November 13, 2012

by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.

Key points

- A status-quo election puts the "fiscal cliff" front and center.

- The stock market's knee-jerk reaction was to sell; could further weakness light a fire under politicians?

- Good news has come from recent economic numbers, but sentiment will remain under pressure until the fiscal cliff is resolved.

A lot of money was spent, a lot of mudslinging occurred, a lot of time passed and here we are: precisely where we were a week ago before the election. I can't help but wonder whether the election's outcome was not because voters wanted the status quo, but because voters really don't know how they want the country's problems solved. You can read more about the post-election environment from a policy perspective in Michael Townsend's latest report.

Stocks to DC: "Rise above or else!"

The stock market took it on the chin last week, reflecting several intertwined post-election themes: Bets on a Romney win were likely unwound, investors are trading in and out of perceived sector winners and losers, while many investors are also bracing for coming tax increases. Financial, energy and technology stocks were particularly hard-hit—driven by the regulatory landscape in the case of the first two and dividend concerns in the case of the latter (more on that at the end of this report).

Ideally, what does not happen is a repeat of August 2011, when markets went into riot mode during the debt-ceiling debacle and subsequent downgrade of US debt by Standard & Poor's. Unfortunately, it is a distinct possibility. I do expect the markets—more likely on the stock side—to play an important role as a messenger to our politicians.

Fiscal cliff in sharp focus

Dominating the conversation as we wind out the year is the "fiscal cliff." At this stage, there are many possibilities:

- Fall off the cliff entirely;

- Short-term deal with only partial Bush tax-cut expiration and delays or deals on other components;

- Grand bargain;

- Full kick-the-can;

- Kick-the-can, but strike outline of eventual deal as "down payment."

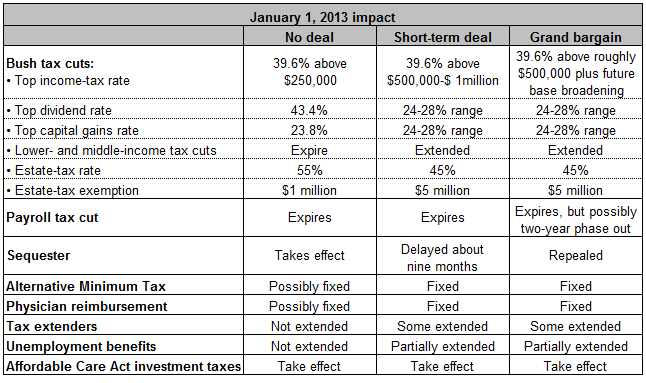

The first three broad possible outcomes are highlighted below in a table put together last week by our friends at ISI Group:

ISI Outlook for Fiscal Policies Under Three Lame-Duck Scenarios

Source: ISI Group, as of November 9, 20112.

It's our perspective that the full kick-the-can option may be even less favorable for the market and economy than falling off the cliff altogether. Frankly, can-kicking has become a sport played too often in Washington. Look, we know what the problems are—waiting for some period of months won't provide new solutions. We have a model for the perils of perpetual can-kicking and it's the debacle that is the eurozone.

Fiscal slope is more apt description

Entirely falling off the cliff would be treacherous, too, as it would very likely mean a recession. That historically brings rough sledding for the stock market, but perhaps more important, it would highlight how dysfunctional our partisan government has become. That said, falling off the cliff would be more akin to falling down a slope: Neither the tax-cut expirations nor the sequestration spending cuts would happen all at once, but instead would be spread out over the course of the year. The psychological effect would be more intense, and may already be in play.

The best option, in our opinion, would be some sort of grand bargain encompassing fundamental tax reform, spending rationalization and real reform to entitlement programs. At the same time, the structure would ideally unleash some of the economy's potential, allowing stronger growth to work its magic on the revenue side as well.

Economy has been accelerating…will it last?

On the economic front, in advance of the election—and notwithstanding Hurricane Sandy—the news had been trending better. Over the past several weeks we've enjoyed an ample string of better-than-expected data, including housing, retail sales, employment, consumer sentiment/confidence, trade, consumer installment debt, bank lending and M2 money supply.

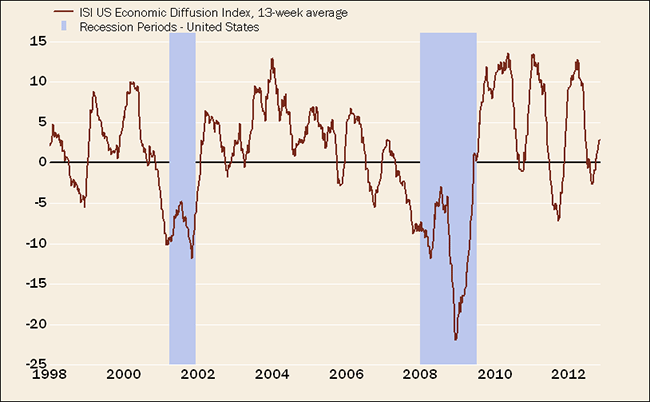

As a result of this improvement (and as you can see in the chart below) ISI's economic diffusion index—which incorporates all of the indicators they monitor each week, and measures strength minus weakness—made a new cyclical high last week.

