realistic case for a better macro (and market) environment than many are expecting.

Déjà vu

As you all know, much of what has been plaguing markets and confidence this spring/early summer is reminiscent of last summer's economic soft patch. Other than the aftermath of Japan's natural and nuclear disasters, the markets have faced similar pressures as last summer.

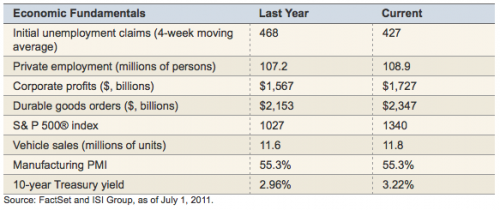

But at the same time, there has been meaningful improvement in most of the underlying fundamentals, as you can see in the table below.

Earnings surprise potential

Let's hone in on corporate profits, which are 10% higher than they were at this point last year (see table above).

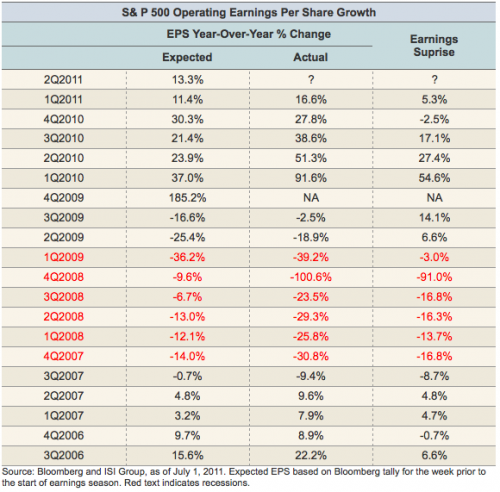

We are just now heading into the reporting season for 2011's second-quarter earnings. According to Bloomberg, the S&P 500 is expected to post 13.3% year-over-year earnings growth in the second quarter, which is down from over 14% less than a month ago.

And there's a lot of chatter that estimates haven't come down enough to reflect the aforementioned economic soft patch (and margin pressure from previously elevated commodity prices).

ISI Group recently looked at the history of quarterly earnings relative to expectations and found that in the past 12 nonrecessionary quarters, analysts' earnings estimates were too low 75% of the time by an average of 10.8 percentage points (see table below). All other factors aside, it would suggest that second-quarter S&P 500 earnings growth could actually be above 20%.

During the past seven quarters, the stock prices of companies that beat earnings estimates outperformed the overall market by about 275 basis points over the ensuing six weeks. On the other hand, the stock prices of companies with earnings disappointments underperformed the overall market by about 400 basis points during the same period.