Inflation in the emerging markets has been our largest consideration in determining to underweight emerging market equities coming into the new-year. Despite the fact that China has raised its lending rates and banking reserve ratios several times, real rates (10-year government bond-yields, stripping out inflation) continue to be negative. It would be foolish for us to say that there is no inflation in U.S. and North America as anybody taking a trip to the gas pump or grocery store would easily disagree. However, inflation in areas such as China and India remain a huge concern as the currency war coming out of the recovery forced many countries to adopt monetary policy unsuited for their economies. With inflation still an issue in these major emerging areas, further rate hikes are likely, which spells further headwinds for the equity markets of emerging economies. With cash a deteriorating asset in this environment and with commodity instability, we envision U.S. equities as an unlikely winner of global fund flows.

- Fundamental Factors: From a valuation perspective, the Dow looks attractive trading at a price-to-earnings (P/E) ratio of 13.8x and a modest but still reasonable dividend of 2.3%. In addition, it also trades at a lower volatility level than most other major benchmarks around the world with a realized 30-day volatility of 10.4. As mentioned in our 2011 Outlook report, another major reason why we recommended paring back emerging market equities in favour of U.S. equities is the strong cash balances of U.S. companies in general. At the time, we believed the strong cash balances would firmly place many American companies in a good position to raise dividends and/or increase stock buyback plans. So far, this thesis has come to fruition with the Dow companies raising dividends per share by 13.2% on average over the last two quarters, attracting global fund flows and causing a tailwind for U.S. equities.

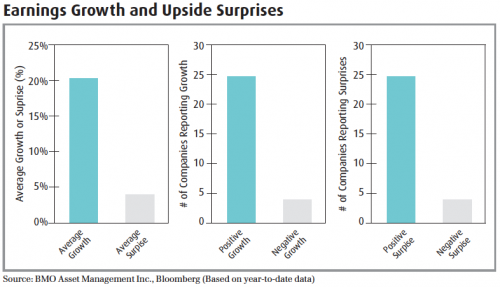

The ability to deliver earnings surprises both on the upside and downside is a big factor in driving an asset’s price action. At the start of the year, expectations of U.S. firms still remained low, as many investors believed a majority of the sales in 2010 were due to restocking. That low expectation made it easy for U.S. firms to report positive earnings surprises in the two quarters passed. Despite low forward looking P/E and price-to-sales ratios (P/S) of 12.6x and 1.3x respectively, we believe earnings expectations are still low. This potentially leaves further possibilities that the Dow could deliver additional positive earnings surprises in the two quarters that remain.

- Technical Factors: Although intrinsic value may drive the long-term price of an asset, investor sentiment is what causes the price to deviate from intrinsic value over the short- to mid-term. Investors looking solely at valuations must realize that securities usually tend to be inexpensive for good reason. In fact, the price of that said security will not see any appreciation until demand picks-up, or otherwise sentiment improves. Moreover, while most investors consider metrics such as P/E and P/S ratios to be valuation measures, in actuality, they can be argued to be sentiment indicators. Measures such as the Bloomberg Fear/Greed Indicator show that sentiment is currently more favourable for the Dow, than the Emerging Markets.