This editorial is a guest contribution from Mark Noble, Horizons Exchange Traded Funds Inc.

The tremendous bounce back that occurred in global equity markets over the one year period ended March 31, 2010, demonstrates how leveraged ETFs can be a tremendously powerful tool for an investment portfolio.

One of the biggest advantages of leveraged ETFs is that they offer non-recourse leverage, which means investors cannot lose more than their initial investment (i.e. no margin calls), even though the ETFs use borrowed money to achieve leverage and magnify returns. To ensure all investors benefit from this feature, regardless of the timing of their investment, the leveraged ETFs offered by Horizons BetaPro are reset on daily basis.

If an investor doesn't rebalance their own position, compounding as a result of this daily reset will start to kick in.

In a positive trending market with lower volatility an investor should generally expect to gain more than two times the period return of the underlying index as the gains from their investment will also have two times return exposure to the resulting in a positive compounding effect.

Conversely, in a negative trending market, an investor should generally expect losses to be less than two times the period return of the underlying index as only the reduced principal of the investment will have two times exposure to the next day's returns, creating a decaying pool of assets.

By design, Horizons leveraged ETFs reset their asset exposure at the end of each day so they can deliver two times the next day's returns of the underlying index.

Without rebalancing by the investor, in volatile markets the performance of leveraged ETFs relative to the period returns of the underlying index can be substantially different from period returns during trending markets with low volatility.

Known as "volatility drag"– the daily resets of the leveraged ETF's exposure relative to the underlying index will alter the investor's initial exposure to the underlying index during periods of higher volatility. The longer high volatility remains the more unpredictable period returns of the ETF can become, if the investor does not rebalance their position. This feature of leveraged ETFs has been well documented by investment commentators and the financial media.

What hasn't been as well documented – and is just as important to understand – is how well leverage works in an investor's favour during periods where there is a clear direction of index performance and lower volatility. During a trending market, the compounded return exposure, creates a starting point for the next day that is greater than the 2:1 exposure of the initial investment to the underlying index. The growth of the ETF's compounded investment exposure and a steady stream of positive returns work in the investor's favour.

The rally in the global equity markets that occurred between March 2009 and the end of March 2010 is a clear example of this.

Horizons BetaPro had the six best performing ETFs in Canada during this period of time. Five of these ETFs were designed to deliver two times the daily return of major North American equity indexes, such as the S&P 500®, NASDAQ 100® and the S&P/TSX 60TM.

If an investor had bought any of these ETFs during the lows of March 2009, and held them without rebalancing their position for an entire year, they would have achieved more than twice the performance of the specified underlying index.

All chart returns are 1-year period ending March 31, 2010.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Here are two examples of the leveraged inverse tracking ETFs for the S&P 500® and MCSI Emerging Markets. Notice that in each case, the ETFs delivered far less than two times the inverse period returns over the underlying index. Over the last year it actually ended up being closer to a one times inverse correlation to the underlying index.

All chart returns are 1-year period ending March 31, 2010.

Source: Bloomberg

Source: Bloomberg

The ability of leveraged ETFs to deliver more than two times performance of their underlying index in a lower volatility environment over a sustained period can create a number of portfolio uses. One of those uses could actually be risk mitigation.

A recent report by TD Waterhouse, pointed out that the two times performance of the ETFs means investors could have taken full equity positions with closer to 50% of the invested capital. This means an investor could have used leveraged ETFs to fully participate in the gains of the equity market rally, with significantly less initial capital. The remainder of their capital could, in theory, have been used to bolster more conservative holdings or alternative non-correlated asset classes.

If an investor has a view on the direction of the market, and volatility, leveraged ETFs can be a powerful portfolio tool. Both leveraged and inverse leveraged ETF options can be used on both the upswing and downturns of a variety of market sectors.

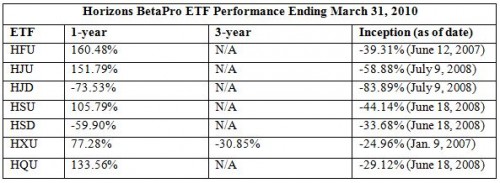

Here is the performance of the ETFs mentioned in this article.

Horizons BetaPro Bull Plus and Bear Plus Exchange Traded Funds ("HBP Plus ETFs") use leveraged investment techniques that magnify gains and losses and result in greater volatility in value. Horizons BetaPro Spread Exchange Traded Funds ("HBP Spread ETFs") which combine long and short exposure, also use leveraged investment techniques that magnify gains and losses and which may result in greater volatility in value.

HBP Plus ETFs and HBP Spread ETFs are subject to leverage risk, and Horizons BetaPro Single Exchange Traded Funds ("HBP Single ETFs"), Horizons BetaPro Inverse Exchange Traded Funds ("HBP Inverse ETFs"), HBP Plus ETFs and HBP Spread ETFs (collectively, "HBP ETFs") are subject to aggressive investment risk and price volatility risk, which are described in the HBP ETF's prospectus.

Each HBP Plus ETF seeks a return, before fees and expenses, that is either 200% or -200% of the performance of a specified underlying index, commodity or benchmark (the "target") for a single day. Each HBP Spread ETF seeks a return, before fees and expenses, that is the sum of 100% of the performance of one specified underlying target plus -100% of the performance of a second specified underlying target for a single day.

Each HBP Single ETF or HBP Inverse ETF seeks a return that is 100% or - 100%, respectively, of the performance of a specified underlying target. Due to the compounding of daily returns, an HBP Plus ETF's, HBP Spread ETF's or HBP Inverse ETF's, returns over periods other than one day will likely differ in amount and possibly direction from the performance of the specified underlying target(s) for the same period. Investors should monitor their holdings, as frequently as daily, to ensure that they remain consistent with their investment strategies. The indicated rates of return for the HBP ETFs in the Performance Table are the historical annual compounded total returns including changes in per unit value and reinvestment of all dividends and distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any investor that would have reduced returns.

The rate of returns shown in the charts are used only to illustrate the effects of the compound growth rate and are not intended to reflect future values of the NHP ETFs or returns on investment in the HBP ETFs. Commissions, management fees and expenses all may be associated with HBP ETFs. HBP ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

"Standard & Poor's®" and "S&P®" are registered trademarks of Standard & Poor's Financial Services LLC ("S&P") and "TSX®" is a registered trademark of the TSX Inc. ("TSX"). These marks have been licensed for use by BetaPro Management Inc. The HBP ETFs are not sponsored, endorsed, sold, or promoted by Standard & Poor's or TSX and its affiliated companies and none of these parties make any representation, warranty or condition regarding the advisability of buying, selling and holding units/shares in the HBP ETFs.

All trademarks/service marks are registered by their respective owners and licensed for use by BetaPro Management Inc. and none of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in HBP ETFs. Complete trademark and service-mark information is available at www.hbpetfs.com/pub/en/Trademark.aspx.

Please read the prospectus before investing.

Comments are closed.