by Lance Roberts, Clarity Financial

In this past weekend’s newsletter, I discussed the markets walk along a bullish trend line:

“There is little reason to believe, at the moment, the current bull market has ended. I say this for the following reasons:

- Central Banks are still engaged globally which continue to provide liquidity support for the markets.

- The Federal Reserve is unlikely to tighten monetary policy in September.

- Overall investor sentiment is still in “greed mode.”

- Intermediate-term “buy” signals remain intact currently.

- Bullish trend lines remain supportive.

- Short-term oversold conditions have been achieved.”

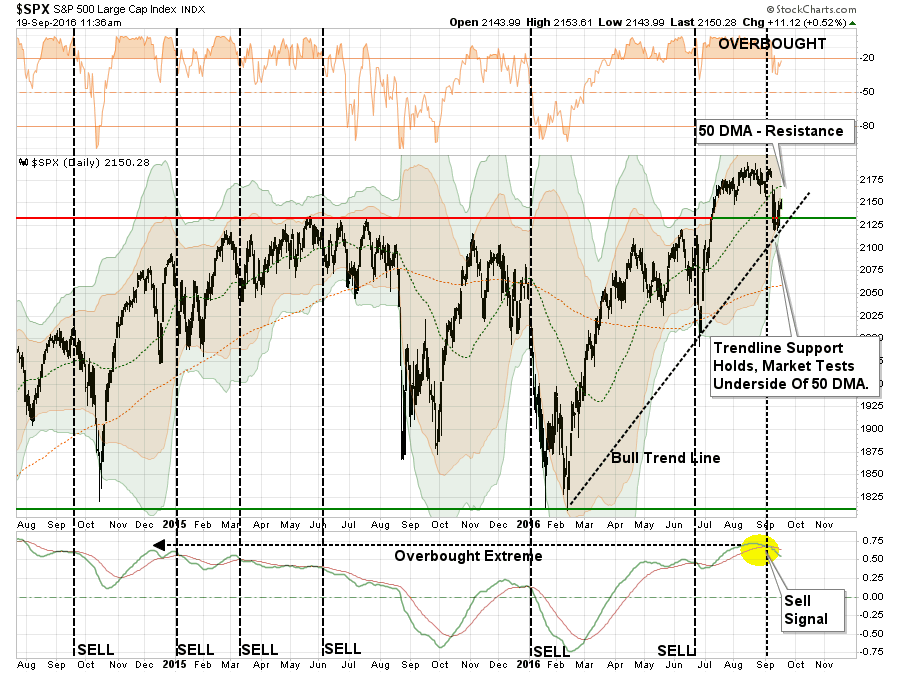

The chart below shows the support the bullish trend lines from the February lows are currently providing.

However, a key difference to note is the bottom of the chart which shows a “sell signal” registered from very high levels. While this DOES NOT mean the market cannot advance from current levels, it does suggest that any advance will be very limited and likely volatile.

Importantly, the market is currently trading below its 50-day moving average which will provide some resistance to a short-term advance in the market. Given the markets remain overbought in the near term the most risk of a further correction from current levels remains elevated.

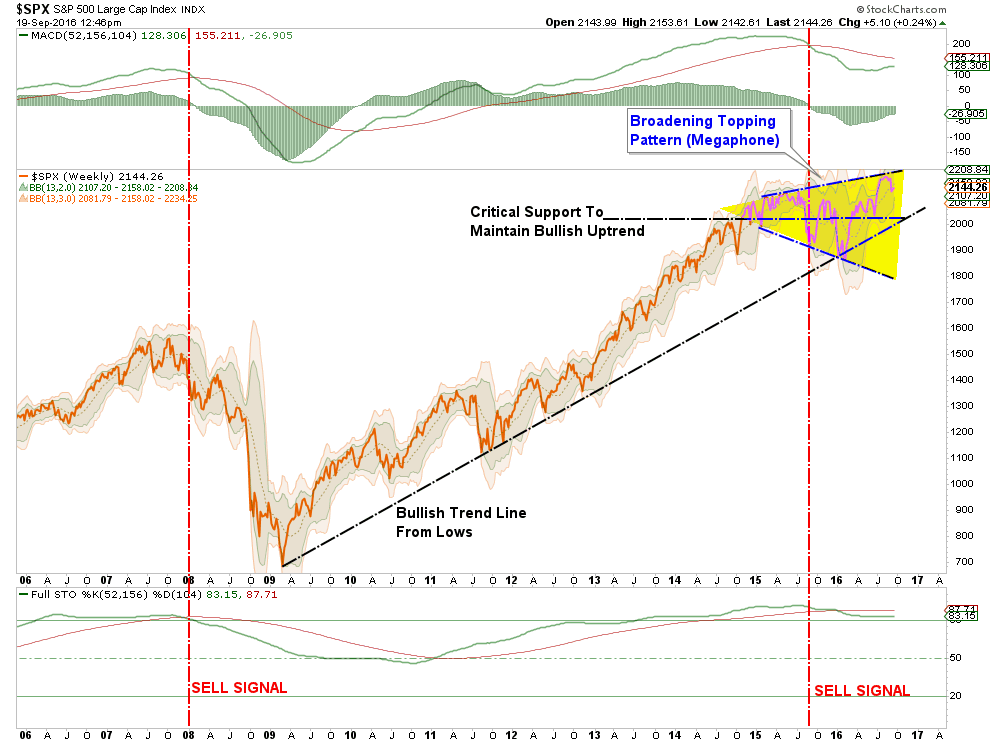

Stepping back to a longer-term view, a little different picture emerges. The chart below is a WEEKLY view of price data to smooth out the volatility of daily price action. I like weekly and monthly views from a portfolio management process as it reduces knee-jerk reactions, whipsaws, and overall turnover.

As shown, the market is currently very overbought on a weekly basis and on a sell signal (vertical dashed black lines). Importantly, as I have noted with the yellow highlights, the last time the overbought condition coincided with a “sell signal” the markets struggled to make an advance. Of course, the end result was the “Brexit” decline that was met with a flurry of Central Bank activity to propel the markets higher.

The difference, this time, is the liquidity spigots may not come readily to the rescue to prevent a further decline to resolve the current overbought conditions. Note previously, that similar setups led to deeper corrections. Importantly, the yellow highlights note a potential correction process over the next couple of months. Such a process would also coincide with the more important longer-term topping process as I pointed out a couple of weeks ago.

“Furthermore, on a longer-term basis, the market continues within a “broadening topping process” or a ‘megaphone’ pattern. While these patterns do not always come to fruition, the fact this one is combined with dual sell-signals, which was only registered prior to the financial crisis, does provide some cause for concern. “

