by Dylan Ball, Executive VP, Franklin Templeton Global Equity Group

European value investing is a strategy that many investors have tended to overlook in recent years. But in fact, since 1999, the European value style has outperformed the growth style and has shown particular resilience when global value and non-US equities have generally struggled.1 Dylan Ball, executive vice president, Templeton Global Equity Group, explains why he thinks it’s time for European value investing to shine.

European equities have seen a general resurgence in investor interest in recent quarters, mostly from passive inflows. However, we believe the general uptick in investor interest has been for good reasons given the positive conditions in Europe right now.

We see signs that European companies are beginning to return to corporate earnings growth, and we believe we will see fundamentals reassert themselves at the heart of investment decisions. Against that background, we see strong value in active European equity strategies right now.

Two Strands: Valuations and Earnings

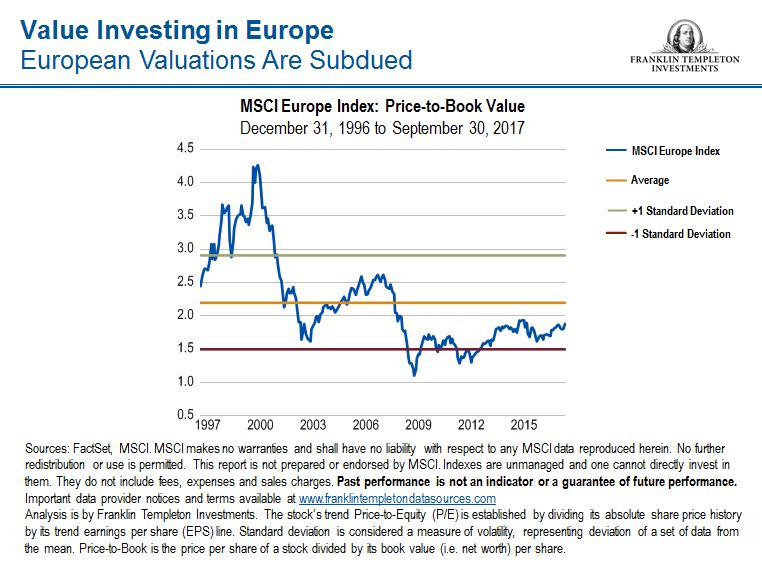

Many stock market indexes across the world have reached all-time highs recently. However, price-to-book values in Europe remain below their long-term averages, in some cases by up to one standard deviation.2

So we reckon there’s a good case for value opportunities in Europe. Active managers can look through the index to valuations on a company-by-company basis.

A Potential Two-Fold Opportunity

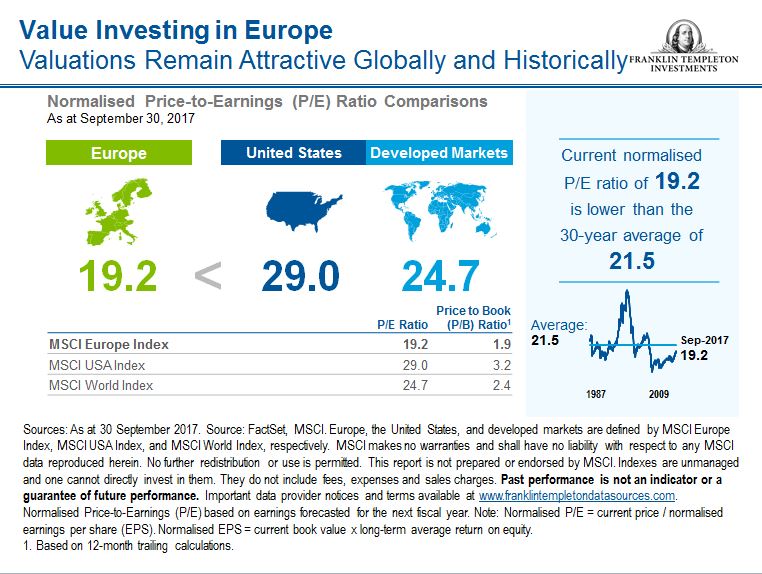

We see a potential two-fold opportunity. Europe’s price-to-earnings (P/E) levels are low on an historical basis.3 And there are signs of recovering corporate earnings across the region. We’re already seeing evidence via stock prices of investors trying to anticipate the early stages of an earnings rebound.

