Bond investors are used to managing interest-rate risk and credit risk. But the financial crisis should have taught us that there are times when liquidity risk can be just as important to manage. Now is one of those times.

Why has liquidity become such a prevalent risk in today’s fixed-income markets?

Simply put: there’s a lot less of it. Stricter regulations that require banks to hold more capital against losses have prodded them into slashing inventories of assets such as corporate bonds. This leaves the banks unable to play the part of willing buyer when investors want to sell.

These liquidity dynamics likely magnified recent sell-offs in high-yield bonds and bank loans. It’s unclear how quickly interest rates will rise in anticipation of tighter Federal Reserve policy next year. But rise they probably will, and any drift upward could intensify selling pressure. In a worst case scenario, today’s trot to the exit could turn into a mad dash—and we doubt that everyone would fit through the door.

The good news is that liquidity risk is manageable—and can even offer attractive opportunities, given the right time horizon. When liquidity dries up in one sector, it can be plentiful in another. If managed properly, it can be an additional source of returns.

Here are five things investors can do to stay afloat:

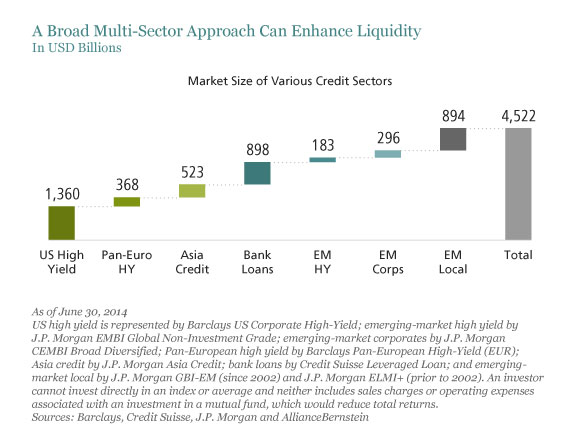

1) Broaden your horizons with a multi-sector mind-set. Liquidity is episodic and can affect different sectors in different ways. Consequently, segregating one’s allocations into single-sector funds—high yield, emerging markets and so on—can be dangerous; if liquidity dries up in one sector, investors can quickly find themselves trapped. In our view, a holistic and dynamic multi-sector approach that lets investors tap into a broad universe of fixed-income assets offers better protection should liquidity in a specific sector dry up (Display).

2) Don’t skimp on cash and don’t overlook derivatives. Holding too much cash has been a losing proposition for investment returns these past six years, thanks to the Federal Reserve’s successful campaign to drive down the risk-free interest rate. But cash can come in awfully handy when it comes to meeting redemptions in low-liquidity environments. That’s why US mutual funds were allocating 9% of their portfolios to cash on average through August, according to Morningstar. Investors were much less prepared when the global financial crisis hit: the average cash allocation in December of 2008 was just 1.6%. To offset the potential performance drag of cash, investors can potentially improve returns by tapping the derivatives market to get exposure to “synthetic” securities. The liquid derivatives market also gives investors access to additional pools of liquidity.

3) In today’s market, look for “hands-on” trading expertise. Historically, traders at asset management firms mostly executed orders. But as banks have retreated from the bond-trading business, the responsibilities of buy-side traders have grown. The best traders are adept at finding sources of liquidity and making the most of opportunities caused by its ebb and flow. Investment managers who have embraced a more active role for traders stand a better chance, in our view, of managing liquidity risk effectively.

4) Be flexible with your investment horizons. This is especially important when low liquidity makes the trading environment so inflexible. When liquidity is plentiful, it’s easy to exit trades that have achieved their objectives. But in today’s fixed-income markets, investors shouldn’t assume liquidity will be there when needed. That’s why we think it pays to dig deeply into every possible investment. Multiple time horizons, including “holding to maturity,” should be considered when analyzing bonds. And if holding a particular bond to maturity doesn’t look attractive in today’s environment, investors might want to reconsider the security altogether.

5) Consider selective investments in private credit. File this one under the “silver lining” tab: the forces that have been reducing liquidity—increased regulation and stricter capital requirements—are also unlocking attractive opportunities in private credit. As banks originate fewer residential and commercial mortgages and lend less to mid-size companies, asset managers are filling the void. Yields on many private credit assets are on average considerably higher than those on more traditional bonds. The reason, of course, is simple: these investments are not as liquid. But as we’ve seen, liquidity isn’t what it used to be throughout the fixed-income market. In our view, investors with long time horizons may want to consider taking advantage of these “illiquidity premiums.”

We believe that these prudent steps can help investors navigate a less liquid market.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Douglas J. Peebles is Chief Investment Officer and Head of Fixed Income at AllianceBernstein (NYSE:AB).