Pulling Out of Growth Scare

Source: FactSet, ISI Group, as of November 5, 2012.

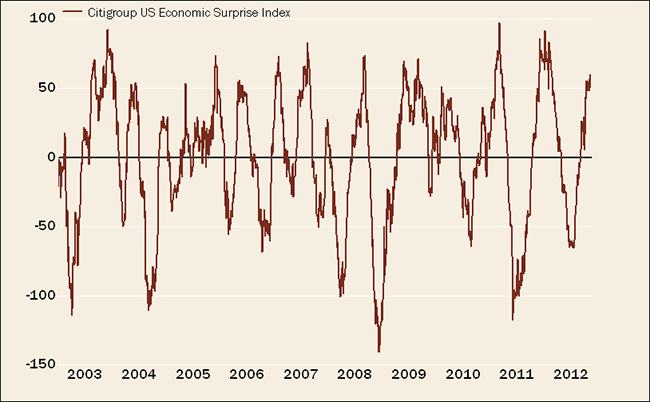

In addition, Citigroup's economic surprise index also made a new cyclical high last week, as you can see in the chart below.

Positive Economic Surprises

Source: FactSet, as of November 9, 2012. Index measures the amount that economic activity surprised or disappointed relative to analyst expectations and is calculated daily in a rolling three-month window.

In fact, last week, two high-profile economic research firms—ISI and High Frequency Economics—upped their third-quarter real gross domestic product estimates. ISI went from the initial print of 2.0% to 2.5%, while HFE's estimate jumped to 2.8%.

Spotlight on recession risk

Growth in 2013 will increasingly come into focus, however, and the likelihood of a recession to be avoided is not only predicated on the outcome of the fiscal cliff, but also the amount of fill there is in the growth cushion. Hurricane Sandy is obviously coming into play, both as a near-term economic drag and an eventual economic boost as rebuilding begins.

Housing's strength has been impressive, but it's nowhere near enough to cushion the blow if we go over the cliff. And although Federal Reserve Chairman Ben Bernanke may have cemented his position as Fed chief thanks to President Obama's re-election, we've written ad nauseam about the diminishing returns of the Fed's three rounds of quantitative easing.

Taxes … going up, no matter what

Prior to the election, it seemed odd that so much attention was being focused on the expiration of the Bush tax cuts, but much less on the tax increase imbedded in the Affordable Care Act. With the ACA no longer under the threat of repeal, and as Mike Townsend highlighted in his report, there are two additional taxes set to hit on January 1, 2013 (though both only for individuals earning more than $200,000 and couples earning more than $250,000): the 0.9% Medicare tax and the 3.8% investment income tax. The latter is, in effect, a tax hike on capital gains and dividends that will be implemented, as it has nothing to do with the fiscal cliff.

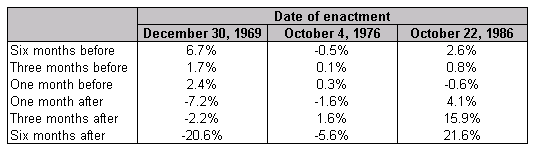

As you can see below, capital-gains tax hikes in the past have led to mixed results for stock market performance:

S&P 500 Index® Performance Before and After Cap Gains Tax Increases.

Source: Strategas Research Partners.

But looking more closely, you can see that the capital gains tax hike in 1986 was met with very strong market performance. Why? Because it was part of President Ronald Reagan's bipartisan tax reform, which slashed marginal and corporate tax rates while also eliminating many deductions. I hope our policy-makers heed the message of this particular history.

Many clients have asked about the implications of the coming tax hike on dividend-paying stocks, especially if the markets begin to discount the additional hike that would come via the Bush tax cuts' expiration. In the near term, we expect to see a surge in special dividends announced by some companies before year-end. We also expect companies—such as in the technology space—that have recently been inclined to initiate dividends to hold off on that decision.

But we also think investors will continue to hunt for companies that have maintained high payout ratios over time, regardless of dividend tax rates. As such, the rise in the dividend tax rate may have more of an impact on the number of companies paying dividends versus dividend stocks' performance.

Coiled springs

I do see some coiled springs in the economy that could be loosened if/when a deal on the fiscal cliff comes to fruition. We've seen several phases of meaningful economic traction since the Great Recession ended in mid-2009, only to be squashed by often-political forces. As I noted in my report two weeks ago, businesses have been hoarding a record amount of cash as they await more certainty on the tax/spending front. I do fear, however, that more market rioting may be needed before our politicians are forced into action.

Important Disclosures

The S&P 500 Index is a market-capitalization weighted index that consists of 500 widely traded stocks chosen for market size, liquidity, and industry group representation.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Thumbs up / down votes are submitted voluntarily by readers and are not meant to suggest the future performance or suitability of any account type, product or service for any particular reader and may not be representative of the experience of other readers. When displayed, thumbs up / down vote counts represent whether people found the content helpful or not helpful and are not intended as a testimonial. Any written feedback or comments collected on this page will not be published. Charles Schwab & Co. may in its sole discretion re-set the vote count to zero or remove the modules used to collect feedback and votes.

Copyright © Charles Schwab & Co., Inc.