This article is a guest contribution from James Paulsen, Chief Investment Strategist, Wells Capital Management.

Bond Market Deflation Redux!??!

Despite almost 3.5 percent real GDP growth in the last year, the 10-year Treasury bond yield recently dropped below 3 percent to one of its lowest levels of the post-war era. Moreover, its collapse from almost 4 percent just a couple of months ago has been breathtaking and unnerving. What does the bond market know? Is it suggesting another coming financial calamity? A double- dip? An imminent nasty deflation? Recent action in the bond market has intensified fears not only because of the speed and magnitude of the drop in long-term Treasury yields, but also because this event is widely perceived as unique to the post-war era. Well, actually, it’s not so rare. Is it really “different” this time?

Bond Market Deflation Scare.....the Sequel?!?

Surprisingly, the behavior of the bond market in the last year has very closely paralleled the beginning of the last economic recovery. Then, as now, after a brief recovery hiccup, the 10-year Treasury bond yield collapsed to almost 3 percent during the summer of 2003 amidst an intensifying deflationary scare. Thereafter, however, the economic recovery strengthened, deflation fears subsided, and bond yields quickly reversed and surged higher.

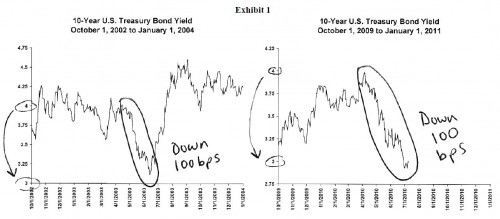

Although current action in the bond market may not continue to emulate the last recovery, its

similarity to that time merits consideration. Exhibit 1 illustrates movements in the 10-year Treasury yield during the early-2000s recovery and the current recovery. In late 2002, economic reports started to improve and the 10-year Treasury bond yield quickly rose from about 3.5 percent to about 4.25 percent. In the current economic environment, “better economic reports” caused yields to rise from about 3.2 percent in late 2009 to almost 4 percent in early April.

In the spring of 2003 and again this spring, the 10-year bond yield began a rapid and significant collapse, declining in both cases from about 4 percent to about 3 percent. Not only were the speed and magnitude of these bond market movements remarkably similar, the catalyst producing their collapse was the same—intensifying deflation fears.