by Sober Look

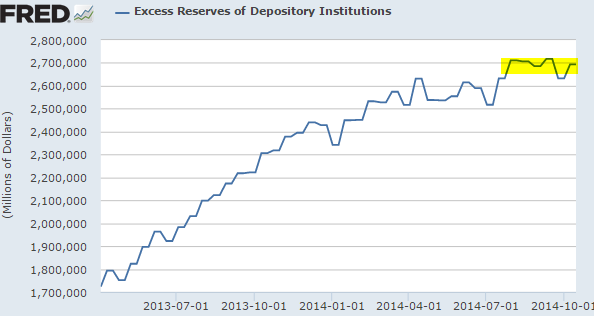

There has been a bit of confusion about what today's FOMC announcement means with respect to Quantitative Easing. The statement says that " the Committee decided to conclude its asset purchase program this month". It's important to point out that while this is the end of the Fed's bond purchases (for now), the US monetary expansion has ended this past summer. The outcome is visible in the the banking system's excess reserves, which flattened out around July.

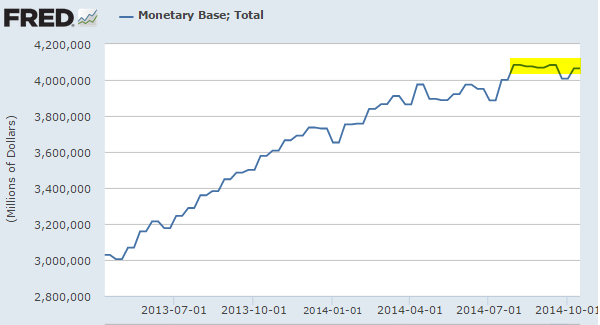

That in turn resulted in the US monetary base leveling off at just below $4.1 trillion, as the so-called "money printing" effectively ended in July.

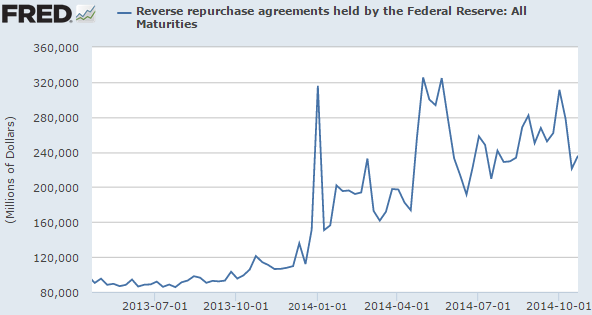

This begs the question: How is it that the excess reserves and the monetary base stopped growing this summer while the securities purchases and the balance sheet expansion continued through October? The answer has to do with some other balance sheet items that offset ("absorbed") reserve creation. The key item to consider here is the Fed's reverse repo position, which became more impactful as the securities purchases ebbed.

While the Fed's securities program is just ending now, the US monetary expansion was finished months ago. Therefore, other than its psychological effect, today's announcement should have a limited impact on the economy.

Copyright © Sober Look