Why EM? Why now?

by Jeff Feng, Head of Emerging-Markets Equities, Invesco Hong Kong Ltd., Invesco Canada

I’ve said it before, and I’ll say it again: I believe investing in emerging markets (EM) is best done using a truly active approach. Performance numbers tell one part of story – I’ll cover the numbers a little later in this post – but other elements of the “why active in EM” story are: managing risk, long-term growth potential, and understanding complex and unfamiliar local markets.

I’ve been managing EM investments for the bulk of my 20-year career. I love my work and believe strongly in the Trimark discipline, particularly how it applies to the EM space. In this post, I’ll give you my view on why EM is an appealing asset class and then cover how we build and manage the fund for the long-term. Finally, I’ll review the performance that has resulted from this approach since our team took over Trimark Emerging Markets Class in April 2013.

The case for emerging markets

EM countries have been playing an increasingly important role in the global economy for many years. In fact, global economic growth has become steadily more dependent on emerging economies over the last three decades. Adding to this is research from the International Monetary Fund showing that EM growth is expected to continue outpacing that of developed economies.1 Why?

Technology, decreased reliance on commodities and globalization are all important factors. However, in my view, the single most important factor in EM growth is demographics – the huge uptick in middle-class economic growth. This segment of society is growing at an astonishing pace in many countries – including China – and this has spurred an economic shift that is changing the face of economies around the world. How can an investor take advantage of this shift? With income growth comes spending – and consumer spending is not only a key investment theme for us, but also an element of our risk mitigation discipline.

Consumer bias

The spending habits of a growing middle class are more stable than, say, commodity prices, which are driven by volatile and often unpredictable forces. I’ve written in the past about what I refer to as a shift from the “old EM” to the “new EM” – economies less reliant on commodity prices and driven more by consumption is key to this shift. As household incomes grow, people with new-found disposable income buy things that were unheard of for previous generations: cosmetics, entertainment, technology, vacations, enhanced education for their kids and more.

Our consumer bias is clear in the sector allocation of Trimark Emerging Markets Class: 28.89% Consumer Staples; 24.03% Consumer Discretionary; 18.29% Information Technology; 18.43% Financials; and just 4.03% Industrials, as at August 31, 2017.

Building an EM portfolio | Business quality

When we consider companies for any of our portfolios, we start with four key business elements, and we use an acronym to describe the process: FORS. What is FORS?

F: Free cash flow

- Companies that convert a high percentage of earnings into free cash flow

O: Organic growth

- Companies that are capable of above-average organic growth rates – compounding intrinsic value at an above-market rate

R: Returns on invested capital

- Companies with a high return on invested capital through a full economic cycle – those that make the most of the tangible capital that they invest back into the company

S: Sustainable competitive advantage

- Companies with a competitive “moat” around the business that makes it extremely difficult for a competitor to mimic the business or steal market share – brand loyalty, cost advantage, a distribution network or a patent, for example

Building an EM portfolio | Management & valuation

If our research turns up a business that meets our FORS requirements, we then move on to an in-depth analysis of the management team and determine our independent valuation of the company.

When it comes to valuation, we are looking for companies trading at a roughly 30% discount from the intrinsic value we’ve established for the business. This provides us with the margin of safety we’re looking for.

To properly gauge the quality of a management team, we meet them in person at their offices, likely numerous times. In addition, we’ll often meet with suppliers, vendors, analysts and key competitors. This process is demanding, but I believe it is a big part of the “active” in “active management.”

In 2015, I relocated to Hong Kong to better facilitate this part of the process. By being on the ground, I can visit many more companies in the region, with less expense and fewer hours spent travelling. I am closer to the markets in which we invest and am therefore better able to understand the idiosyncrasies of local markets. On top of that, I now have direct access to the Invesco analyst and portfolio management teams in both Hong Kong and Shanghai. Because visiting companies, meeting with management teams and acquiring on-the-ground knowledge are key parts of our investment process, I’ve found many benefits to living and working in the region.

With business quality (FORS), management quality and valuation research all in place, we’ll then decide if we want to make an investment or keep the company on a watchlist for further evaluation.

