by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Thursday March 31st

U.S. equity index futures were mixed this morning. S&P 500 futures were unchanged in pre-opening trade.

The Canadian Dollar was unchanged following release of the January real GDP report. Consensus was an increase of 0.3% versus a gain of 0.2% in December. Actual was an increase of 0.6%. On a year-over-year basis, GDP growth increased 1.5%, well above the consensus estimate of 1.1%.

Index futures were virtually unchanged following release of Weekly Jobless Claims report. Consensus was 265,000. Actual was 276,000.

McDonalds added $0.39 to $126.22 after the company announced plans to add more than 1,000 restaurants in China. RBC Capital raised its target price to $135 from $132.

Lululemon (LULU $67.80) is expected to open higher after Wedbush raised its target price to $80 from $72.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/30/stock-market-outlook-for-march-31-2016/

Note seasonality chart on the Health Care sector.

Technical action by S&P 500 stocks yesterday

Technical action was bullish. Stocks breaking intermediate resistance levels included AAP, CCI, CSRA, DGX, DLTR, FE, IBM, MSI, TMO, UTX. No breakdowns.

Trader’s Corner

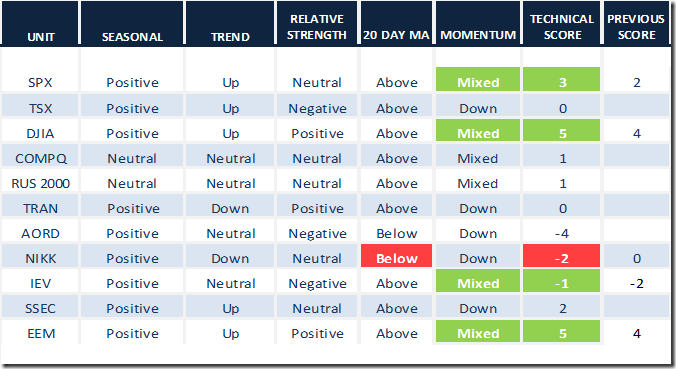

Daily Seasonal/Technical Equity Trends for March 30th 2016

Green: Increase from previous day

Red: Decrease from previous day

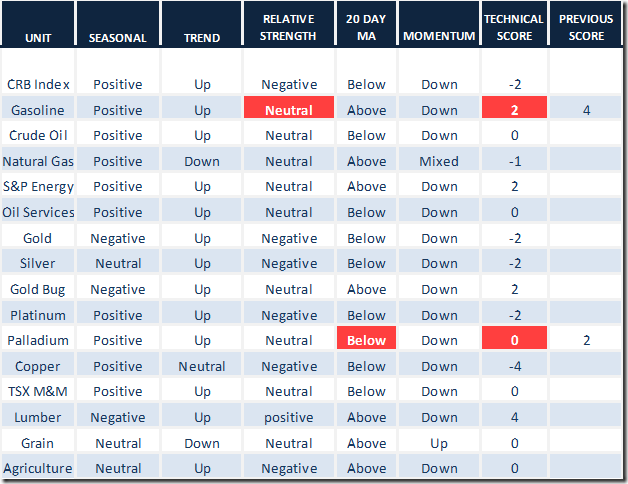

Daily Seasonal/Technical Commodities Trends for March 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

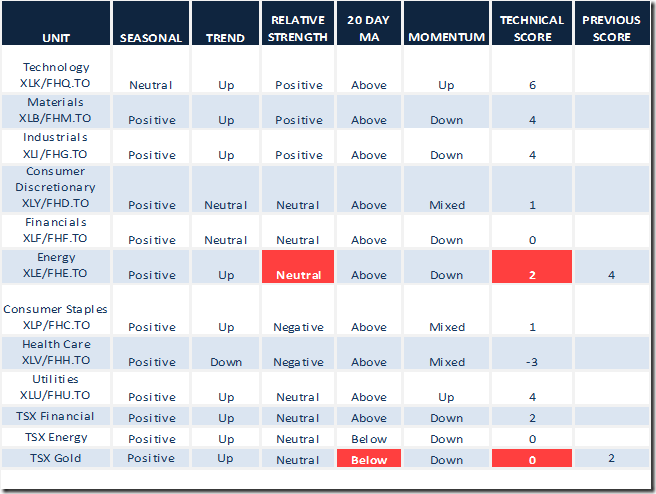

Daily Seasonal/Technical Sector Trends for March 30th 2016

Green: Increase from previous day

Red: Decrease from previous day

Outlook for North American Equity Market This April

Historically, the month of April has been the second strongest months of the year for performance by North American equity markets. During the past 20 periods, the S&P 500 Index has gained an average of 2.3% per period and the TSX Composite Index has improved 1.6% per period. Strength has been most notable in the first half of the month. Equity markets are buoyed by anticipation of a series of positive recurring annual events in April including release of first quarter results and the holding of annual shareholder meetings. Frequently, first quarter results are released during annual shareholders meetings. CEOs love to offer positive guidance when meeting shareholders at annual meetings

Performance by U.S. equities this April is expected to be less than average. Anticipation of good news from annual recurring events will be muted at best. First quarter revenues and earnings by major U.S. companies will be brutal when compared with revenues and earnings during the same period last year. Consensus for companies in the S&P 500 Index calls for a decline of 1.1% in revenues and a drop of 8.7% in earnings. Earnings by companies in the Energy sector are expected to be particularly hard hit. Strength by the U.S. Dollar Index on a year-over-year basis will have one last dampening impact on quarterly revenues and earnings of U.S. companies with international operations. Investor sentiment also will not be helped by anticipation of an increase in the Fed Fund Rate following the next FOMC meeting on April 27th.

The outlook for Canadian equities this April is more promising than the outlook for U.S. equities. Economic benefits of a lower Canadian Dollar relative to the U.S. Dollar Index are starting to surface. Consensus for TSX 60 companies shows average (median) earnings per share gains of 1.2% on a year-over-year basis: 29 companies are expected to report higher earnings, 27 companies are expected to report lower earnings, three companies are expected to report no change and one company is not comparable.

Canadian companies expected to record the highest percent gain in first quarter earnings per share included Couche Tard, CGI Group, Saputo, Constellation Software and Manulife Financial

Companies expected to record the highest percent decline in earnings include mining and energy companies.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca