Double dips and external shocks

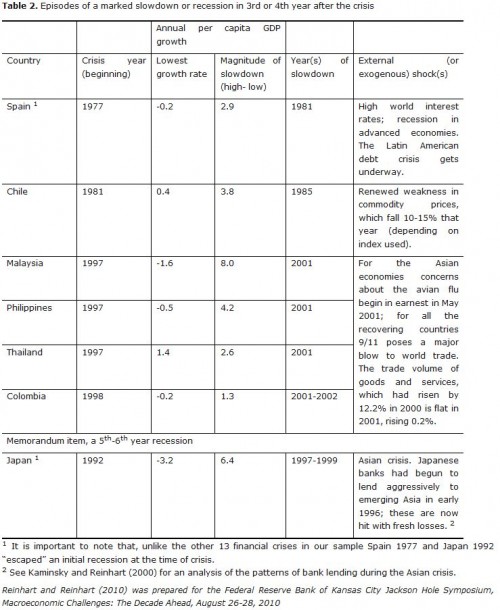

The media is filled with concerns about a “double dip,” or that the economic recovery will stall out after only a few quarters of growth. Our analysis is based on annual data, so brief spurts of growth bracketed by output declines might be smoothed away in yearly observations. But a more general pattern, often applied to Japan’s experience in the late 1990s (which actually stretches the window to encompass the 5th and 6th year after the crisis), is documented in Table 2. Of the 15 post World War II episodes examined, nearly one half of these (seven episodes) involved a broadly-defined double dip.

As shown in Table 2, growth rates often became negative once more after the crisis. The magnitude of the slowdown (measured as the highest post-crisis growth rate less the lowest recorded subsequently) also provides a sense of the loss of momentum. These post-crisis downturns help explain why growth rates are significantly lower and unemployment rates higher in the decade after the crisis and why these results are not driven by weak economic performance that is common in the vicinity of the crisis.

Concluding observations

In our recent paper we document in the private sector what Reinhart and Rogoff (2009) document in the public sector, namely that that the years following severe financial crises are characterised by high levels of debt and leveraging. This observation is essential in understanding why these financially frail economies are particularly vulnerable to adverse shocks, whether or not they emanate from the demand and supply factors discussed in our paper. A drag on spending might owe to mistakes in domestic policies or hysteresis effects of the crisis. But the list of event in Table 2 suggests that there is an important role for plain “bad luck,” originating in exogenous events or external developments that strike at a time when the economy remains highly vulnerable.

Reinhart and Reinhart (2010) was prepared for the Federal Reserve Bank of Kansas City Jackson Hole Symposium, Macroeconomic Challenges: The Decade Ahead, August 26-28, 2010

References

Kaminsky, Graciela L and Carmen M Reinhart (2001), “Bank Lending and Contagion: Evidence From the Asian Crisis”, in Takatoshi Ito and Anne Krueger (eds.), Regional and Global Capital Flows: Macroeconomic Causes and Consequences, University of Chicago Press for the NBER:73-99.

Reinhart, Carmen M and Vincent R Reinhart (2010), “After the Fall”, NBER Working Paper 16334, forthcoming in Federal Reserve Bank of Kansas City Economic Policy Symposium Volume, Macroeconomic Challenges: The Decade Ahead at Jackson Hole, Wyoming, on August 26-28, 2010.

Reinhart, Carmen M and Kenneth S Rogoff (2009), This Time is Different: Eight Centuries of Financial Folly, Princeton Press.

Copyright (c) VoxEU.org