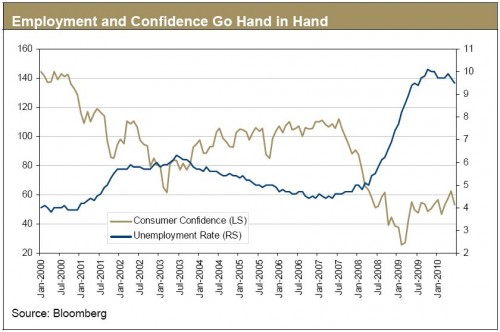

Although a double-dip is unlikely, we do remain concerned about the weak outlook for growth and sticky high unemployment at this point in the recovery cycle. We remain especially concerned for the developed economies of Europe and America. Through the inventory restocking, now mostly completed, business leaders have maintained a cautious outlook and have continued to refrain from adding to their payrolls, hence keeping unemployment levels high. Consumer confidence, housing, and retail sales data have all been weaker in the past month and this weakness circles back to unemployment in a self-fulfilling pattern. As a result, we expect developed economies to remain tepid for some time and although it may feel ‘recessionary’, technically it isn’t. This contrasts with Asia, where developing nations continue to enjoy rapid economic acceleration. Countries like China, Korea, and Taiwan have all recently tightened monetary conditions as they are faced with too much rather than too little economic growth. These countries will need to ensure their monetary and foreign exchange policies adjust appropriately in order to maintain a stable growth outlook. The dichotomy of growth poses both short and longer term challenges for investors. Markets are likely to continue to recalibrate to different growth rates and consumption patterns in what is rapidly becoming known as the new normal. As we adjust to the new normal, investing holds a great deal of uncertainty ahead. We suggest investor caution remains warranted.

U.S. Economy/Earnings Season

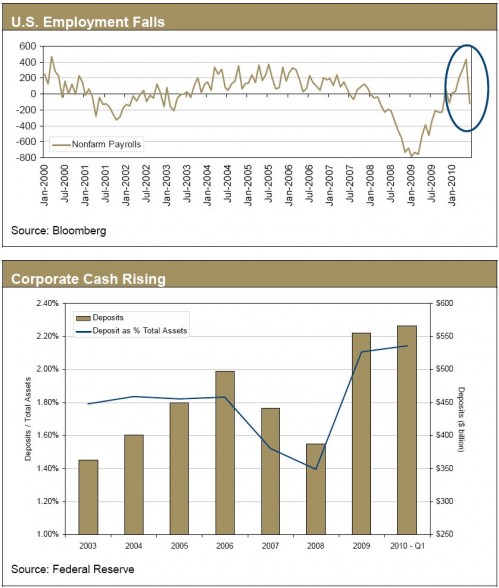

Recent data out of the United States suggests its economy has turned decidedly slower. In May, employment data showed the economy created 431,000 new jobs (a decent headline number). However, a closer look showed most of those new positions were temporary, government created jobs. Permanent, private sector job creation has been pretty much AWOL this spring, a symptom of corporate conservatism and the overall sluggish nature of this recovery. Unfortunately for the bulls, the June data confirmed what we saw in May and showed the U.S. lost jobs for the first time in 2010. In addition, May retail sales (linked to the employment situation) were far weaker than economists had been expecting and all bets are off that this recovery will be led by the U.S. consumer since there are now cracks in consumer confidence. Lastly, U.S. home sales in May were dismal as sales fell with the expiry of a government tax credit for first time buyers. Even the Federal Reserve (‘FED’) has acknowledged the economy hit a soft patch this spring when it recently adjusted its growth forecast lower for the year. The FED noted consumption was now beginning to align with muted income gains and they cut back their growth outlook by about 0.25%. It is not all bad news however as the manufacturing sector remains strong and technology spending has jumped in conjunction with a corporate computer system upgrade cycle. Monetary policy should remain accommodative as far as the eye can see with the FED not wanting to disrupt the fledgling recovery. We should also remember that companies are sitting on a growing stockpile of cash. With the economic outlook still uncertain, corporations have been building cash on their balance sheets. Some estimate there could be upwards of $1.8 trillion of excess cash reserves building on S&P500 companies alone. Normally, cash would be put to work either by investing in their business, buying other companies, or increasing dividends and share buybacks. For now, corporations appear to be happy sitting on cash. However, a time will come when they will feel less risk averse and will put this cash to work which should have significant implications for investors.

As you are reading this, we are now in the early stages of the second quarter Earnings Season. Earnings Season (the next three weeks or so during which companies will report their most recent quarterly results) has so far had some surprises, mostly positive but some negative. Alcoa kicked things off last week and beat analyst consensus expectations. More significant were the results from Intel, which reported its best quarter ever, period. With the S&P500 and TSX down significantly over the past month, investors have priced in flat to little earnings growth over the next year. Equity analysts have also lowered their expectations, but unlike investors, they have only dropped their expectations slightly. Consensus forward estimates for the market still remain mostly bullish, calling for roughly 20% earnings growth over the next year. During Earnings Season, we will be paying exceptionally close attention to management guidance. Guidance captures the front line view of what is happening in the economy. It would not surprise us to hear less negativity about the actual economy than what both the equity and bond markets have currently priced in. Favourable earnings news may be the long awaited positive catalyst needed to offset the past few weeks of building negative sentiment towards stocks and the economy.