As you can see in the chart below, the current normalised P/E ratio—which is used to strip out short-term seasonal effects—is 19.2 for Europe. In the United States, the multiple is nearly 29 times.

That’s a startling difference, in our view. When we look at normalised P/E ratios on a historical basis, the long-term average P/E ratio in Europe is 21.5. So, we believe there should be plenty of upside potential for European equities.

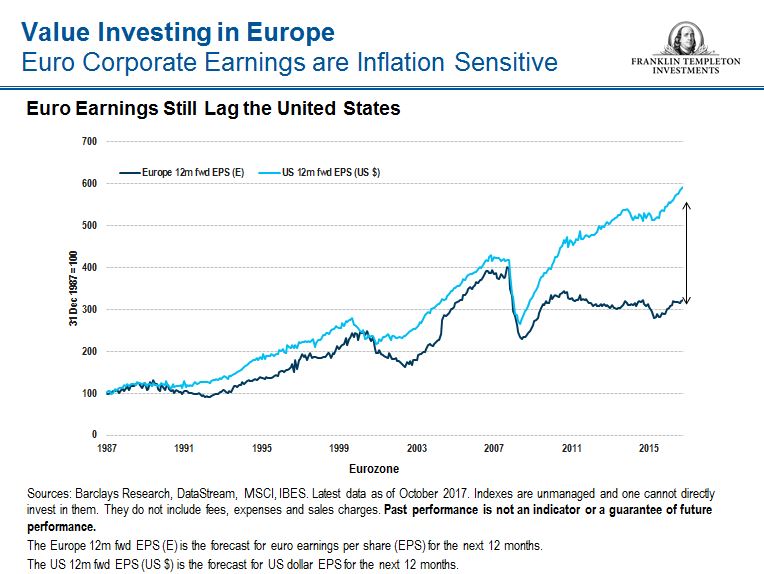

At the same time, it’s clear that European corporate earnings are still trying to recover fully from the 2007–2009 Global Financial Crisis as has already occurred in other regions.

Reasons for Optimism

There are other reasons for optimism, in our view. In particular, there are signs of a macroeconomic recovery underway.

We believe the devaluation of the euro seems to be coming to a close, and we consider that generally to be a good sign for European equities. It shows that a recovery of some sorts is underway. And the opportunities to potentially profit from the devaluation of the currency against the dollar are not what they were two to three years ago.

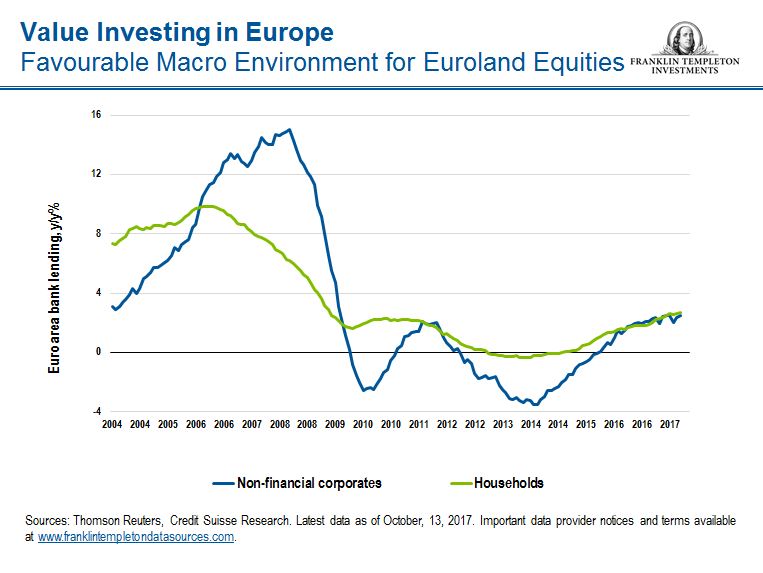

Looking at the credit cycle, loan growth has been positive since 2015. In fact, we’re currently seeing positive loan growth of around 2-3%4, and not just in corporate lending portfolios but also in household portfolios. (See chart below).

