by William Smead, Smead Capital Management

In his 1980 book, Contrarian Investment Strategy, David Dreman opens with an analogy comparing the stock market to a casino with two distinct sides. The “red” room has lots of action and an occasional player striking it rich quickly. In effect, you become royal. Unfortunately, most of the players leave without the money with which they entered, because the house has the odds stacked heavily in its favor. The other side, the “green” room, was very quiet with numerous players slowly stacking up a large pile of chips and most of the players winning. The odds were stacked in their favor against the house, but nobody ever ordained them to get rich quickly.

In a spectacular song from last year, the performer Lorde explains what Dreman first wrote 31 years ago:

And we’ll never be royals (royals)

It don’t run in our blood

That kind of luxe just ain’t for us.

We crave a different kind of buzz.

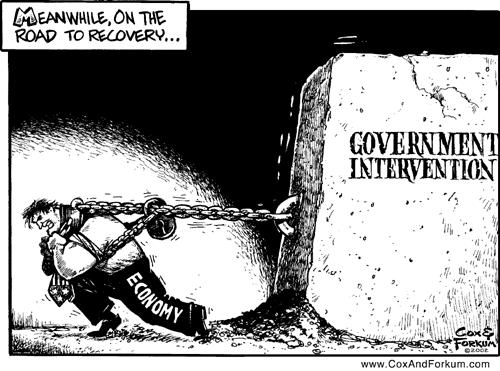

Every few years a group of stocks, usually attached to the most exciting new technologies, create their own version of the “red” room. Lately, the names are Facebook, Twitter, LinkedIn, Priceline, Amazon, Netflix, etc. By virtue of their meteoric revenue growth, these companies become stock market “royals,” making instant billionaires out of founders and instant millionaires out of some of the speculators in the “red” room.

Dreman explained in his book why “it don’t run in our blood.” For every stock among newer and exciting technologies, there are hundreds of failures. The totality of “that kind of luxe” causes most investors to leave much poorer than they came. It’s like playing the lottery because in the long run almost everyone loses. A few years back it was the Client Relationship Management (CRM) companies and before that, it was Google, Research in Motion, Apple and Amazon. They became Jim Cramer’s “Four Horsemen of 2007.” These were the stocks the “red” types were chasing.

Lorde continues:

Let me be your ruler (ruler),

You can call me queen Bee

And baby I’ll rule, I’ll rule, I’ll rule, I’ll rule.

Let me live that fantasy.

Dreman explained the “green” room in his book. The players buy cheap stocks as measured by low price-to-earnings (P/E) ratios and sit patiently collecting above-average dividends until their share value rises. Academic studies from Fama-French, Bauman-Conover-Miller and Francis Nicholson demonstrate that the cheapest 100 stocks in the S&P 500 Index by P/E, price-to-book, price-to-dividend and price-to-sales outperform over one year on a yearly rebalanced basis and even more over longer holding periods (Nicholson). His argument is backed up by Warren Buffett’s piece called, “The Super Investors of Graham and Doddsville,” published in the fall, 1984 issue of Hermes, the Columbia Business School magazine. All of Buffett’s friends who practiced buying cheap stocks with a “high margin of safety” and held them patiently, outperformed the US stock market over long-term time frames. In effect, it seems those practicing in the “green” room get to be long-term “rulers” of the passive indexes. We consider Buffett to be the “Queen Bee” and spiritual leader of those who practice in the “green” room. He’s “ruled and ruled” and these disciplines allow patient investors to “live that fantasy.”

My friends and I—we’ve cracked the code.

We count our dollars on the train to the party.

And everyone who knows us knows that we’re fine with this,

We didn’t come from money.

The great irony of this discussion is that Lorde participates in an industry that seems very similar to the exciting and conceptual world of investing in new technologies via the public stock markets. There are millions of wonderful singers and song writers who attempt to find a hit with the magnitude of her spectacularly successful song. A tiny fraction of those artists ever succeed and get to “count our dollars on the train to the party.” Even the ones like her, who succeed, often find themselves lacking follow-up success and become part of VH1’s “One-Hit Wonders.”

Dreman, Buffett and his friends, along with those who penned the academic studies appear to have “cracked the code.” Dreman managed billions of dollars over a long career. Buffett is nearly the wealthiest man in the world and the wealthiest investor in companies run or created by someone else. At Smead Capital Management, we are making our best effort to “crack the code.” We believe that valuation matters dearly, so we select and patiently hold securities that we consider to be undervalued as part of our normal discipline. “And everyone who knows us knows that we’re fine with this,” because like Lorde, “We didn’t come from money.”

Warm Regards,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com