Overall though, the growth trajectory of the U.S. economy has become more subdued. High unemployment combined with the headwinds of higher regulation (financial, health and energy reforms) and higher taxes (federal and state) will expose the U.S. to the sting of deeper slowdowns and accelerations than in the past 25 years. Gone are the days of financial deregulation and the occasional tweak to interest rates which created a smoothing effect on the economy. Investors’ patience is sure to be tested as markets recalibrate for slower growth. Expect concerns over the economy to battle with an upbeat earnings season as we seesaw our way through the next number of weeks.

China

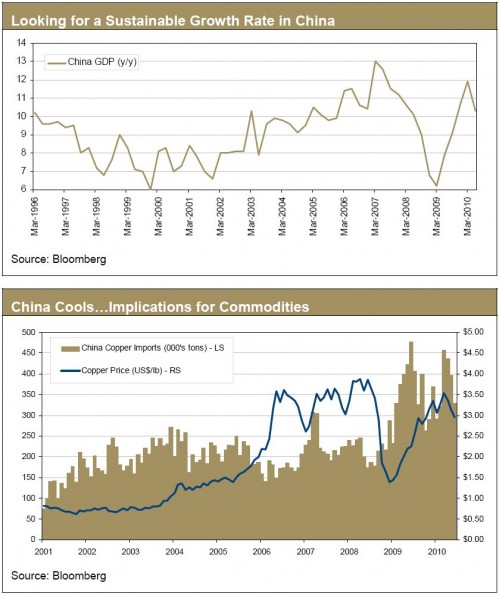

The June Purchasing Managers Index fell for the third consecutive month, this time to a reading of 52.1. All aspects of the new orders, employment, and input costs are now rising in China at a slower pace thanks to tighter lending policies and a recent decision to float the Yuan primarily against the U.S. dollar. Industrial production data also fell in June making it rather clear the world’s current economic leader is losing some momentum. We want to be clear that we view these developments as a slowdown and not a meltdown of the Chinese economy. Beijing policymakers have been tapping the brakes on the Chinese economy for the past six months as they try to slow down an increasingly speculative property market. GDP grew at a blistering 11.9% in the first quarter but has since slowed to 10.3% in the second quarter. Retail sales in China have remained very solid as the country continues to transform itself into a more domestic consumption oriented economy. Given the recent slowing, a rate hike now seems unlikely in the third quarter. Monetary conditions appear balanced at present with real estate and the stock market having corrected.