by Robert Seawright, Above the Market

Regular readers will recall that I began my Wall Street career on the ginormous fixed income trading floor of what was then Merrill Lynch in downtown Manhattan. Of the hundreds of people who called the seventh floor of the World Financial Center home during the workday then, astonishingly few were women and even fewer were traders – those who committed hundreds of millions of dollars of Merrill’s capital every single day. Even so, and despite rampant and often aggressive sexism, the women were always amongst the very best of the breed – smart, shrewd, savvy and discerning.

Part of that was to be expected. In such a male dominated, testosterone fueled world, only the very best women would be allowed access to that boy’s club in the first place. And only the very best of them would be allowed to stay. Still, the women traders I knew seemed more calculating and less prone to foolish errors than many of their male counterparts. They were also quicker to recognize and fix the errors they did make. And the research data backs up my anecdotal experience.

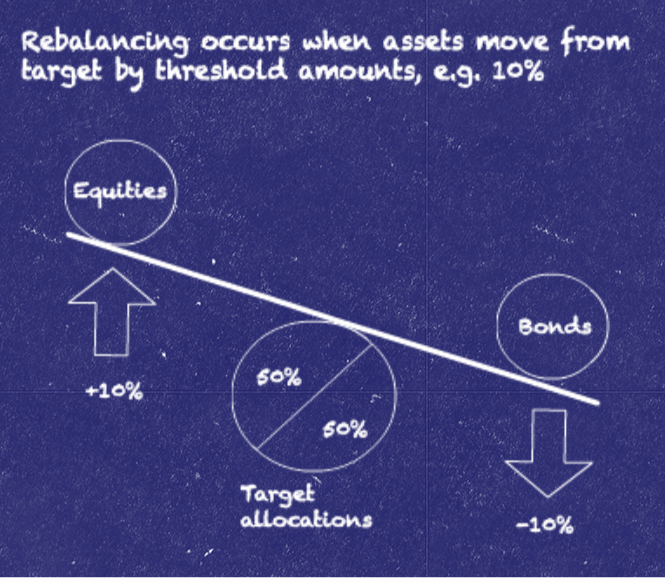

Which, in a roundabout way, brings me to my point. Last week I participated in an excellent conference entitled Diversifying Income and Innovations in Asset Allocation put on by S&P Dow Jones Indices in Beverly Hills. I spoke about retirement income strategies. Among the other presenters was Deborah Frame of Cougar Global Investments in Toronto. Her presentation focused on asset allocation and it was very enlightening.

During the cocktail hour, she and I were discussing the research literature that looks at the differences in men and women when it comes to investing. She took exception to my having characterized one of those differences, consistent with the literature, as women being more “risk averse” than men. She made the point that women are more “risk aware” – more cognizant of the risks they face and smarter about dealing with them (in general, of course). In her view, that’s why, for example, women so routinely asked for directions (in the days when phones didn’t come with GPS) when they weren’t sure where they were, and men so routinely refused to do so.

And, by golly, she was right. Since women generally are better investors, they should be portrayed positively (more “risk aware”) rather than negatively (more “risk averse”). Moreover, since men (again, in general) are more risk seeking and more likely to make foolish investment decisions, they should not be the standard to which women are compared. It should be the other way around. It was sexist of me to look at things otherwise.

Thanks, Deborah. Lesson learned (I hope).

Copyright © Above the Market