Canadian Banks are Cash Machines

by Gareth Watson, CFA – Vice President, Investment Management and Research, Richardson GMP

It was a good week to be a TSX investor. When three quarters of that index are exposed to commodities and financials, investors can’t help but smile when banks post solid earnings and commodity prices continue to climb. Such was the case over the past 5 days. The biggest story domestically had to be the continuation of bank earnings season after CIBC and National Bank reported last week. Bank of Montreal managed to just beat expectations on Tuesday, while TD Bank and Royal Bank easily surpassed consensus estimates on Thursday. TD Bank raised its quarterly dividend by 5 cents to $0.66/share. Bank of Montreal actually fell in price on the day it reported as higher expectations had been built to the market, but TD Bank and Royal’s easy beat caused their stock prices to rally 3.8% and 5.2% respectively. While Royal Bank has underperformed all of its peers over the past 52 weeks, it is outperforming all Canadian banks on a year-to-date basis.

While banks were certainly at the forefront, commodity prices were not willing to take a back seat as events in the Middle East and North Africa continued to influence oil and precious metal prices. In fact, WTI crude oil prices advanced by another US$7.00 per barrel since last Monday which has caused nothing but further pain at the gas pumps. While the gains were not as strong, the uncertainty of geopolitical events and the uncertainty of the U.S. Budget caused precious metal prices to move higher with silver spot prices adding another US$2.00 per ounce.

While the ongoing budgetary debate dominated talk on Capitol Hill in Washington, Apple’s unveiling of the iPad 2 was one of the top corporate stories of the week as Steve Jobs decided to make an appearance to reveal the new and improved device which will be shipped in the United States on March 11 and to 26 other countries, including Canada, on March 26. While no official launch date for the Research In Motion Playbook has been released, April 10 is the date being discussed around the water cooler. And it wasn’t just stocks making headlines this week as the Canadian dollar reached a level not seen since early 2008. The loonie was getting closer and closer to the US$1.03 level by week’s end.

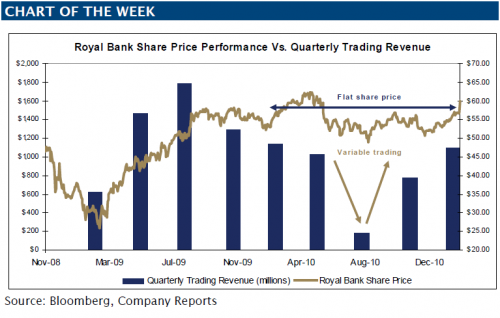

Banks Like Trading Revenue

Before Royal Bank reported earnings this week, the stock had vastly underperformed its peers over the past year with an essentially flat 52 week return. Its underperformance was likely a result of its poor trading revenues in the third fiscal quarter of 2009. Royal Bank’s Q1/11 earnings easily surpassed expectations on Thursday and a return of trading revenue above the $1 billion mark is one of the reasons. As the chart to the left shows, it’s hard for a bank stock to rally when market conditions are poor and trading revenue falls. While the past quarter’s results were certainly positive, it’s also important to remember that trading revenues are a function of market conditions, so improving EPS results thanks to stronger markets in the past do not guarantee positive results in the future.

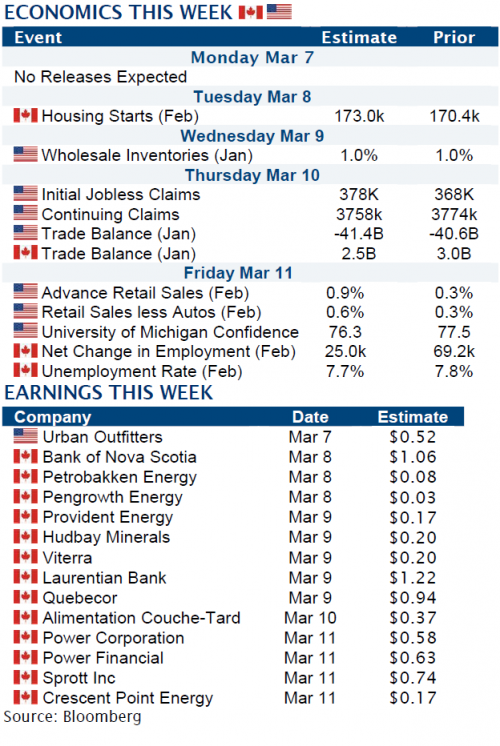

The Trading Week Ahead

From a corporate and economic news perspective, next week is shaping up to be relatively quiet in the United States as the bulk of Q4/10 reporting season is over and economic releases will be low in quantity. If anything, we will find out what the “US consumer” is thinking with retail sales for February to be announced on Friday along with the University of Michigan Consumer Confidence Index. The budgetary squabbles in Washington will persist which could add more pressure to the Greenback as the U.S. trade weighted dollar finds itself at its lowest level since last November.

Corporate earnings will continue to flow out of Canada with the Bank of Nova Scotia being the last of the big banks to report on Tuesday. Considering that all the other banks have either met or beaten expectations, there is no reason to think that Scotia will be different. And while there are few economic releases coming out of Canada next week, the employment data on Friday will be material as economists are expecting our job growth to continue and our unemployment rate to fall. This data will follow a stronger than expected employment report out of the U.S. this morning where 192,000 jobs were created.

It’s unlikely that events in the Middle East will be resolved over the weekend, so investors are likely to see continued volatility in commodity markets with energy and precious metals being the main focus. While Libya has dominated the news headlines from the Middle East region, this was the first week in many where we did not see demonstrations flare up in a new country. And the volatility in the commodity markets can only mean continued volatility for the Canadian dollar. Admittedly, this volatility has only caused an upward trajectory for the loonie since Tunisia began its protests, but any indication that the region could settle down in the near future could take some wind out of the sails of the Canadian dollar. Whether or not that will happen is certainly the subject of debate.

Copyright (c) Richardson GMP