Canada

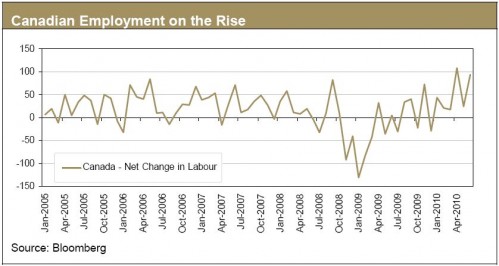

The Bank of Canada is likely to raise overnight interest rates again for the second consecutive month. If there were any doubt about the Bank’s intentions, the June employment report likely put those doubts to rest. 93,000 new jobs were added in June, putting employment levels just 0.1% (14,000 jobs) below the October 2008 peak. The job recovery in Canada has been truly outstanding. For perspective, Canada’s job gains in the past three months are the Canadian equivalent of the U.S. adding 2.5 million positions. Canada has added jobs five times faster than the U.S. making a rate hike pretty much a done deal. Despite our domestic strength, Canada still remains vulnerable to any number of slowdowns in global markets much larger than ours.

Summer Investment Strategies

Investors may find that dealing with unpredictable and sometimes volatile summer weather may prove less of a challenge than dealing with investment markets that are clearly on edge. Technical indicators show pockets of weakness are likely to continue over the coming weeks and perhaps months. A positive earnings season with upbeat guidance may prove to be the positive catalyst needed to break the ongoing negative sentiment that has taken hold of markets. Since late April, cyclical stocks have been underperforming the market due to uncertainty over Europe and China. The uncertainty has recently engulfed the fragile state of the U.S. economic recovery. We continue to recommend a more cautious stance towards equities, and suggest investors consider liquid, dividend paying companies with defensive characteristics as an ideal place to navigate the current period of heightened volatility. In addition, high yield bonds are now as inexpensive as they have been in the past year, despite a surge in corporate profitability and default rates being back down to levels last seen at the end of 2007. Sovereign debt fears have pushed spreads wider with investors scrambling into U.S. Treasuries. The 10-year U.S. bond now yields below 3.0% which is a clear sign of the lack of risk appetite in the markets today. REITs also continue to look attractive for yield investors. REITs have raised an abundance of cash in the past year and are now deploying that capital. REITs have traditionally been underinvested in Canada but there is good growth potential as, traditionally, much of the real estate has been held privately. REITs will also likely be a destination of choice for Income Trust investors who will see their universe continue to shrink ahead of the January 2011 deadline.