by LPL Research

Many of you know these poker references (not that anyone in LPL Research plays the game), but for those who do not, “going all in” refers to literally betting all your money on your current hand. As the name implies, “drawing dead” means that there is no possible way, no cards that you can be dealt, that will result in your winning. The worst possible thing that can happen is that you go “all in” on a hand on which you are “drawing dead.”

There is an increasing feeling among economists, and the financial markets, that central bank monetary policy is actually hurting the economy, not helping it. In other words, central banks may be drawing dead. On Thursday, September 8, 2016, there will be a meeting of the European Central Bank (ECB). At its last meeting on July 21, 2016, the ECB noted its concern about weakness in the economy, and particularly the uncertainty around the Brexit vote that had occurred less than one month prior. The ECB took no action at that meeting, but suggested strongly that it could take action in the future.

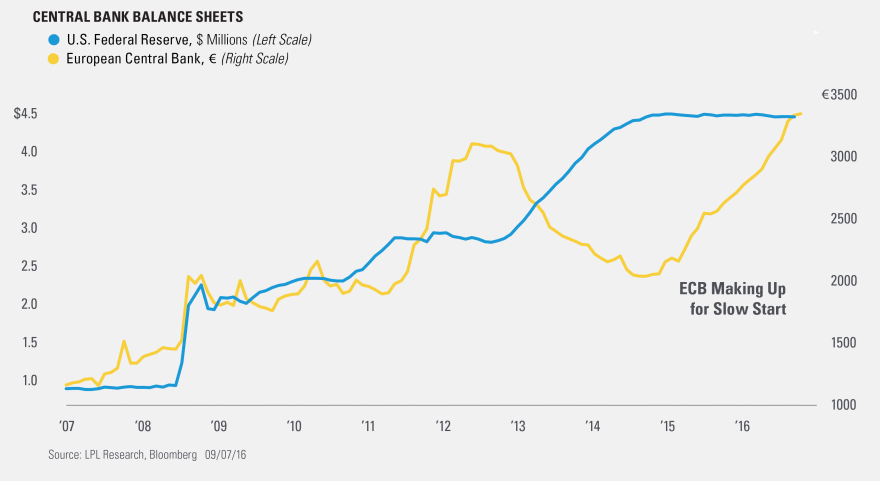

After letting its balance sheet shrink for a few years, the ECB has been expanding its balance sheet aggressively (see the figure below). The ECB’s current quantitative easing (QE) program is scheduled to end in March 2017, so there is plenty of time for it to extend its current program. There is limited pressure to go all in. The harder part for the ECB to realize that it may in fact be drawing dead and the correct policy is to fold its current hand and stop throwing good money after bad.

The ECB recognizes this issue, with ECB President Mario Draghi saying in a June 9, 2016, speech, “But monetary policy does not exist in a vacuum. The situation of central banks is better described as independence in interdependence, since other policies matter a great deal” (italics in official transcript). He then proceeded to discuss other policy mechanisms outside of the ECB’s purview, including structural and educational reforms, which he believes are necessary.

President Draghi has noted frequently that the ECB still has tools at its disposal; it still has chips to throw into the pot. Its decision tomorrow will say a lot about whether it has determined, and can admit to itself and to the world, that it may in fact be drawing dead and should fold its hand.

****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Quantitative easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking #1-533040 (Exp. 09/17)

Copyright © LPL Research