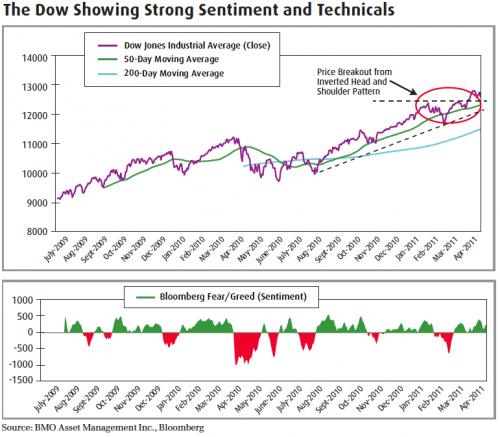

Of the major global market indices, the Dow is currently the only one broad market that is recognized by our Global Index TrendSpotter Model to be showing a positive trend. Trending markets are where the majority of returns are made for most investors. Moreover, the inverted head-and-shoulders seen in the Dow several weeks ago tends to indicate a bottom reversal as seen by its sharp appreciation coming out of the pattern.

In a market where volatility shocks have become a common theme and a greater divergence exists between the performance of equity markets around the globe, tactical asset allocation will increasingly drive portfolio alpha. Surprisingly, U.S. equities have emerged as the front-runner this year, delivering strong returns and attracting global fund flows. Although we continue to believe the long-term emerging market growth story, earnings surprises and further dividend increases from U.S. companies will continue to drive sentiment for the Dow Jones Industrial Average higher. Currency-hedged solutions delivering pure exposure to the underlying without USD/CAD volatility will mitigate the negative impacts of the declining U.S. dollar, leaving investors with only equity market returns.

Footnotes

1 In a survey conducted by the World Economic Forum, Canada was ranked the first in having the “world’s most sound banking system.” This survey was released in the wake of the 2008 financial crisis after Canadian banks displayed a strong resilience

2 Carry-trade: A strategy in which an investor sells a certain currency with a relatively low interest rate and uses the funds to purchase a different currency yielding a higher interest rate. A trader using this strategy attempts to capture the difference between the rates, which can often be substantial, depending on the amount of leverage used. The carry trade can also be applied to non- currency assets as investors can borrow funds in low interest rate countries to invest in non-currency investments that may be more volatile. When these assets sell off, investors are forced to liquidate assets to pay back loans.

To be added to the distribution list for our Monthly Strategy Report and Trade Opportunities Report, please visit our homepage at bmo.com/etfs to subscribe or email alfred.lee[at]bmo.com with title: “Add to distribution list.”

The Dow Jones Industrial AverageSM is a product of Dow Jones Indexes, a licensed trade-mark of CME Group Index Services LLC (“CME”), and has been licensed for use. “Dow Jones®”, “Dow Jones Industrial AverageSM”, “Dow Jones Canada Titan 60” “Diamond” and “Titans” are service marks of Dow Jones Trademark Holdings, LLC (“Dow Jones”)and have been licensed for use for certain purposes. BMO ETFs based on Dow Jones indexes are not sponsored, endorsed, sold or promoted by Dow Jones, CME or their respective affiliates and none of them makes any representation regarding the advisability of investing in such product(s).

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing. The funds are not guaranteed, their values change frequently and past performance may not be repeated.

This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment.

BMO ETFs are administered and managed by BMO Asset Management Inc., a portfolio manager and a separate legal entity from the Bank of Montreal.

® Registered trade-marks of Bank of Montreal.