Oil Outlook – H2/15 Recovery

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• The West Texas Intermediate (WTI) oil price is down a remarkable 45% since its July 2014 peak of US$107/bbl. In our view, the price shock has largely been supply-driven, rather than demand-driven. Through this challenging period for prices global oil demand has remained strong at 94.7 mln bbl/day in Q4/14, up 1.5 mln bbl/day from the previous quarter.

• It is estimated that the global oil market is currently oversupplied by 1 to 2 mln bbl/day, or roughly 1% of daily oil demand. With OPEC drawing a line in the sand, and deciding not to cut production to balance the market, it will likely come down to US producers to trim production and balance the market.

• This has started to playout as seen by the material reduction in US rig count over the last few months. As of February 20, the US oil rig count declined to 1,019, which is down 29% Y/Y and 37% since the October 2014 high of 1,609. While rig count is down significantly, this has not yet triggered a decline in US oil production, which as of last week was at a 30-year high of 9.28 mln bbl/day. We believe there will be a lag in US oil production levels, as rig count reflects more on exploration & development rather than actual production.

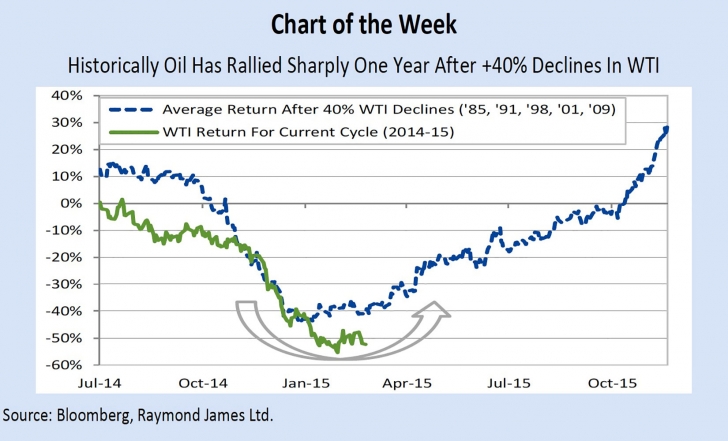

• Interestingly, history points to a near-term bottom in WTI. We looked at previous +40% oil declines over the last three decades and calculated the average oil price recovery following a 40% drop. Based on historical patterns, this signals a low in the coming months. This would align with our US energy analyst, Pavel Molchanov and Chief Investment Strategist, Jeff Saut, who see higher prices later this year. We concur, believing oil is likely to consolidate in H1/15 before moving higher in H2/15.

Read/Download the complete report below:

Copyright © Raymond James