Canada Market Cheat Sheet (March 7, 2011)

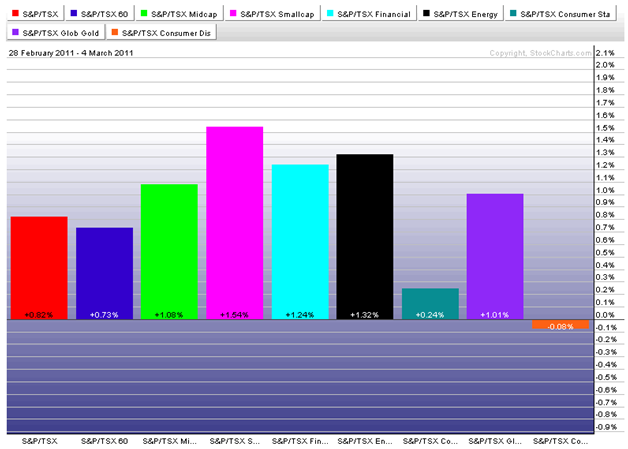

TSX and Subgroups - Past Week Ending March 4, 2011

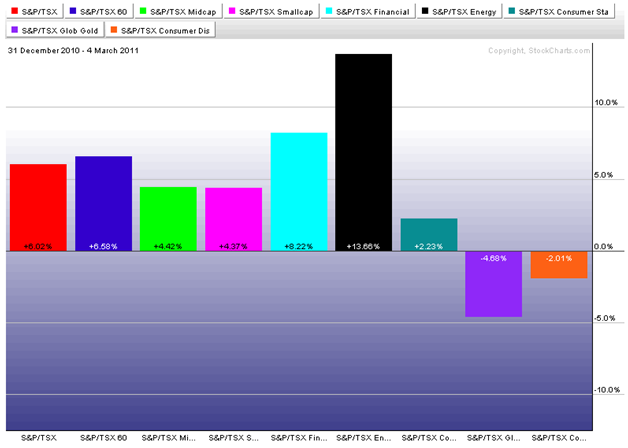

TSX and Subgroups Year to date ending March 4, 2011

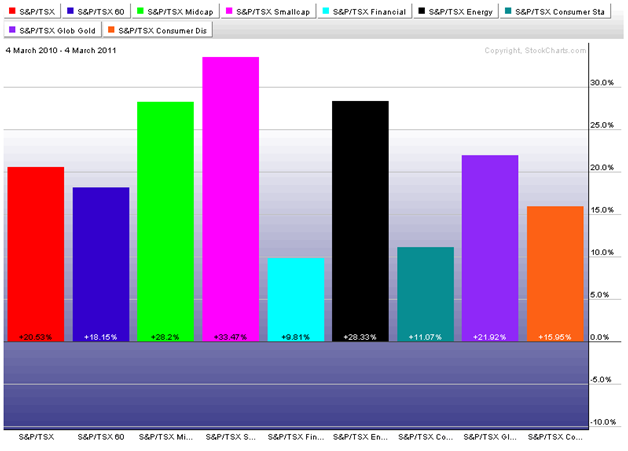

TSX and Subgroups - Past Year ending March 4, 2011

Strengths

- Corporate earnings will continue to flow out of Canada with the Bank of Nova Scotia being the last of the big banks to report on Tuesday. Considering that all the other banks have either met or beaten expectations, there is no reason to think that Scotia will be different. And while there are few economic releases coming out of Canada next week, the employment data on Friday will be material as economists are expecting our job growth to continue and our unemployment rate to fall. This data will follow a stronger than expected employment report out of the U.S. this morning where 192,000 jobs were created. [Richardson GMP]

- RBC shares surge on record profit - Boosted by strong loan growth and rising capital markets activity, Royal Bank of Canada posted its highest ever quarterly profit, well ahead of analyst expectations. Canada's largest bank had net earnings for the first quarter of $1.84-billion, or $1.24 a share, up 23% from last year. [Canada.com]