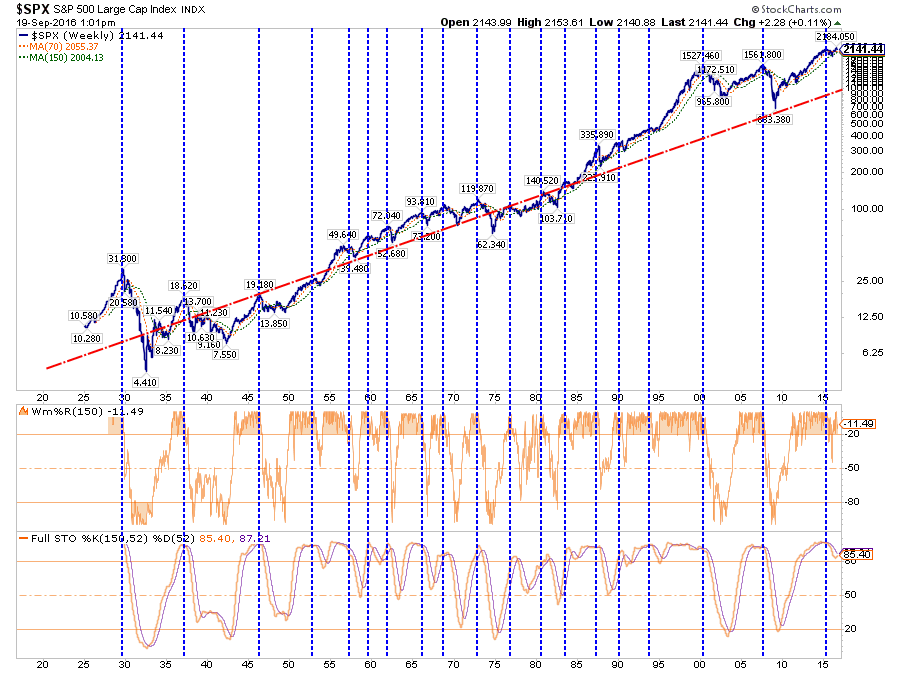

If we step back to a longer-term picture we see a very similar pattern setting up which confirms the potential risk to investors. The chart below is a weekly chart going back to 1925. Previous levels of such extreme deviation from the long-term trend, combined with extreme overbought conditions, have led to less than favorable outcomes for investors.

Sure, this time could be different. However, since every previous similar condition turned out “not to be” are you willing to risk your retirement on it?

This is why, despite the mainstream media’s contention you are NOT smart enough to manage your money and should just “buy and hold,” taking some action with respect to preservation of principal is critical at this late stage of the investment cycle.

The difference between a successful long term investor and an unsuccessful one really comes down to following these very simple rules. Yes, I said simple rules, and they are – but they are the most difficult set of rules for any one individual to follow because of the simple fact that they require you to do the exact OPPOSITE of what your basic human emotions tell you do – buy stuff when it is being liquidated by everyone else and sell stuff when it is going to the moon.

The 7 Impossible Trading Rules To Follow:

So, how are you supposed to do that? There are rules. These rules are not unique or new. They are time tested and successful investor approved. Like Mom’s chicken soup for a cold – the rules are the rules. If you follow them you succeed – if you don’t, you won’t.

1) Sell Losers Short: Let Winners Run: It seems like a simple thing to do but when it comes down to it the average investor sells their winners and keeps their losers hoping they will come back to even.

2) Buy Cheap And Sell Expensive: You haggle, negotiate and shop extensively for the best deals on cars and flat screen televisions. However, you will pay any price for a stock because someone on television told you too. Insist on making investments when you are getting a “good deal” on it. If it isn’t – it isn’t, don’t try and come up with an excuse to justify overpaying for an investment. In the long run – overpaying will end in misery.

3) This Time Is Never Different: As much as our emotions and psychological makeup want to always hope and pray for the best – this time is never different than the past. History may not repeat exactly but it surely rhymes awfully well.

4) Be Patient: As with item number 2; there is never a rush to make an investment and there is NOTHING WRONG with sitting on cash until a good deal, a real bargain, comes along. Being patient is not only a virtue – it is a good way to keep yourself out of trouble.

5) Turn Off The Television: Any good investment is not dictated by day to day movements of the market which is merely nothing more than noise. If you have done your homework, made a good investment at a good price and have confirmed your analysis to correct – then the day to day market actions will have little, if any, bearing on the longer-term success of your investment. The only thing you achieve by watching the television from one minute to the next is increasing your blood pressure.

6) Risk Is Not Equal To Your Return: Taking RISK in an investment or strategy is not equivalent to how much money you will make. “Risk” only relates to the permanent loss of capital that will be incurred when you are wrong. Invest conservatively and grow your money over time with the LEAST amount of risk possible.

7) Go Against The Herd: The populous is generally right in the middle of a move up in the markets but they are seldom right at major turning points. When everyone agrees on the direction of the market due to any given set of reasons – generally something else happens. However, this also cedes to points 2) and 4) – in order to buy something cheap or sell something at the best price – you are generally buying when everyone is selling and selling when everyone else is buying.

These are the rules. They are simple but impossible to follow for most. However, if you can incorporate them you will succeed in your investment goals in the long run. You most likely WILL NOT outperform the markets on the way up but you will not lose as much on the way down.

Remember, while you can always replace a lost opportunity, and even eventually regain lost capital, you can NEVER replace time lost in “getting back to even.”

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In