Does QE = Quantitative Exuberance?

David Andrews CFA, Private Client Strategist, Richardson GMP

Unless you have been living in a bunker deep underground for the past month or so, you are likely aware of the Federal Reserve’s well advertized intention to become a large buyer of U.S. assets in the near future. Quantitative Easing has put a floor under riskier assets (like stocks and commodities) and QE expectations have supported the upward price surge of the past six weeks.

Unless you have been living in a bunker deep underground for the past month or so, you are likely aware of the Federal Reserve’s well advertized intention to become a large buyer of U.S. assets in the near future. Quantitative Easing has put a floor under riskier assets (like stocks and commodities) and QE expectations have supported the upward price surge of the past six weeks.

What you may be less certain about is how much ‘buying’ the Fed will do and what has already been ‘priced in’ to riskier assets like stocks, commodities, and precious metals? The Fed’s intentions to boost asset prices and increase the pace of re-employment are well known but how much stimulus will be required to achieve these goals? The common thinking is somewhere between $800 million and $1 trillion will be spent over the coming twelve months. Japan’s tepid QE in the 90s brought about poor results suggesting the Fed will be rather aggressive when it does start buying.

How much has the stock market priced in? Credit Suisse recently estimated that for every $100 million of QE, the S&P500 goes up by 9 points which would suggest 70-90 points of the current S&P500 level (1 ,1 83) can be attributed to anticipation of large scale asset purchases by the Federal Reserve. As perverse as it sounds a self-recovering economy could effectively weigh on a stock market already hooked on the notion of stimulus.

September U.S. economic data was again mixed with September housing starts and the weekly jobless claims better than expected, but fewer building permits were issued and industrial production weakened in September. The “U.S. dollar up, risk asset prices down” trade was popular in what turned out to be a choppy trading week. The commodities-heavy S&P/TSX was volatile but finished higher, largely taking its cues from gyrations of the U.S. dollar. The S&P500 finished this week slightly higher but rode a seesaw range of 1 ,1 59-1 ,1 89 to get there. Perhaps another bright sign for stock market investors was that both the NASDAQ and the S&P500 went through a Golden Cross; where the 50 day moving average crosses above the 200 day moving average. Historically, the market performs better for 3-6 months following a Golden Cross.

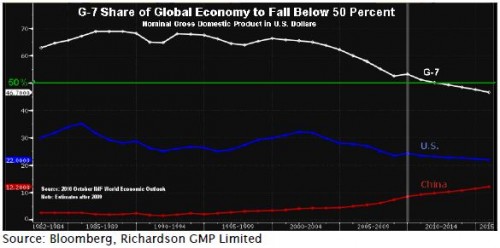

G7 Shrinkage

The ‘Group of Seven’ will see its share of the world economy fall below 50% by 2012 confirming the shift of economic power and potential investment market returns to the developing world. MSCI Emerging is up 1 2% year to date; almost twice the return of the S&P500. Getting coordinated action among the G7 was a challenge, but the G20 is the new forum for global cooperation. G20 Lite takes place this weekend where currency manipulation and trade deficits will be discussed.

Looking Forward

The last week of October will again be a busy one. Over the weekend, the G20 will be meeting in South Korea to discuss trade and currency imbalances that could jeopardize the global economic recovery. Countries from China to the U.S. are accused of relying on artificially weak exchange rates to spur growth. Participants have so far balked at the idea of capping trade surpluses and deficits so it is unlikely to result in any significant policy changes. At least they are talking...

Earnings Season continues to roll with many bellwether Canadian companies reporting their quarterly results. Last week, saw a flurry of companies report mostly better than expected results. Key notables included strong results by Apple, IBM, Citigroup, and Goldman Sachs. Earnings Season to this point has been better than expected with 85% of companies beating expectations. We look for that to continue in the week ahead with several consumer and energy companies due to report.

Investors will get an updated look at the state of the U.S. housing market with existing and new home sales as well as CaseShiller price data early in the week. Uncertainty over the Foreclosure uncertainty, overhang of inventory, and little Consumer confidence (an offshoot of housing and employment) does not bode well for U.S. real estate.

Copyright (c) Richardson GMP