- TD shares climb after dividend boost - Toronto-Dominion Bank shares soared 3% Thursday morning after TD became Canada's second major bank — and the first of the Big Five — to hike its dividend since the financial crisis. On the heels of a strong first quarter that beat analyst estimates, TD hiked its quarterly dividend by 5¢, or 8%, to 66¢. [Canada.com]

- From a corporate and economic news perspective, next week is shaping up to be relatively quiet in the United States as the bulk of Q4/10 reporting season is over and economic releases will be low in quantity. If anything, we will find out what the "US consumer" is thinking with retail sales for February to be announced on Friday along with the University of Michigan Consumer Confidence Index. [Richardson GMP]

Weaknesses

- The budgetary squabbles in Washington will persist which could add more pressure to the Greenback as the U.S. trade weighted dollar finds itself at its lowest level since last November. [Richardson GMP]

- Canada needs 'ownership' of local firms - Foreign ownership of Canadian resources tends to play out as an ideological debate between nationalists who want to keep them tightly under Canadian control and free marketers who feel open borders work best, particularly when Canadians are expanding so much abroad. In reality, there are many more implications and they don't fit neatly under either banner. Among those who feel it's time for a fuller national debate is Leo De Bever, leader of Alberta's $70-billion pool of public sector funds, including pension funds, endowments and the Alberta Heritage Savings Trust Fund. [Canada.com]

Opportunities

- In the red-hot mining M&A world, Canada rules and China still lags far behind - That is one of the findings of a giant survey on global mining dealmaking by PricewaterhouseCoopers (PwC). The study, released Thursday, counted a staggering 2,693 mining deals in 2010 worth US$113-billion. It is the most deals struck in a single year, and another record is anticipated this year after a very hot start. [Financial Post]

- From a corporate and economic news perspective, next week is shaping up to be relatively quiet in the United States as the bulk of Q4/10 reporting season is over and economic releases will be low in quantity. If anything, we will find out what the "US consumer" is thinking with retail sales for February to be announced on Friday along with the University of Michigan Consumer Confidence Index. [Richardson GMP]

- Businesses, consumers adapt to make the best of it, while trying to minimize collateral damage - Exporting manufacturers – with costs in Canadian dollars and revenues in U.S. dollars – are usually seen as the big losers, and that's still true. But those that survived the recession tend to be the strongest and most adaptable, and many have adjusted their business models to take a high dollar into account. Currency hedging is now a matter of course, even for small exporters, and the elevated currency has made it cheaper to import up-to-date machinery. Many resource companies, meanwhile, are riding a commodity price boom, and that's more than enough to offset the high dollar. However, for those exporting commodities with depressed prices – natural gas, for instance – the soaring loonie makes a bad situation worse. [Globe and Mail]

Threats

- And the volatility in the commodity markets can only mean continued volatility for the Canadian dollar. Admittedly, this volatility has only caused an upward trajectory for the loonie since Tunisia began its protests, but any indication that the region could settle down in the near future could take some wind out of the sails of the Canadian dollar. Whether or not that will happen is certainly the subject of debate. [Richardson GMP]

- Alberta dairy cow found with mad cow disease - (Reuters) - Canadian government officials have found a dairy cow in Alberta with mad cow disease, but the finding is not surprising and shouldn't affect beef exports, a spokesman for the Canadian Food Inspection Agency said on Friday. [Reuters]

- It's unlikely that events in the Middle East will be resolved over the weekend, so investors are likely to see continued volatility in commodity markets with energy and precious metals being the main focus. While Libya has dominated the news headlines from the Middle East region, this was the first week in many where we did not see demonstrations flare up in a new country. [Richardson GMP]

- And the volatility in the commodity markets can only mean continued volatility for the Canadian dollar. Admittedly, this volatility has only caused an upward trajectory for the loonie since Tunisia began its protests, but any indication that the region could settle down in the near future could take some wind out of the sails of the Canadian dollar. Whether or not that will happen is certainly the subject of debate.