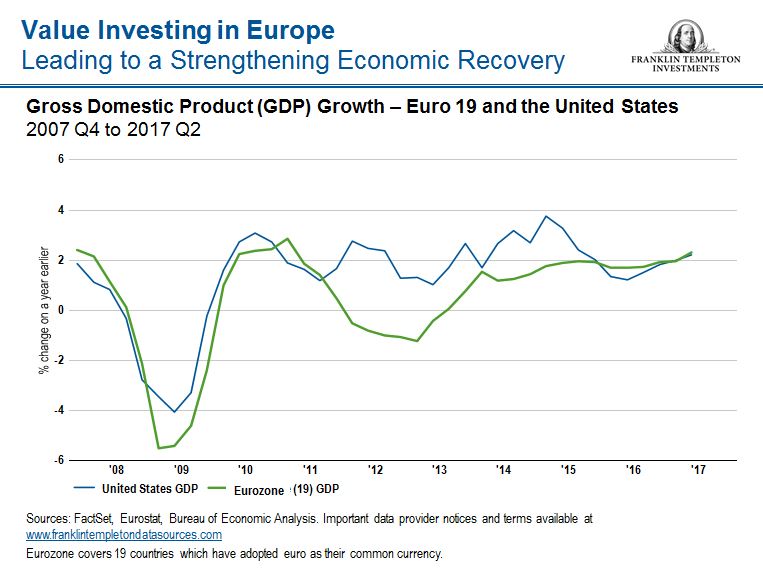

In addition, by the end of August 2017, eurozone unemployment was at an eight-year low,5 while the eurozone manufacturing purchasing managers’ index (PMI)6 was at a six-year high.7 In the second quarter of 2017, European gross domestic product (GDP) growth was above US levels for the first time since 2007.8

What Does This Mean For Investors?

We think it’s remarkable that European corporate earnings should still be 48% below pre-financial crisis peaks given these positive macroeconomic factors. By comparison, US earnings are around 16% above of their pre-crisis high in 2008.

In our eyes, that spells potential opportunity.

But in order to explore that opportunity, we need to understand why earnings in Europe have fallen behind those of the United States.

We see a big discrepancy. Although top-line European sales and revenues have recovered, earnings have not. That poses some questions. Are European companies less competitive? Is the European Central Bank’s stimulus programme less effective at filtering into the wider economy than the US Federal Reserve’s programme?

The answer seems to be in the profit margins of European companies.

As we’ve noted in the past, European companies tend to be price-takers. When inflation falls, European firms tend to cut prices to compete with their US and Asian peers. When inflation rises again, European companies tend to raise their prices.

Therefore, once European companies respond to rising inflation, we’d expect a closure of the earnings spread with the United States.

And as individual stocks’ fundamentals re-emerge as a differentiator in performance, we think active management can really show its value. Our analysis suggests this may already be happening.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Value securities may not increase in price as anticipated, or may decline further in value. To the extent a portfolio focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a portfolio that invests in a wider variety of countries, regions, industries, sectors or investments. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments.

_______________________________________________________

1. Source: FactSet, MSCI. As at September 30, 2017. European Value is represented by MSCI European Value Index and European Growth is represented by MSCI European Growth Index. MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. Past performance is not an indicator or a guarantee of future performance. See www.franklintempletondatasources.com for additional data provider information.

2. Standard deviation is considered a measure of volatility, representing deviation of a set of data from the mean.

3. The P/E ratio is a valuation multiple defined as market price per share divided by annual earnings per share (EPS).

4. Source: Thomson Reuters, Credit Suisse Research. Latest data as of 13 October 2017.

5. Source: FactSet, Eurostat. See www.franklintempletondatasources.com for additional data provider information.

6. Purchasing managers’ index is a monthly survey used as an indicator of economic health in the manufacturing sector.

7. Source: FactSet, Markit, See www.franklintempletondatasources.com for additional data provider informatin.

8. Source: FactSet, Eurostat, Bureau of Economic Analysis.