by Ryan Detrick, LPL Research

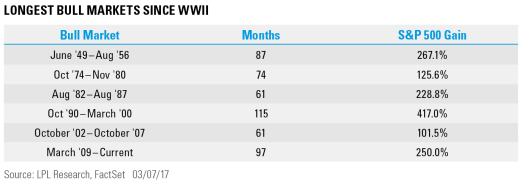

Eight years ago [today], the S&P 500 closed at 676.53, which was the low close for the worst bear market in equities since the Great Depression. No one would have ever believed it possible at the time, but at 97 months old, this now ranks as the second-longest bull market since World War II. On a percentage basis though, both the 1950s* and 1990s bull markets saw larger percentage gains.

Per Ryan Detrick, Senior Market Strategist, “We don’t believe bull markets die of old age; they die of excesses. This bull might be old, but we aren’t seeing the same type of overspending, overborrowing, or overconfidence we’ve seen at other major market peaks. This doesn’t mean there won’t be pullbacks along the way, because there will be, but it does suggest this old bull could still have a few tricks up his sleeve.”

To put things in perspective, on a price basis (so no dividends included) the S&P 500 was actually lower in both 2011 and 2015—not to mention it didn’t make any new highs for 14 months from May 2015 until July 2016. And who could forget the 15% correction that ended in February 2016. So many think this bull market was simply straight up, but it has been anything but. Like all long bull markets, there were many scary times along the way.

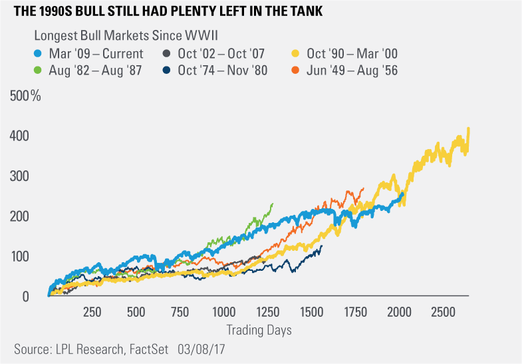

Last, be aware that at the same stage of its bull market, the 1990s bull was up 255% now versus the current bull, which is up 250%. That bull went on to go as high as up 417% before it peaked some 18 months later. We aren’t calling for that, but pointing out that just because something might seem old, that doesn’t mean it will die right away.

Be on the lookout for our Weekly Market Commentary next week, where we will discuss the overall health of the bull market.

IMPORTANT DISCLOSURES

*Please note: The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of predecessor index, the S&P 90.

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Stock investing involves risk including loss of principal.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking #1-588711 (Exp. 3/18)

Copyright © LPL Research