This is what "printing money" looks like

Since late 2008, when it launched the first of its three Quantitative Easing programs, the Fed's accusers have bemoaned its massive money-printing, sure that it would lead to the debasement of the dollar, the advent of hyperinflation, and the end of the world as we know it. I was part of that crowd initially, but soon realized that the Fed's massive expansion of bank reserves was not inflationary because it simply offset the banking system's incredible demand for safe, dollar liquidity. I've had many posts over the years which have expanded on this theme.

I've been an avid student of monetary policy and inflation ever since I spent four years living in Argentina in the late 1970s. As I recall, inflation averaged about 125% a year while I lived there, and during a visit to the country in the mid-1980s I was fascinated to watch hyperinflation unfold: prices almost tripled within the span of three weeks. A year ago I wrote a post on the subject of inflation and Argentina, in which I explained that the conditions in Argentina that allowed a huge increase in inflation don't exist here in the U.S., fortunately. The government of Argentina relies on direct printing of money to finance its deficit, whereas the U.S. government finances its deficit by selling bonds. When the Argentine government needs to finance a budget shortfall, it can "borrow" money directly from its central bank in exchange for an IOU, which in practice is never repaid. This shows up on the central bank's books as "Loans to the Federal Government." In essence, the Argentine central bank simply runs the printing presses whenever the government needs money, and the government pays its bills with funny money.

Here's what it looks like when a central bank "prints money" and high inflation results:

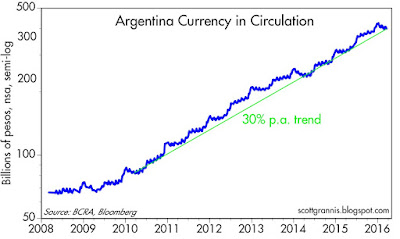

Argentina's most recent bout of money printing and high inflation started back in 2009, when the government started running a deficit that needed to be financed by money printing. By early 2010, the growth in the supply of currency in circulation in Argentina was nearing 30%. Currency in circulation has grown at an annualized rate of about 30% ever since, as the chart above shows—in the past six years, the supply of currency has expanded almost five-fold, from 82 billion to 400 billion pesos. In the U.S., in contrast, currency in circulation has been growing at a 6-7% annual pace for decades, and strong offshore demand for greenbacks has been the main driver of that growth.

True money printing results in higher inflation because there's basically too much money chasing too few goods and services. Printing money with no solid backing and in excess of the public's need for money simply causes the value of money to fall and prices to rise. We see this in the chart above, with the early signs of money printing showing up in the black market (referred back then as the "blue" rate of exchange) in mid-2010. Since March of 2010, the peso has fallen by almost 75% against the dollar, and inflation has been running around 30% per year. We don't know for sure how much inflation there's been, because the government office charged with measuring inflation was long ago told to just make up the numbers. The government of Cristina Kirchner didn't want to acknowledge what it was doing, but everyone who lives there knows that inflation was been very high for many years.

The new government of Mauricio Macri has vowed to stop the money printing, but it hasn't happened yet. The problem is that Argentina still can't finance its deficit by borrowing money legitimately. That may change soon if the government is able to mend relations with its foreign creditors and if it manages to rein in its excessive spending. I'm optimistic it will happen, and if it does we should see slower growth in currency, a gradual stabilization of the peso, and stronger growth in the economy. Big changes are afoot in the southern part of Latin America, and it could get pretty exciting if Brazil joins the reform movement.

Copyright © Scott Grannis