Long-term EM outperformance

The portfolio building process I’ve described above gives us a high conviction in each of the companies we choose, therefore we tend to choose fewer companies overall than our peers. The historical holdings range for Trimark Emerging Markets Class is 50-70 names. Our active share numbers have been more than 90% since the current team took over in 2013.2

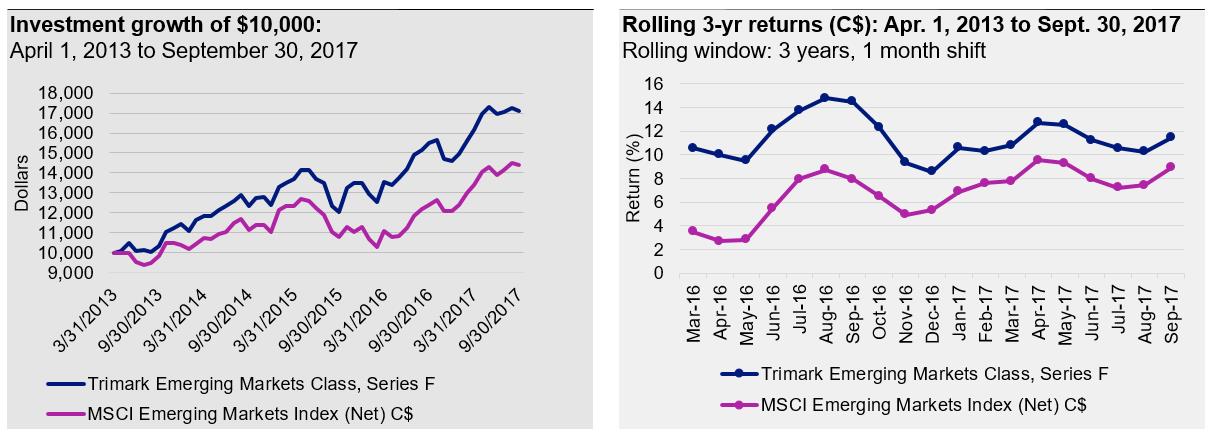

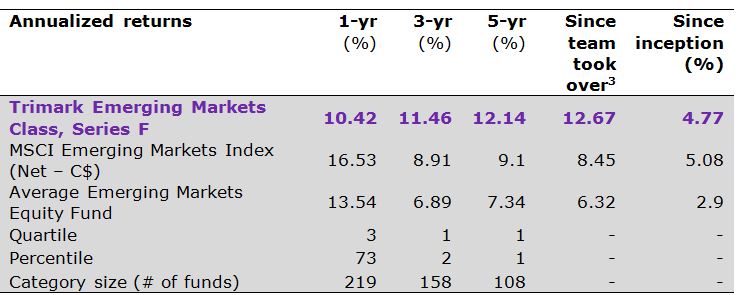

Ultimately, we aim for long-term performance consistency – I hope the charts below help illustrate how we compare.

Source: Morningstar Research Inc., as at September 30, 2017. The since-inception date of Trimark Emerging Markets Class is January 12, 2011. For any given datapoint, the category average is the simple average of all the values for that datapoint for all the funds within a particular Morningstar Category.

If you have any questions about Trimark Emerging Markets Class, the FORS process or our Global Equities (FORS) team, don’t hesitate to reach out. Please leave a comment in the comment area below, or advisors, you can get in touch with your sales rep at any time.

Glossary

Free cash flow (FCF): The cash that a company is able to generate after spending the money required to maintain or expand its asset base. FCF allows a company to pursue opportunities that enhance shareholder value.

Return on invested capital (ROIC): A profitability ratio that measures the return that an investment generates for those who have provided capital (i.e., bondholders and shareholders. ROIC indicates a company’s ability to turn capital into profits.

Intrinsic value: The actual value of a company or an asset based on an underlying perception of it true value, including all aspects of the business, in terms of both tangible and intangible factors.

Active share: The percentage of a fund’s holdings that differs from its benchmark index’s holdings. By quantifying a fund’s degree of active management, active share provides

a means of distinguishing funds that have the potential for outperformance from those that are likely to deliver index-like returns (source: CFA Institute, 2013).

Rolling return: The annualized average return for a period ending with the listed year.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog