You’ve probably already heard that this week marks the eighth anniversary of the bull market. Some would argue, myself included, that bull markets don’t start at the depths of a bear, but whatever, let’s just go with it for the purposes of moving past a dead and beaten horse.

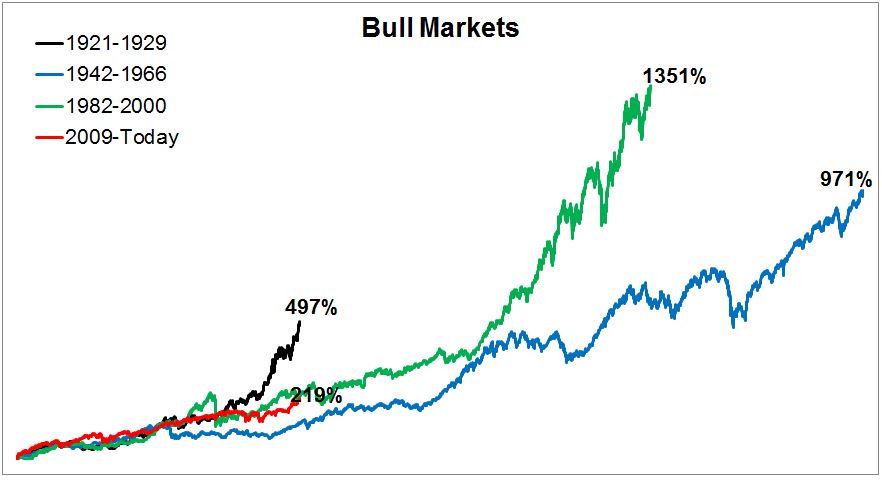

The United States has only experienced three bull markets before this current one, and with so many variables, it would be futile to look at such a small sample and say something like “The market typically peaks when valuations are X” Or “The market typically peaks when stocks are X standard deviations above their X-day moving average” Or “The market typically peaks when inflation is running above X% and the Fed tightens.” Each of the periods below had their own idiosyncrasies, but the only thing we can definitively say is that at some point, they all came to an end.

The difficulty of surviving a long bull market is underrated, as this current episode is proving. We’ve learned with every 5% correction that there is just no way to know which one will mark the end. Maybe it comes suddenly like in 1929, or maybe it will be more gradual like in the late 1960s. Either way, the most important question the average investor needs to ask themselves is this: Can I stick with my current allocation whether the bull runs for another few years or whether it ends tomorrow.

The difficulty of surviving a long bull market is underrated, as this current episode is proving. We’ve learned with every 5% correction that there is just no way to know which one will mark the end. Maybe it comes suddenly like in 1929, or maybe it will be more gradual like in the late 1960s. Either way, the most important question the average investor needs to ask themselves is this: Can I stick with my current allocation whether the bull runs for another few years or whether it ends tomorrow.

Copyright © The Irrelevant Investor